Complaint Volume and Resolution Rates

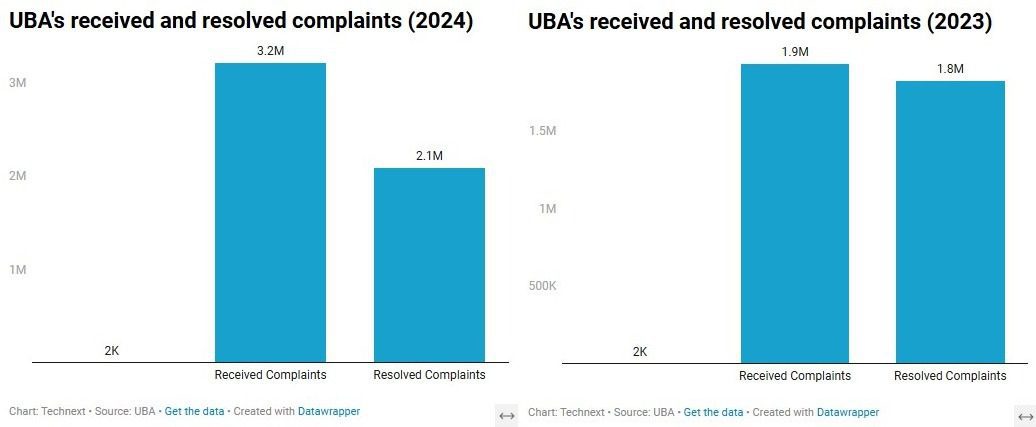

The United Bank for Africa (UBA) has reported a substantial rise in customer complaints regarding unsuccessful transactions, receiving 3,210,708 such issues in 2024. This represents a 66.3% increase compared to the 1,930,518 complaints recorded in 2023. According to the bank's data, UBA successfully resolved 75% of the total complaints received in 2024, amounting to 2,090,122 cases.

The bank's 2024 sustainability report, which was published on the Nigerian Stock Exchange (NGX) on Friday, highlighted UBA's ongoing commitment to maintaining an effective complaints management platform. This platform is designed to be user-friendly and readily accessible to all customers.

While the bank received over 3.2 million complaints in 2024, the total amount customers claimed in these complaints was N262.8 billion. The term "amount claimed" refers to the sums customers are seeking as refunds or reimbursements.

A year-over-year comparison reveals a 14.6% increase in resolved complaints, moving from 1.8 million in 2023 to 2.1 million in 2024. Following the resolution of these complaints, the total amount claimed by customers decreased from N262.8 billion to N188 billion in 2024.

In terms of financial redress, UBA refunded N2.3 billion to customers in 2024, a significant jump from the N450 million refunded in 2023.

The report also indicated that the total number of unresolved complaints in 2024 exceeded 1.1 million, a notable increase from 107,000 in 2023. Further breakdown shows that 218 unresolved complaints were escalated to the Central Bank of Nigeria (CBN) for intervention, while 1,120,907 complaints remained pending with the bank.

Complaint Resolution Methodology

UBA outlined its methodology for addressing customer complaints. Complaints submitted through the bank's various channels are directed to a specialized internal team. This team is responsible for resolving cases within established timelines, which are aligned with the CBN's complaint resolution guidelines.

The bank also emphasized that all cases are tracked and reviewed to identify the root causes of issues. Based on these findings, fixes are implemented to enhance processes, platforms, products, and the overall customer experience.

"Key Performance Indicators have been developed to effectively measure and monitor the efficiency and performance of the process, which is also periodically reviewed to ensure the bank is efficient at handling customer complaints," the report stated.

This initiative follows the CBN's reviewed Draft Guidelines on ATM operations, which mandate instant resolution for failed "on-us" ATM transactions and a maximum of 48 hours for failed "not-on-us" ATM transactions.

Complaint and Resolution Processes

UBA detailed the specific steps involved in its complaints and resolution processes for unsuccessful transactions:

- •Customers can submit complaints through any branch, via phone calls, email, live chat, Leo (UBA's virtual assistant), and social media platforms.

- •Upon receipt, the complaint is logged on the bank's Complaints Management platform, and the customer is notified with a unique case identification number.

- •Efforts are made to resolve the complaint during the first contact. If this is not possible, the case is referred to the appropriate department.

- •Once a complaint is resolved and closed, the customer receives a confirmation notification.

- •Customers have the option to confirm their satisfaction with the resolution or to dispute the closure of their case.

- •Customers can escalate their complaints for further review or investigation, adhering to CBN guidelines.