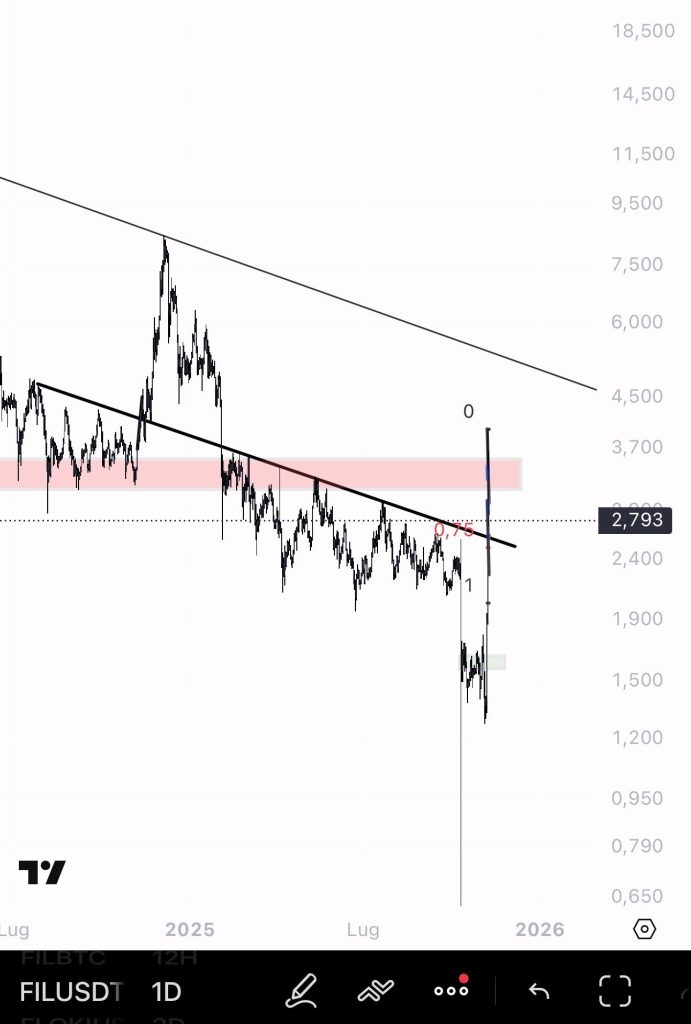

Filecoin has maintained a steady presence recently, and its chart does not indicate weakness. The current price action suggests the market is preparing for its next significant move rather than a decline.

Instead of retracing gains after its recent surge, the FIL price has held above its primary trendline on the daily timeframe. This is typically the first indicator that buyers remain in control of the market.

Although the daily candles have narrowed, volatility has decreased, and the trading range has tightened, this does not necessarily signify a loss of momentum. Analyst EliZ suggests that this controlled compression is often a precursor to substantial expansion.

A Deliberate Accumulation Phase for Filecoin

Examining the daily chart shared by EliZ, FIL continues to respect the trendline established during its last rally. The FIL price has not fallen below this line, even during sharp pullbacks, indicating consistent buyer defense of this level.

Many altcoins typically experience rapid retracements or enter volatile ranges after a significant price spike. FIL, however, has adopted a different approach, slowing down and stabilizing its price action.

The current market structure exhibits all the characteristics of a compression phase. The FIL price is consolidating within a downward-sloping channel, but instead of declining, it is repeatedly bouncing off the same support zones.

Despite selling pressure, buyers are absorbing every attempt to drive the price lower. Such market behavior often precedes a stronger upward movement rather than a collapse.

Key Levels to Monitor for the FIL Price Breakout

A closer look at the lower timeframes further clarifies this trend. FIL has been forming a tight bull flag just above the $0.75 region, with dips being consistently bought up almost immediately.

The decreasing volatility suggests that the market is conserving energy for a potential breakout, rather than drifting into a downtrend.

In the short term, the critical level to watch is the $2.90–$3.00 area. A sustained break above this zone would serve as the first significant indication that the compression phase is concluding.

A move beyond this level would reposition the price within the mid-range of the channel, potentially opening the path towards the resistance zone located around $3.50–$3.70.

Beyond that, the chart presents further intriguing possibilities. The 1D structure reveals a long-term diagonal resistance situated near the $4.50–$5.00 region.

Should FIL successfully reach and surpass this level, it would signify a shift in the broader market trend, potentially marking the beginning of a much larger reversal.

What Lies Ahead for FIL?

Currently, the chart conveys a clear message: FIL is not breaking down, but rather accumulating strength. As long as the FIL price remains above the established trendline and continues to absorb selling pressure within its narrowing range, the bullish outlook persists.

Compression phases can often appear uneventful until the moment of a breakout, and FIL is exhibiting all the signs of approaching such a pivotal point.

If buyers effectively capitalize on the current situation, the next move could propel FIL well beyond its current range and towards higher resistance levels that have not been tested in months.