Key Takeaways

- •Cryptocurrency liquidations totaled $223 million in the past hour, significantly impacting Bitcoin and Ethereum.

- •Long positions accounted for the majority of losses, reaching $155 million.

- •The event has reignited discussions about the inherent risks associated with high-leverage trading in the current market climate.

Recent Liquidation Events

In the past hour, a substantial $223 million was liquidated across the cryptocurrency network. Data from Coinglass indicates that long positions experienced the most significant impact, totaling $155 million in losses, while short positions amounted to $67.4 million.

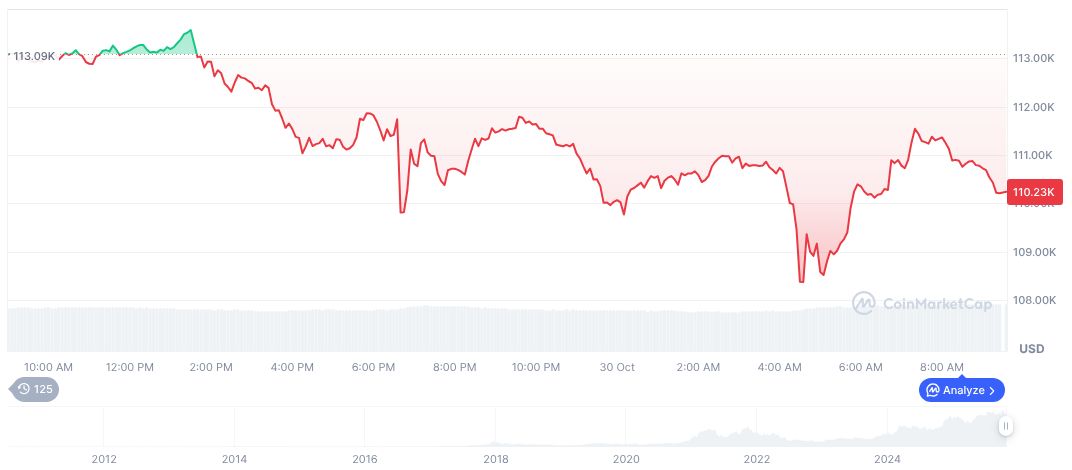

These liquidations primarily affected major cryptocurrencies like Bitcoin and Ethereum. This event underscores the ongoing market volatility and highlights the inherent risks associated with high-leverage trading, especially amidst prevailing economic uncertainties.

Market Volatility Concerns Rise

A recent liquidation event, totaling $223 million, has significantly impacted the cryptocurrency market. Long positions were disproportionately affected, with losses reaching $155 million, drawing attention to the volatility inherent in leveraged trading across prominent cryptocurrencies like BTC and ETH.

Such liquidation events often signal immediate stress within the market, leading to considerable impacts on traders' portfolios. These occurrences typically correlate with rapid shifts in market sentiment and prompt speculative adjustments.

Information gathered indicates a lack of specific direct commentary from key figures within the crypto industry regarding the recent $223 million liquidation event.

Historical Context and Warnings on Leverage

High-leverage trading carries significant risks, as evidenced by past market events. For instance, the October 2025 crypto crash saw over $19 billion in liquidations within a 24-hour period, demonstrating the potential dangers of excessive leverage, a situation comparable to recent liquidation dynamics.

Bitcoin, currently trading at $107,784.09, was a substantial component of the recent liquidation losses. According to market data, Bitcoin's market capitalization stands at $2.15 trillion, with a dominance rate of 58.94%. The cryptocurrency experienced a 4.53% decline over the past 24 hours, contributing to broader market unease.

The Coincu research team observes that the continuation of high-leverage trading in the current volatile market conditions could precipitate further price instability. Drawing upon historical patterns, industry experts consistently advocate for enhanced risk management strategies and the implementation of robust regulatory mechanisms to effectively mitigate potential market disruptions.

Important Disclaimer

The information presented on this website is intended as general market commentary and does not constitute investment advice. Readers are strongly encouraged to conduct their own thorough research before making any investment decisions.