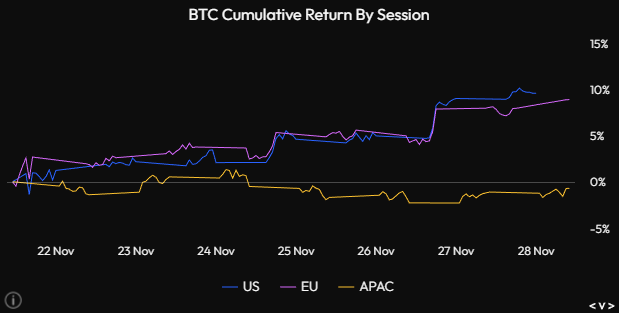

Bitcoin is posting a steady recovery this week, with US and European trading hours taking clear leadership in driving returns. This shift marks a notable turnaround from recent weeks, when the same regions were responsible for sharp sell-offs and persistent downward price pressure.

Data for the week shows US and EU sessions climbing consistently into positive territory, reflecting renewed confidence after a period dominated by defensive trading and heightened volatility. APAC hours, in contrast, have remained muted, creating a clear divide in regional momentum.

ETF Stabilization Helps Remove Market Stress

The improvement comes as ETF flows finally begin to normalize. After several weeks of significant outflows, products across the board have started to show green days again, reducing one of the biggest sources of downward pressure. This stabilization has provided the liquidity backdrop needed for Bitcoin to recover in a more orderly way.

A slowdown in distribution from long-term holders, many of whom had aggressively sold into weakness throughout November, further relieved the market. With fewer large sell orders hitting the books, price action has been able to grind higher without interruption.

Coinbase Premium Turns Positive as U.S. Institutions Resume Bitcoin Buying

A Gradual Recovery Takes Shape

While it remains uncertain whether this momentum will fully restore market confidence, the shift in regional leadership is meaningful. With US and EU sessions showing sustained strength and ETF conditions improving, Bitcoin finally has room to breathe after its heaviest correction in months.

For now, the market’s slow climb reflects a decisive change in behavior: selling has eased, buyers have returned, and the tone is no longer one-sided.