Upbit, South Korea's largest cryptocurrency exchange, experienced a significant security breach on November 27, 2025, resulting in the loss of approximately 44.5 billion KRW, equivalent to $36 million USD, in stolen digital assets.

This incident highlights the persistent cybersecurity vulnerabilities within the digital asset exchange sector and raises questions about regulatory oversight and market stability. Experts are pointing to potential involvement from North Korea's Lazarus Group in the sophisticated attack.

Details of the Hack and Upbit's Response

The Upbit hack involved the theft of digital assets primarily linked to the Solana blockchain. The method of attack is believed to have involved inferring private keys by analyzing wallet address patterns, a complex technique that Ki Young Ju, CEO of CryptoQuant, suggests is likely attributable to North Korea's Lazarus Group. South Korean authorities are conducting investigations, while Upbit has suspended all digital asset operations and initiated the process of moving funds to cold wallets as a precautionary measure.

Upbit has pledged to reimburse all affected users from its own reserves. Oh Kyung-suk, the exchange's CEO, publicly apologized for the incident and reaffirmed the company's commitment to covering all user damages, emphasizing Upbit's dedication to user security. Analysts, including Hwang Suk-jin, have speculated that the timing of the attack, potentially coinciding with major corporate mergers, could indicate the involvement of insider threats or advanced external support networks.

"We plan to fully cover any damages using Upbit’s own assets to ensure no harm comes to customer funds," stated Oh Kyoung-suk, publicly apologizing for the hack and promising enhanced security measures and cooperation with regulatory bodies.

Historical Context and Market Implications

This breach is not the first time Upbit has been targeted by sophisticated actors. In 2019, also on the same date, Upbit faced a similar hack attributed to the Lazarus Group, underscoring the ongoing threat posed by state-backed entities to cryptocurrency exchanges.

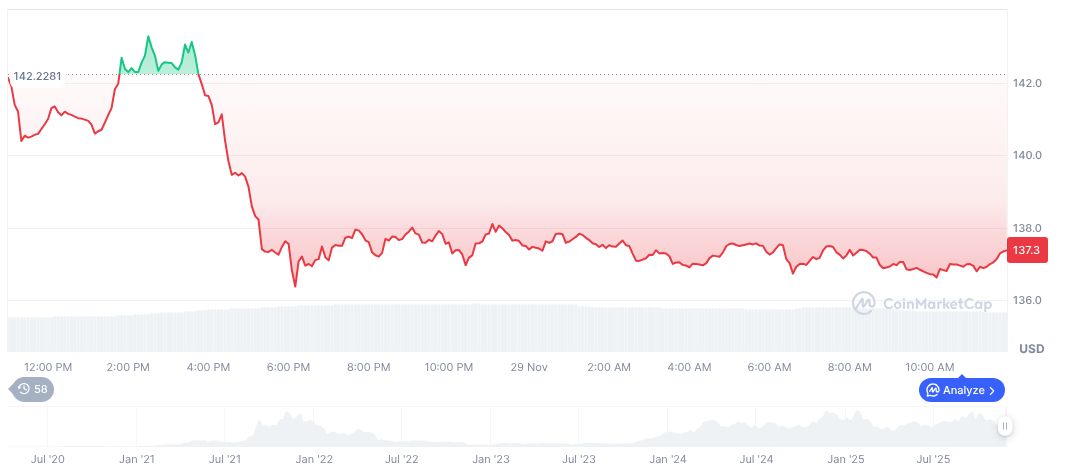

The market impact is being closely watched. According to available data, Solana's current valuation is $135.81, with a market capitalization of approximately $76 billion. Trading volume for Solana has seen a notable decrease of 47.44% in the past 24 hours, reflecting broader negative price trends observed in recent months.

Industry experts are calling for increased attention to cybersecurity measures and potential regulatory enhancements within the cryptocurrency space. They stress the critical importance of implementing robust technological upgrades to prevent future breaches. This sentiment is echoed in reports highlighting previous losses and market vulnerabilities to state-sponsored attacks.