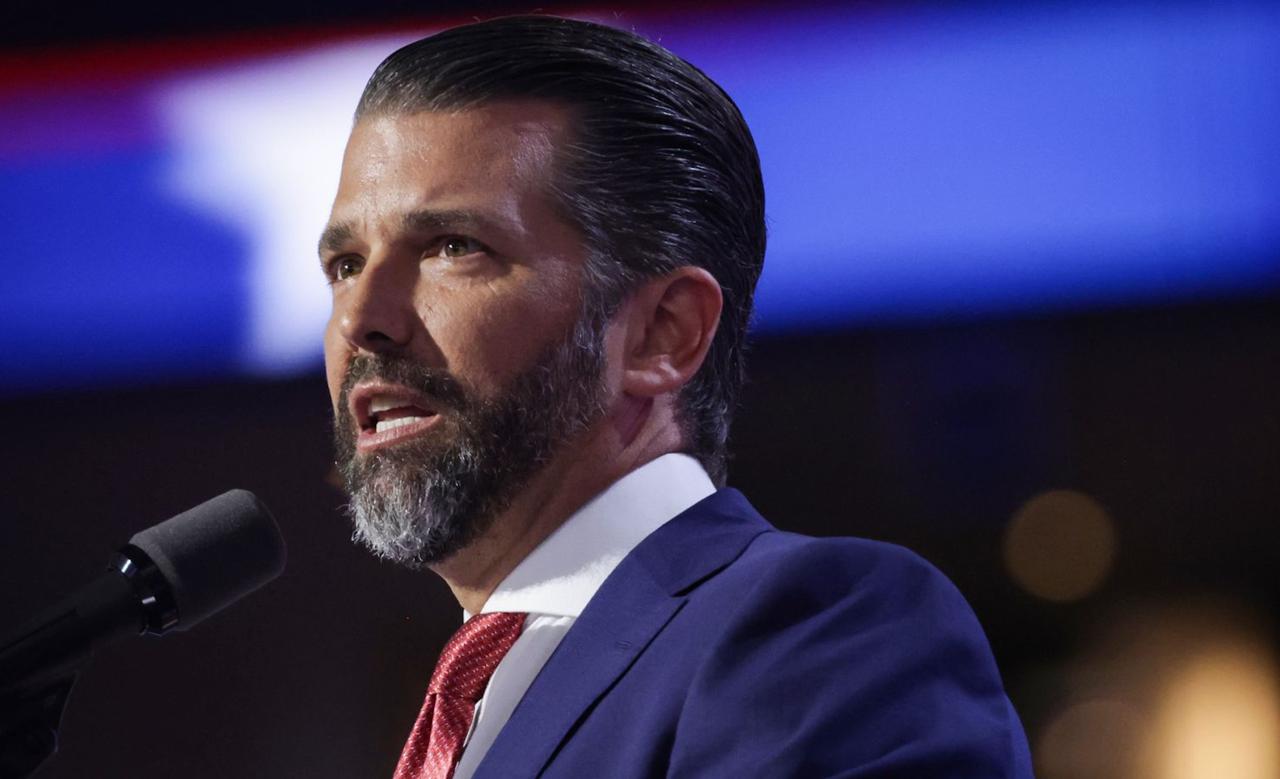

American Bitcoin (Nasdaq: ABTC), the mining firm backed by Eric Trump and Donald Trump Jr., delivered its strongest financial results to date, reporting a third-quarter profit alongside a sharp increase in revenue. The company released the numbers on Friday, November 14, marking its first full quarter as a publicly traded business.

Financial Results Show Significant Momentum

The company posted $3.5 million in net income, a notable turnaround from the $576,000 loss recorded during the same quarter last year. Revenue soared to $64.2 million, more than double what the firm generated in the previous quarter and far above the $11.6 million recorded a year ago.

Profitability was supported by an improvement in operational efficiency, with gross margin rising to 56%, a seven-point increase from Q2.

Bitcoin Holdings and Mining Growth Accelerate

Operational performance also improved sharply. American Bitcoin added more than 3,000 BTC in Q3 through a combination of mining output and market purchases. As of September 30, 2025, the company held 3,418 BTC on its balance sheet, a figure that increased to 4,004 BTC by November.

At the same time, the miner expanded its computing power significantly. Its total mining capacity grew by approximately 2.5× quarter-over-quarter, reaching about 25 exahash per second (EH/s). This expansion was one of the primary drivers behind the surge in revenue and BTC accumulation.

Looking Ahead

With stronger margins, rising production capacity, and a growing Bitcoin treasury, American Bitcoin is positioning itself as one of the fastest-scaling U.S. mining firms heading into 2026. The company’s backing by members of the Trump family continues to draw attention from both investors and critics, but its Q3 results reflect substantial operational progress during its early period as a public company.