Political Discourse and Senate Procedure

Donald Trump has been advocating for the Republican Party to eliminate the Senate filibuster and end government shutdowns. He has expressed these views through various media appearances and messages on social platforms. His suggestions are aimed at streamlining legislative action, but they are encountering internal resistance within the GOP.

This situation highlights a strategic tension within the Republican Party regarding governance philosophies. While Trump's call aims to shift legislative dynamics, immediate reactions from GOP Senators show a division, with many emphasizing the importance of maintaining bipartisan respect for procedural traditions.

As Senate Majority Leader John Thune stated, "The filibuster makes the Senate the Senate." This sentiment underscores the deep-seated value many Republicans place on the filibuster as a critical component of Senate procedure and a mechanism for ensuring broader consensus in legislation.

Impact on Cryptocurrency Markets

Despite the significant political discourse surrounding the potential elimination of the Senate filibuster, there is no anticipated direct impact on the cryptocurrency market. This is primarily because the debate remains at the procedural level and does not directly involve market regulations or frameworks that would influence digital assets.

Decisions regarding the filibuster align more with policy-making processes and legislative efficiency rather than market regulatory frameworks. Consequently, the effects on digital assets such as Ethereum or Bitcoin are expected to be minimal, if any. The focus of this political discussion is on governance and legislative strategy, not on the direct regulation or control of the cryptocurrency sector.

Market Data and Insights

Did you know? Abolishing the filibuster has been an ongoing debate for decades, with its potential removal often raising the stakes in legislative efficiency but consistently facing bipartisan reluctance.

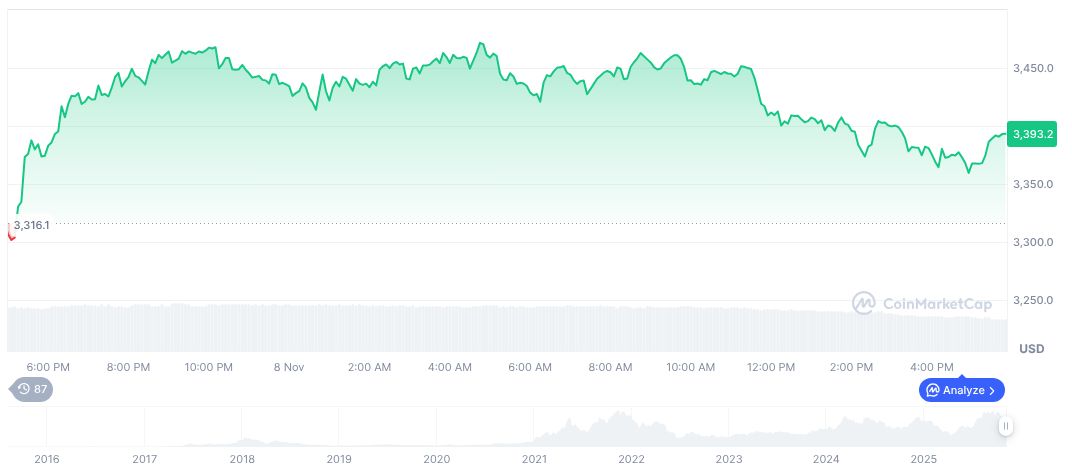

According to CoinMarketCap, Ethereum is currently priced at $3,448.56. Its market capitalization stands at $416.23 billion, representing 12.09% of the total cryptocurrency market. The 24-hour trading volume for Ethereum reached $23.49 billion, showing a decline of 37.77% in that period. Recent price movements indicate a 1.30% increase in the last day, but a 10.95% decrease over the past week.

Research from Coincu highlights that political stability can significantly benefit economic activities, including the cryptocurrency sector. Regulatory certainty, which can stem from established procedural operations like the filibuster, might help maintain market equilibrium. This, in turn, could contribute to a more favorable investment climate if any legislative changes are enacted thoughtfully.