Trump Media & Technology Group and Crypto.com are announcing plans to launch a publicly traded Cronos via a business combination with Yorkville Acquisition Corp. The reported merger will create Trump Media Group CRO Strategy, Inc., with Steve Gutterman stepping in as CEO and Sim Salzman as CFO once the deal closes in early 2026.

Proposed Treasury and Market Context

The proposed treasury is nothing if not ambitious, aiming for over $6 billion in assets. This includes 6.3 billion CRO tokens, $200 million in cash, $220 million in warrants, and a $5 billion equity line of credit.

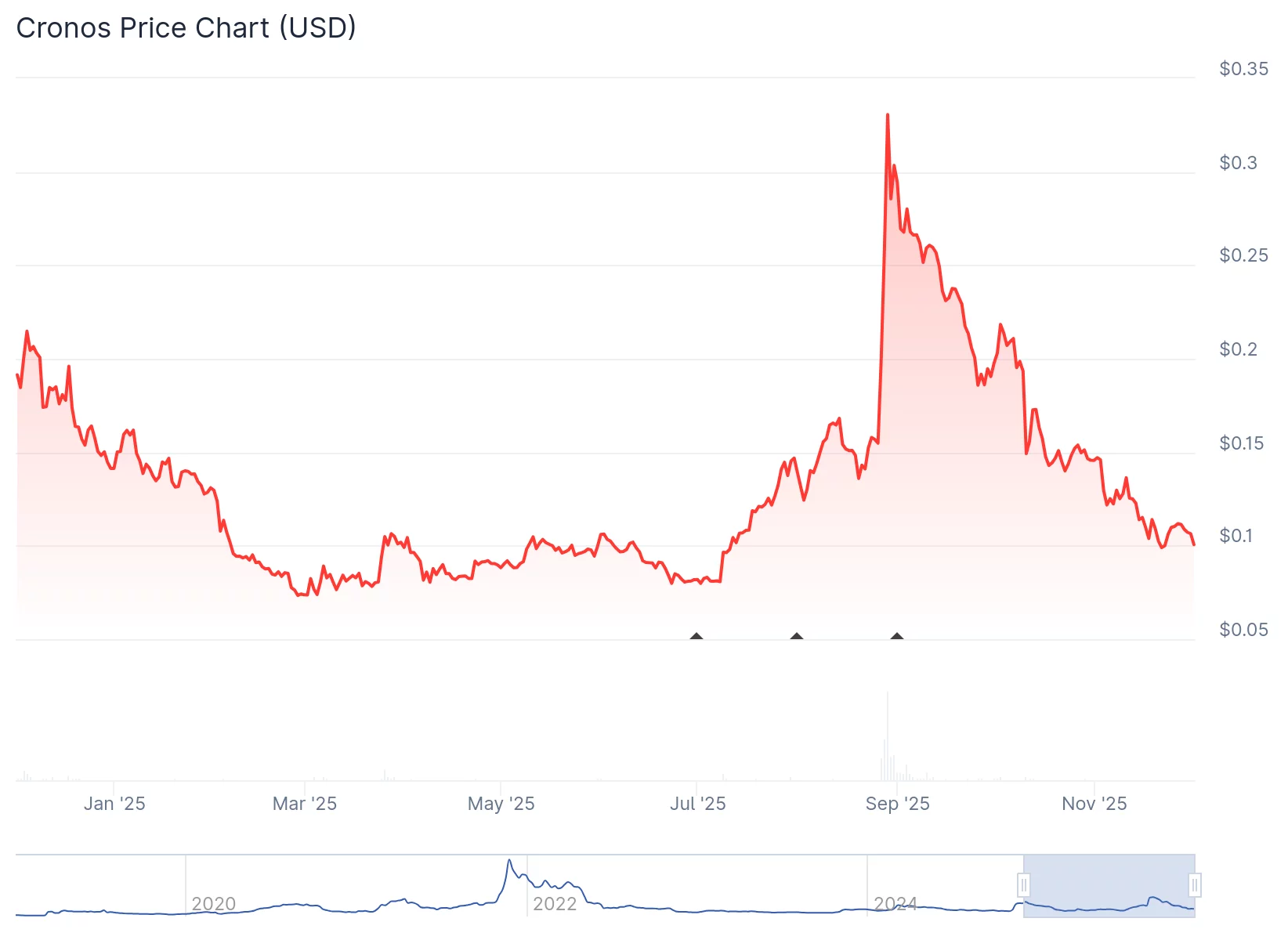

The announcement comes amid a recent tumble in CRO’s price, which shaved the token’s market cap from roughly $1 billion at announcement to about $636 million. Year to date, CRO is down over 47%.

Long-Term Growth Strategy and Integration Plans

Despite the recent price dip, the firms are framing this move as a long-term bet on Cronos growth. Plans include running a Cronos validator node targeting about 6% APY, which will produce steady staking rewards. Trump Media has also pledged to buy $105 million in CRO and integrate the token into its Truth Social and Truth+ reward programs.

According to a joint statement reported by Decrypt, CRO will serve as “the backbone of a growing blockchain ecosystem,” powering both utility, such as transactions, fees, and governance, and yield generation through staking rewards.

Broader Context of Trump Family's Crypto Ventures

This latest development continues the Trump family’s increasing involvement in the cryptocurrency space. A recent 78-page report, titled “Trump, Crypto, and a New Age of Corruption,” alleges that foreign governments, state-linked investors, and politically aligned corporations funneled money into Trump-branded crypto ventures, including the $TRUMP memecoin. The report suggests that in return, donors allegedly benefited from regulatory rollbacks and the quiet shelving of federal investigations into major crypto firms like Crypto.com, as well as Coinbase, Gemini, and Ripple.