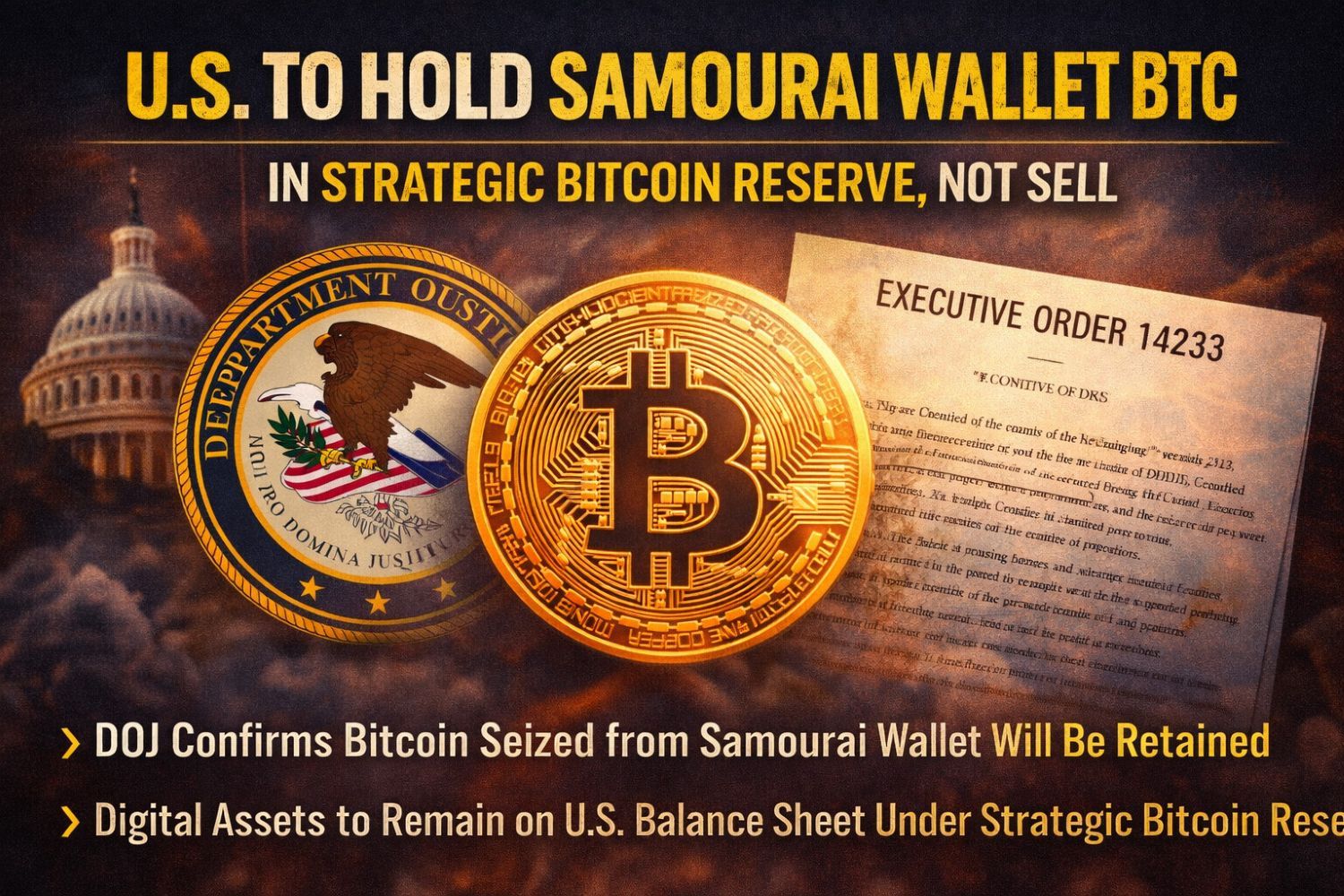

The U.S. Department of Justice confirmed on Friday that Bitcoin forfeited in the high-profile Samourai Wallet case has not been sold or liquidated. Instead, it will remain on the federal government’s balance sheet as part of the Strategic Bitcoin Reserve (SBR) established under Executive Order 14233.

Patrick Witt, Executive Director of the President’s Council of Advisors for Digital Assets, stated in a social media post that the Department of Justice reaffirmed the digital assets “have not been liquidated and will not be liquidated, per EO 14233” and will be held within the government’s Strategic Bitcoin Reserve.

This clarification addresses earlier speculation and blockchain observations that approximately $6.3 million worth of Bitcoin tied to the Samourai Wallet forfeiture had been moved. These movements led some analysts and community members to question whether the assets had been prematurely sold.

Public filings and investigative reporting had suggested the movement occurred through a Coinbase Prime custody address, raising concerns about compliance with the executive order.

Executive Order 14233, signed in March 2025 by President Donald Trump, directs federal agencies to retain Bitcoin obtained through criminal or civil forfeiture. These assets are to be placed into the Strategic Bitcoin Reserve rather than being sold on the open market.

This approach marks a significant departure from historical practices, where digital assets seized by law enforcement were routinely liquidated.

Samourai Wallet and Legal Controversy

Samourai Wallet was a privacy-focused Bitcoin wallet designed to enhance transaction privacy through features such as coin-mixing protocols.

It was widely used by individuals seeking greater confidentiality for on-chain transactions. The wallet was developed by co-founders Keonne Rodriguez and William Lonergan Hill.

Both Rodriguez and Hill were arrested in 2024 and subsequently pleaded guilty in July 2025 to operating an unlicensed money transmitting business tied to the wallet’s mixing services. Prosecutors stated these services facilitated the movement of illicit funds.

The case was prosecuted in the Southern District of New York, and both founders were later sentenced to multi-year prison terms.

As part of their plea agreement, the developers agreed to forfeit their Bitcoin holdings. This resulted in the seizure of approximately 57 BTC, valued at $6.3 million, which is now at the center of the recent debate over federal handling of forfeited digital assets.