Key Developments and Market Impact

Binance CEO Richard Teng expressed gratitude to former President Trump for pardoning Changpeng Zhao, a move that signifies a pivotal moment for both Binance and the broader cryptocurrency industry. This pardon, issued on October 24, 2023, is expected to significantly reduce Binance's legal risks, potentially leading to increased institutional investment and a surge in overall market confidence in cryptocurrencies, including BNB, ETH, and BTC.

The White House, through spokesperson Karoline Leavitt, stated that President Trump exercised his constitutional authority by issuing the pardon. The administration characterized the prosecution of Mr. Zhao by the Biden administration as part of a "war on cryptocurrency," emphasizing that there were no allegations of fraud or identifiable victims in the case.

Karoline Leavitt, White House Spokesperson, stated: "President Trump exercised his constitutional authority by issuing a pardon for Mr. Zhao, who was prosecuted by the Biden administration in their war on cryptocurrency. In their desire to punish the cryptocurrency industry, the Biden administration pursued Mr. Zhao despite no allegations of fraud or identifiable victims."

BNB Price Surges Amid Legal Clarification

The market has responded positively to the announcement of the pardon, with traders anticipating a potential increase in investment flows. This positive sentiment is expected to benefit Binance's operational outlook and could lead to an uplift in Binance-related tokens, particularly BNB, due to the reduced legal ambiguities. Historical precedents suggest that major legal decisions often lead to positive market sentiment.

A special informational note highlighted the rarity of U.S. presidential pardons in financial sectors, suggesting that such actions often signal potential policy shifts. This specific pardon is considered unique in cryptocurrency history and could influence future regulatory approaches in the United States.

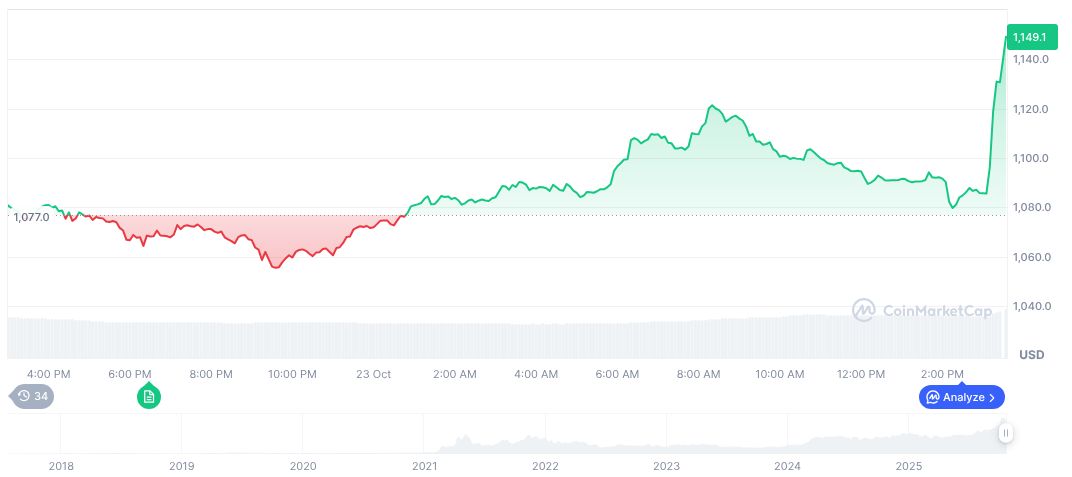

BNB's price has shown a notable increase, standing at $1,116.23 with a market capitalization of $155.36 billion. The token experienced a 4.68% rise over a 24-hour period, despite a slight decline over the preceding week. Trading volume reached $5.69 billion, indicating significant market activity. BNB's 60-day performance showed a 28.27% increase, reflecting growing market optimism.

Coincu's research team has emphasized the potential regulatory impacts following the pardon. This event might foster a more amicable environment for cryptocurrency dealings, potentially encouraging the development of policy frameworks that support innovation and growth. Binance's strategic positioning and its established industry reputation could significantly reshape future dialogues with regulators worldwide.

Financial analysts are observing that the pardon could establish a precedent that influences future regulatory navigation for the cryptocurrency sector. Monitoring price trends in the aftermath of this event is expected to provide valuable insights into how stakeholders may strategically adapt to evolving policies.