Tether CEO Paolo Ardoino has stated that S&P Global Ratings' recent downgrade of Tether's USDT stablecoin is indicative of the traditional finance industry's growing concern. Ardoino suggested that the rating agency's assessment reflects a worry within the "traditional finance propaganda machine" as companies like Tether attempt to operate independently of what he described as a "broken financial system." He asserted that Tether is the "first overcapitalized company in the financial industry, with no toxic reserves" and that it proves the traditional financial system is fundamentally flawed, causing fear among established institutions.

S&P Downgrades USDT's Dollar Peg Rating To Lowest Score

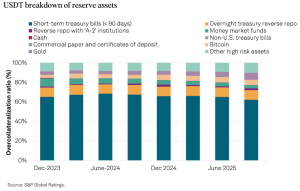

Ardoino's comments follow S&P Global Ratings' decision to assign USDT the lowest score on its stablecoin stability scale. The agency cited concerns regarding the token's ability to consistently maintain its peg to the US dollar. This "weak" assessment was attributed to several factors, including Tether's allocation of USDT reserves to assets considered "higher-risk" and more volatile than the US dollar, such as Bitcoin, gold, loans, and corporate bonds. S&P noted that Bitcoin constitutes 5.6% of USDT in circulation, exceeding the 3.9% overcollateralization margin, with a collateralization ratio of 103.9%. The report warned that a decrease in the price of Bitcoin or other high-risk assets could consequently reduce collateral coverage.

Further concerns raised by S&P Global Ratings include Tether's headquarters in El Salvador and its regulation under the National Commission of Digital Assets (CNAD), which the agency believes has less stringent requirements for reserve assets. The lack of sufficient audits or comprehensive proof-of-reserve reports for Tether's USDT was also highlighted as a significant issue. Despite these concerns, S&P acknowledged that 75% of USDT's backing consists of US Treasurys and other short-term financial instruments deemed "low-risk."

Report Comes Amid Landmark Year For Stablecoins

The S&P Global Ratings report arrives during a period of significant growth for stablecoins. The stablecoin market experienced a substantial surge in momentum following the US President signing the GENIUS Act into law in July. This legislative development provided regulatory clarity to the industry, prompting several major traditional finance firms to explore stablecoin offerings. Consequently, the total market capitalization of stablecoins surpassed $300 billion for the first time.

Amid this market boom, Tether's USDT has maintained its leading position, accounting for over 60% of the market share, approximately $184.529 billion. Data from DefiLlama indicates that Circle's USD Coin (USDC) is the next largest stablecoin, with a market capitalization exceeding $75.48 billion.

Tether Acting Like A Central Bank

Beyond its dominant role in the stablecoin market, Tether has also become a significant holder of US Treasurys, ranking as the 17th-largest holder globally with over $112 billion in short-term US government securities. According to Ardoino, this positions Tether ahead of many countries, including South Korea, Saudi Arabia, and Germany.

With 135 billion of U.S Treasuries, Tether is now the 17th largest holder of U.S debt, passing also South Korea.

Soon Brazil! pic.twitter.com/wUDyvGcSHE— Paolo Ardoino 🤖 (@paoloardoino) October 29, 2025

Tether has also been actively accumulating gold. Jefferies estimates that the stablecoin issuer holds approximately 116 metric tonnes of gold, making it "the largest private-sector gold holder outside central banks." In the third quarter of the current year, Tether reportedly acquired an additional 26 tonnes, representing about 2% of global gold demand during that period. Furthermore, the company has reportedly acquired a substantial equity stake of up to 37.8% in a gold-royalty company, indicating a broader strategy to increase its exposure to the mining sector and develop its tokenized-gold infrastructure.