Donald Trump's Truth Social is set to introduce "Truth Predict," a new feature developed in partnership with Crypto.com Derivatives, allowing users to trade on the outcomes of real-world events. This move positions Truth Social within the rapidly growing prediction market sector, an area where Donald Trump Jr. already has significant ties through his involvement with Kalshi and Polymarket. The announcement has coincided with a notable surge in the TRUMP token, which saw a 20% increase in 24 hours and a 42.5% rise over the week, indicating substantial speculative interest. Concurrently, critics have intensified accusations, labeling the current administration as "the most corrupt government in history," which fuels ongoing scrutiny regarding conflicts of interest and transparency surrounding these ventures.

Trump’s New “Truth Predict” Launch

On October 28, Trump Media & Technology Group (TMTG), the parent company of Truth Social, announced a new initiative in collaboration with Crypto.com Derivatives (North America). This partnership will introduce a feature named "Truth Predict," designed to enable users to trade contracts based on the outcomes of various real-world events. These events could encompass elections, decisions on interest rates, fluctuations in commodity prices, and even sports results.

The company has positioned Truth Social as a pioneering social media platform offering prediction markets, aiming to integrate social interaction with financial speculation. The initial launch is planned for a beta phase in the United States, with subsequent international expansion anticipated. However, the legal framework governing prediction markets within the U.S. remains subject to interpretation. Depending on their structure, these platforms could fall under the purview of the Commodity Futures Trading Commission (CFTC) or face regulations akin to gambling laws, which will significantly influence their operational scope.

Truth Social was established in February 2022 as an alternative to mainstream social media networks, following bans imposed on Donald Trump from several major platforms. TMTG, founded in 2021, is predominantly owned by the Donald J. Trump Revocable Trust, granting Trump a significant economic stake and making him the primary beneficiary of the company's performance.

The announcement of the Truth Predict partnership has already had a discernible impact on the cryptocurrency market. The Official Trump (TRUMP) token, a memecoin operating on the Solana blockchain and associated with the Trump brand, experienced a substantial increase in trading activity. As of October 29, the TRUMP token was trading at approximately $8.3, marking a 20% increase within the preceding 24 hours. This performance made it the top gainer among the top 100 cryptocurrencies by market capitalization, with an overall gain of about 42.5% over the past seven days.

The timing of this surge suggests that the Truth Predict announcement may have acted as a catalyst, propelling the token beyond its previous trading range and attracting considerable speculative interest.

Trump Jr.’s Footprint in the Event-Trading Boom

Truth Predict will utilize a binary-event contract model, similar to established prediction platforms like Kalshi and Polymarket. This model allows participants to place positions on whether specific events will occur, such as "Will the Federal Reserve cut interest rates in December?" or "Will a Republican win control of the Senate in 2026?". Each contract is valued between $0 and $1, with the price reflecting the market's consensus expectation of the outcome. If an event occurs, the "yes" contract settles at $1 and the "no" contract at $0, providing a direct mechanism for users to trade on probabilities.

Truth Predict is expected to be fully integrated into the Truth Social interface, enabling users to discuss, share, and monitor predictions within the same platform where they already engage in communication and content sharing.

Kalshi Inc. operates under a regulated framework, adhering to U.S. derivatives law under the CFTC. This allows both retail and institutional traders to engage in the buying and selling of event contracts tied to economic, political, and social outcomes. According to the Financial Times, Donald Trump Jr. serves as an adviser to Kalshi, positioning him within a licensed exchange environment.

In contrast, Polymarket, which launched in 2020, uses cryptocurrency for users to bet on global events. The platform was fined $1.4 million by the CFTC in 2022 for operating without registration and is currently restricted from serving U.S. customers. Polymarket is reportedly preparing to re-enter the U.S. market through the acquisition of a licensed exchange.

On August 26, Reuters reported that Polymarket secured investment from 1789 Capital, a venture capital firm where Donald Trump Jr. is a partner, and that he joined Polymarket’s advisory board. A subsequent report from Reuters on September 8, 2025, indicated that 1789 Capital had surpassed $1 billion in assets under management.

The same Reuters investigation cited four government ethics specialists who raised concerns about 1789 Capital’s structure, suggesting a potential conflict of interest due to Trump Jr.’s dual role as a partner in the firm and the son of a sitting president. Richard Painter, a former White House ethics lawyer, commented on the irony, stating, "I don’t think the founders would have tolerated this in 1789." Ann Skeet, Senior Director of Leadership Ethics at a university institute, added that "there’s no getting around the appearance" that the firm's private-access model creates "private access to the administration."

