Trove announced the migration of its perpetual DEX platform from Hyperliquid to Solana after raising $11.5 million via ICO and faced liquidity issues on January 19th.

The move has unsettled the community due to expectations of continued operations on Hyperliquid, reflecting broader concerns in the decentralized finance ecosystem about platform reliability.

Price Changes and Future Challenges for Trove

With this migration, Trove aims to leverage Solana's capacity for lower transaction costs and could widen its asset coverage. However, this abrupt shift has unsettled initial backers, creating dissatisfaction over the change in strategic direction. Responses from the community emphasize disappointment, given expectations from earlier disclosures. The announcement sparked rigorous debate, with some users voicing concerns over transparency and project trajectory.

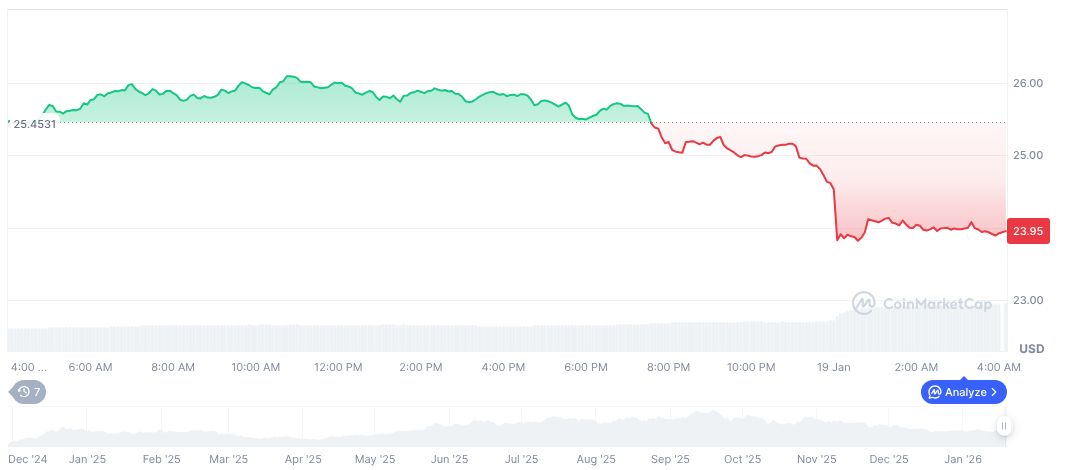

As of January 19, data shows Hyperliquid (HYPE) priced at $23.95, with a market cap of $7.23 billion and a fully diluted value of $23.03 billion. Recent withdrawals led to a 5.93% decrease over 24 hours amid a 99.37% change in trading activity.

Unfortunately, no specific quotes or sources were identified in the search results related to the migration or current developments surrounding Trove's transition from Hyperliquid to Solana.

Expert Insights on the Migration

Trove's switch to Solana highlights a trend in decentralized exchanges seeking networks with higher throughput and reduced fees, following record volume growth on Solana DEXs.

Insights into Trove's transition suggest potential challenges in user retention amidst ecosystem realignment. Historical trends in similar migrations reveal possible impacts on token liquidity and scalability. Solana's robust architecture aligns with Trove's goals; however, regulatory uncertainties could pose future compliance hurdles.

Further analysis into Trove's transition suggests potential challenges in user retention amidst ecosystem realignment. Historical trends in similar migrations reveal possible impacts on token liquidity and scalability. Solana's robust architecture, aligning with Trove's goals, yet regulatory uncertainties could pose future compliance hurdles.