The Uniswap price experienced a significant surge, climbing 62% over the past week to trade at $8.40. This price action occurred despite a 40% drop in trading volume, which fell to $2 billion. The notable increase in Uniswap's value coincides with a strategic move by BitMEX co-founder Arthur Hayes, who has entered the Decentralized Finance (DeFi) space by acquiring 28,670 Uniswap tokens. This acquisition is valued at approximately $244,000.

After 3 years, Arthur Hayes(@CryptoHayes) is back into $UNI— buying 28,670 $UNI($244K).https://t.co/loeYKUb9rNpic.twitter.com/b88wHGlyPz

— Lookonchain (@lookonchain) November 11, 2025

While UNI saw a slight decrease of 1% in the past 24 hours, Hayes' investment follows a period of robust gains. This rally was largely fueled by anticipation surrounding "UNIfication," a proposed plan designed to activate protocol fees, introduce a UNI-burning mechanism, and implement incentives across the Uniswap ecosystem. Arthur Hayes is recognized for his contrarian investment approach, often targeting undervalued assets or those at the cusp of a new narrative cycle.

CryptoQuant CEO Predicts 'Parabolic' Potential for Uniswap

Following Hayes' significant purchase, Ki Young Ju, the CEO of CryptoQuant, has shared his outlook on UNI's price trajectory. He suggested that the token could experience substantial growth if Uniswap successfully activates its fee-switch mechanism. Young Ju highlighted that with Uniswap's year-to-date trading volume reaching $1 trillion, the potential for annual token burns could amount to $500 million, assuming current volume levels are maintained.

Uniswap could go parabolic if the fee switch is activated.

Even just counting v2 and v3, with $1T in YTD volume, that’s about $500M in annual burns if volume holds.

Exchanges hold $830M, so even with unlocks, a supply shock seems inevitable. Correct me if I’m wrong. https://t.co/39QjJsw9uQpic.twitter.com/3FQzAmuOP3

— Ki Young Ju (@ki_young_ju) November 11, 2025

This potential development, he believes, could lead to a parabolic increase in UNI's price.

