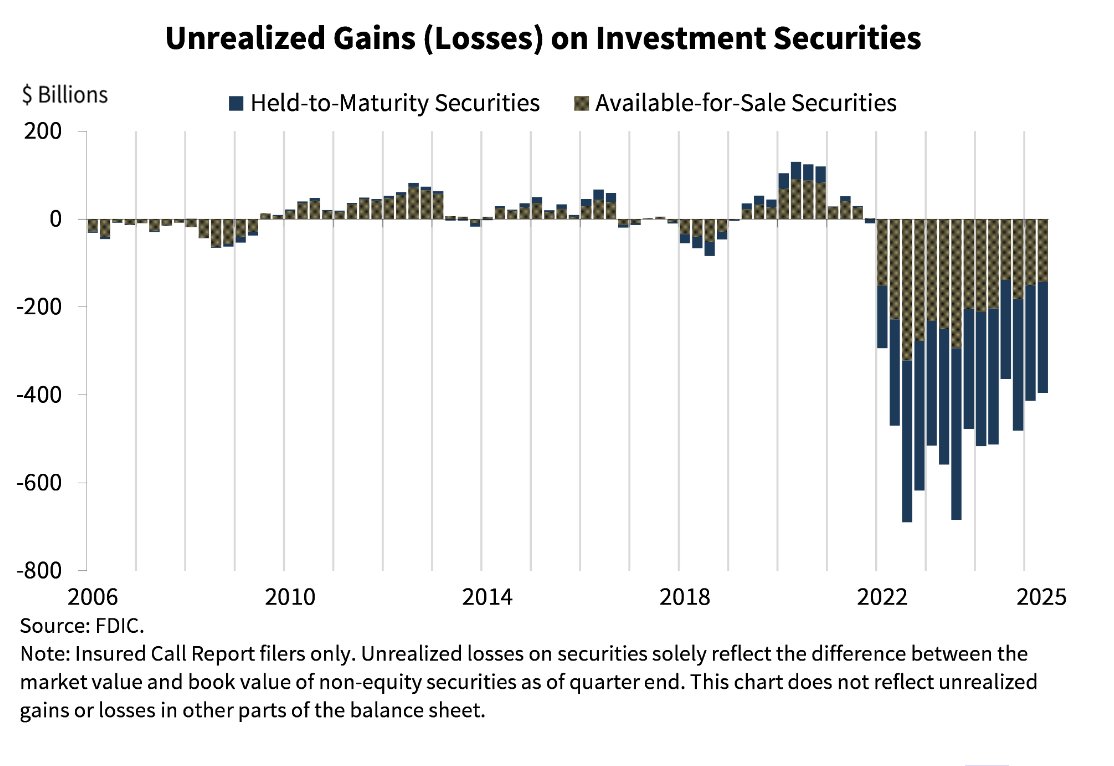

New figures from the Federal Deposit Insurance Corporation (FDIC) reveal that US banks are carrying $395 billion in unrealized losses on their investment securities portfolios for Q2. This represents one of the largest loss positions on record and serves as a stark reminder of the financial stress still lingering across the banking sector.

The data, which breaks down losses into held-to-maturity (HTM) and available-for-sale (AFS) securities, indicates that the pressure on bank balance sheets remains deep and prolonged. The majority of these unrealized losses stem from fixed-income securities that were purchased during the period of zero interest rates. As interest rates subsequently surged, these securities experienced a significant decline in their market value.

A Loss Profile Worse Than 2008

The FDIC’s historical series highlights a striking observation: the scale of unrealized losses recorded since 2022 surpasses the drawdowns experienced during the 2008 financial crisis. Although banks are not mandated to mark HTM securities to market on their income statements, these losses still impact regulatory capital flexibility and constrain the ability to sell these assets without incurring substantial damage.

AFS securities, depicted in blue on the chart, demonstrate even steeper declines because they must be marked at fair value each quarter. Consequently, many institutions have already absorbed significant hits to their equity accounts as a result.

Why the Losses Matter

While unrealized losses may not immediately indicate insolvency, they weaken balance-sheet strength in several critical ways:

- •They restrict liquidity, as banks are disincentivized from selling assets that are trading below their purchase price.

- •They tighten lending conditions, as capital buffers become more precarious.

- •They elevate systemic risk, particularly if deposit conditions worsen or if rapid outflows necessitate asset liquidation.

This same pressure was a contributing factor to the banking turmoil experienced last year, when institutions like Silicon Valley Bank found themselves unable to meet rapid withdrawals while holding substantial losses on their bond portfolios.

The Policy Context

The persistent decline in the value of bank securities occurs while high interest rates continue to reshape the US financial landscape. Even if interest rate cuts commence in 2026, the recovery of these securities to their original value could take years, especially for long-dated bonds acquired at extremely low yields.

Regulators are closely monitoring the sector. Throughout 2024 and 2025, the FDIC has cautioned that unrealized losses remain a significant vulnerability, particularly for regional banks that depend heavily on securities portfolios rather than diversified income streams.

Outlook

As of the second quarter, FDIC data indicates that the US banking system has not fully recovered from the rapid interest rate shock of the past three years. With nearly $400 billion in embedded losses, any renewed stress—whether from deposit flight, an economic slowdown, or credit deterioration—could expose the system's vulnerabilities once again.

For the time being, these losses remain on paper. However, the longer interest rates persist at elevated levels, the more challenging it becomes for banks to escape these losses without significant restructuring or the injection of additional capital.