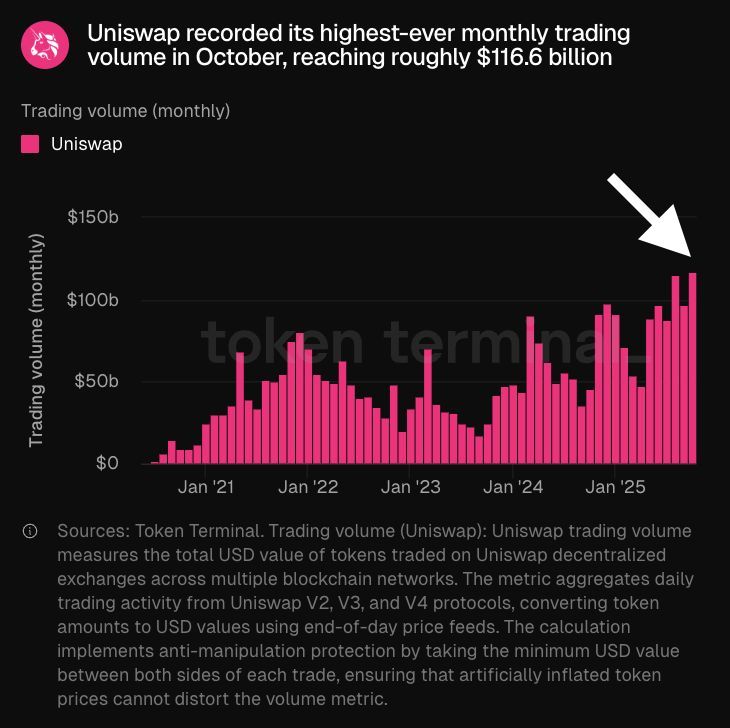

Uniswap just closed its strongest trading month in history, and the timing couldn’t be more important. New data from Token Terminal shows the protocol processing over $116.6 billion in volume during October, marking an all-time high for the DEX and signaling renewed user demand despite wider market volatility.

The surge comes as the community debates one of Uniswap’s most significant structural changes to date: the “UNIfication” proposal, which aims to activate protocol fees and introduce the first large-scale UNI token burn.

Volume Spikes Ahead of Major Governance Overhaul

Although trading volumes across crypto fluctuated sharply in October, Uniswap diverged from the trend. Activity climbed throughout the month, forming the largest volume cluster since the project’s launch.

Analysts point to one major catalyst: investors repositioning in anticipation of the governance proposal that would reshape Uniswap’s revenue model from the ground up. If approved, the upgrade introduces:

- •Protocol fees across select pools

- •A burn mechanism targeting 100 million UNI

- •A new revenue pool that allocates a portion of trading fees into value capture

The proposed framework strengthens the relationship between network usage and UNI scarcity, a dynamic the community has been waiting on for years.

A New Era for UNI Token Value?

Historically, Uniswap has been the largest DEX by far, yet UNI has captured relatively little value from the tens of billions in monthly trading volume. The new model changes that.

By directing one-sixth of all trading fees into a structured pool, the protocol creates a feedback loop similar to a buyback system: more activity → more fees → more UNI removed from circulation.

This marks one of the most aggressive token-value realignments among top-tier DeFi protocols.

Market Reaction: Interest Builds Despite Volatility

While broader crypto markets remain under pressure, interest in UNI has strengthened. Traders view Uniswap’s proposal as a rare example of fundamental progression during a period when many projects are cutting development budgets or delaying upgrades.

At the same time, October’s record volume sends a clear message: user demand for permissionless trading is still accelerating, even as centralized exchanges experience uneven flows.

What Comes Next?

If the UNIfication proposal passes, Uniswap would become one of the first major DeFi protocols to fully link its governance token to protocol revenue in a transparent, on-chain manner. That shift could set a new standard for decentralized exchanges, and potentially reshape how value accrues across the entire sector.

For now, the data speaks for itself: Uniswap is growing, usage is climbing, and traders are positioning early as UNI prepares for one of its most meaningful upgrades to date.