Market Overview

Market conditions across Total3, ETFs, and Bitcoin exchange flows show liquidity shifting into stable positions, creating a cautious backdrop as traders wait for a clear market direction.

- •Total3 data shows stablecoin positioning climbing while altcoins wait for rotation after a key breakout.

- •ETF flows reveal caution, with sharp Bitcoin outflows mirroring defensive institutional positioning.

- •Exchange net flows show sustained BTC withdrawals as long-term accumulation strengthens.

Total3 Signals a Market in Rotation Mode

The focus keyword Total3 became central in a recent breakdown by Stockmoney Lizards, who compared versions of the index with and without stablecoins. Total3 excluding stables continues inside a descending channel that has shaped lower highs since mid-2022. This structure reflects the weakness traders sense as altcoins remain unable to break above their long-term boundary.

In contrast, Total3 including stablecoins has already crossed its established trendline. That move shows that liquidity has not exited the market but instead relocated into stablecoins. The breakout suggests capital is held rather than deployed, reducing immediate pressure but keeping altcoin valuations muted until rotation begins. This gap between the charts forms the basis of the rotation cycle often seen in transitional phases.

Stockmoney Lizards explained that capital tends to move from Bitcoin into stablecoins during stress. It then waits for conditions to settle before rotating into altcoins. Current Total3 behavior indicates that the market remains inside this waiting stage, with liquidity positioned but not yet committed.

ETF Flow Patterns Point to Cautious Positioning

The past 30 days of ETF activity show alternating inflows and outflows without a sustained trend. Bitcoin ETFs recorded the most aggressive shift on November 7, 2025, when withdrawals reached –$558.4 million. Ethereum ETFs followed with a smaller –$46.6 million outflow on the same day.

These movements typically appear during volatile periods when institutions avoid building long exposure. The smaller daily fluctuations across the remaining sessions show active risk management as traders reduce exposure during uncertainty. Ethereum flows followed Bitcoin’s direction through most of the month, showing limited divergence between the two assets.

The November 27 reading posted a modest +$1.716 million inflow. Although small, it marks an attempt to stabilize positioning after a run of defensive sessions. Investors continue to adjust exposure gradually while waiting for stronger confirmation from broader market signals.

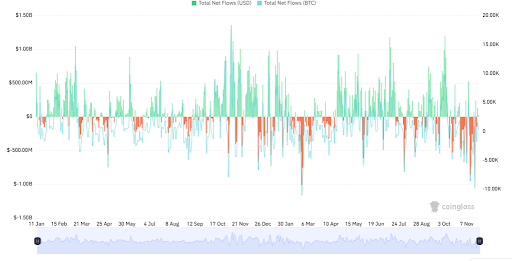

Bitcoin Net Flows Show Accumulation Strengthening

Exchange net flow data over several months presents a pattern of aggressive outflows mixed with brief periods of inflows. Early in the year, inflow spikes above $500 million often appeared during strong price swings before quickly reversing into heavy withdrawals. This behavior suggested opportunistic selling followed by renewed accumulation.

Later in the year, outflows became more pronounced as several events neared or exceeded –$1 billion. These withdrawals typically reflect long-term storage behavior as supply moves away from exchanges. Reduced liquidity in circulation often appears during preparation for larger structural moves.

In the most recent period, October through November, repeated outflows approaching –10K BTC coincided with Bitcoin trading at $91,597.64. These withdrawals signal continued confidence among long-term holders as capital positions for future shifts across Total3, Bitcoin, and ETFs.