Uniswap Price Analysis: A Parabolic Rally in Progress

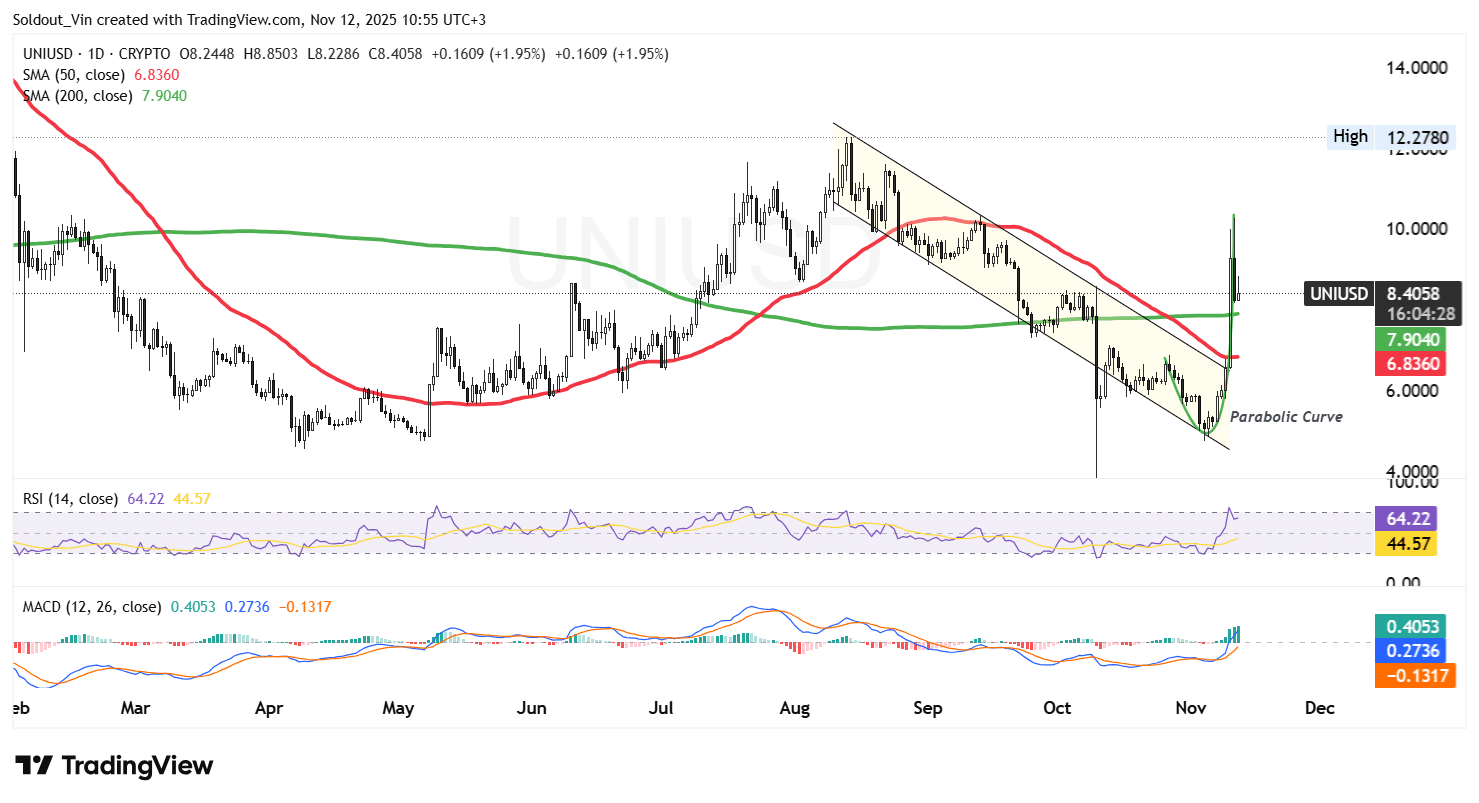

The UNI price chart indicates a strong upward movement. After establishing a double bottom pattern between April and May 2025, the support level at $4.80 provided a foundation for bulls to drive the price higher. This ascent was further supported by a golden cross occurring around the $7.90 mark.

However, resistance encountered at $12.30 temporarily allowed bears to regain control, pushing the Uniswap price into a corrective phase characterized by a falling channel pattern. Despite this bearish pressure, bulls intervened effectively at the $4.90 level, initiating a parabolic rally that saw UNI reach the $10.30 resistance on the 1-day timeframe before consolidating to its current price of approximately $8.40.

Currently, UNI has turned positive and is exhibiting a bullish rally. The price has moved above both the 50-day Simple Moving Average (SMA), which stands at $6.83, and the 200-day SMA, currently at $7.90. This indicates a strengthening positive trend.

Technical indicators further support this bullish sentiment. The Relative Strength Index (RSI) is moving above the 50-midline level and approaching the overbought zone, currently registering at 64, suggesting sustained buying pressure.

The Moving Average Convergence Divergence (MACD) has also confirmed the rally, with the blue MACD line crossing above the orange signal line, forming a bullish crossover. The green bars on the histogram are climbing above the zero line, indicating positive momentum.

UNI Price Prediction: Outlook for Continued Growth

Based on the current technical analysis, the UNI price appears to be positioned for continued bullish momentum. The recent breakout from the falling channel pattern and the formation of a strong parabolic curve are significant indicators.

With the price of Uniswap trading above both the 50-day and 200-day SMAs, it suggests a potential trend reversal and the commencement of a sustained uptrend. If the current momentum is maintained, UNI could target the next resistance level around $10.00. A further extension towards $12.30, the recent swing high, is also a possibility.

However, minor pullbacks are possible as the price may retest support levels near $7.90 or $6.80 before initiating another upward move.