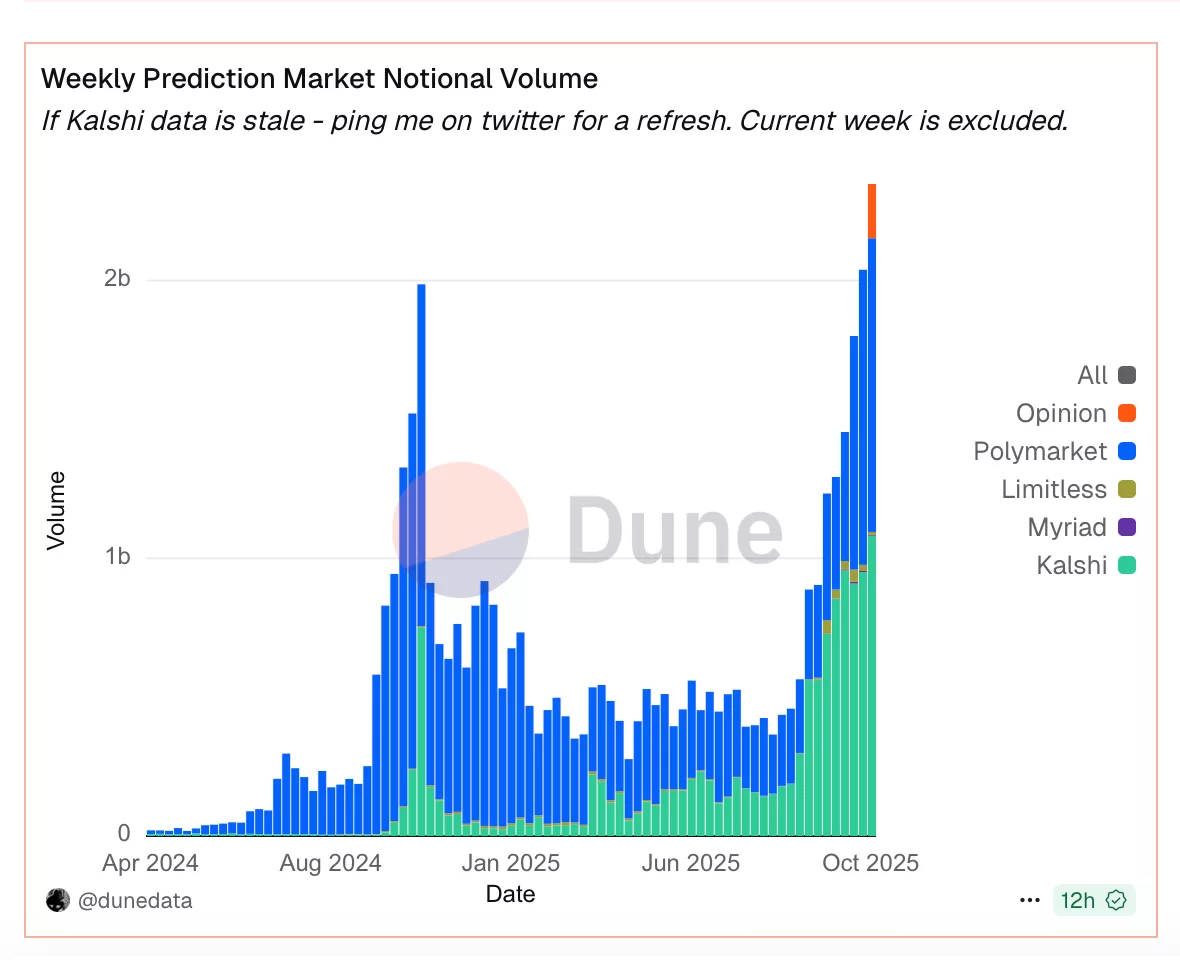

Therefore, Truth Predict enters a market where Donald Trump Jr. already holds advisory and investment positions with two prominent prediction market entities, Kalshi and Polymarket, both active in the same industry. Data from Dune Analytics shows that weekly trading volumes across leading prediction platforms recently exceeded $2.3 billion as of October 20, highlighting the rapid growth of the event-trading market.

Trump’s Crypto Ventures Reignite Conflict-of-Interest Allegations

The Trump family's increasing involvement in cryptocurrency ventures has already faced significant criticism, and the introduction of Truth Predict has intensified these concerns. In the weeks preceding the announcement, lawmakers and ethics experts publicly voiced accusations that the president and his family were leveraging their political positions to enhance their personal wealth through digital asset ventures.

On October 29, Representative John Garamendi asserted that the Trump administration operates as "the most corrupt government in history."

Garamendi cited reports of "private jet gifts from the Qataris" and "$2 billion crypto-coin investments in the Trump family," arguing that the confluence of public power and private business interests has reached an unprecedented level. He urged House Speaker Mike Johnson to address these issues.

The previous day, October 28, Senator Chris Murphy highlighted a concerning sequence of events related to Trump’s pardon of Binance founder Changpeng Zhao.

Murphy wrote, "One week after Trump pardoned Binance’s owner for crimes related to terrorist and sex predator financing, Binance started promoting Trump crypto." He contended that the timing demonstrated an inseparable link between political authority and private promotion, describing the White House as "a full-time, 24/7 corruption machine."

On October 25, Representative Ro Khanna cautioned that "we have a president who is building more wealth through his office than any in history."

Khanna characterized such conduct as corruption and announced his intention to introduce a resolution that would prohibit the president, his family, and members of Congress from trading in cryptocurrency or accepting foreign payments.

Earlier in the month, on October 15, Norm Eisen, a former White House ethics lawyer, stated that Trump "kept his business interests, then used public office to enrich himself, from foreign money to crypto schemes."

Eisen described the situation as "the most corrupt presidency in modern history" and elaborated on this claim in an interview for ABC Australia’s "Chasing Trump’s Billions," a program that investigated Trump’s global financial operations.

The persistent criticism from lawmakers and ethics experts has become a consistent backdrop to the Trump family's expanding business activities. Each new venture linked to digital assets has reignited discussions regarding financial transparency, disclosure standards, and the concentration of economic interests within a sitting administration. The progression of Truth Predict will unfold within this environment, where oversight and transparency are paramount in assessing the public perception of politically connected enterprises.