DOJ Pursues Forfeiture of North Korean Cyber Theft Assets

The U.S. Department of Justice has initiated civil forfeiture proceedings to seize $15.1 million in USDT (Tether) that has been traced to North Korean hackers. This action follows a series of cyberattacks conducted in 2023 against cryptocurrency exchanges globally.

These seizures are part of ongoing efforts by the United States to counter state-sponsored cybercrime. The incidents have raised concerns about the security of digital assets and underscored the importance of international cooperation in combating illicit cryptocurrency activities.

Lazarus Group Linked to Significant Cryptocurrency Thefts

The forfeiture filing by the DOJ represents a continued commitment to disrupting North Korea's cyber-funding operations. The Lazarus Group, a hacking collective with alleged ties to the North Korean government, has been implicated in numerous significant cryptocurrency thefts worldwide. The USDT funds targeted in this forfeiture are believed to be linked to attacks carried out in 2023 against various exchanges.

This development has implications for the liquidity and market perception of Tether. The losses incurred from these hacks varied significantly across different platforms, ranging from $37 million to $138 million.

"These prosecutions make one point clear: the United States will not permit [North Korea] to bankroll its weapons programs by preying on American companies and workers. We will keep working with our partners across Justice Department to uncover these schemes, recover stolen funds, and pursue every individual who enables North Korea’s operations."

Tether's Market Position Amidst Cybersecurity Challenges

The Lazarus Group has been associated with over $600 million in cryptocurrency hacks, including the well-known Ronin Bridge exploit. This ongoing threat landscape highlights the persistent cybersecurity risks within the digital asset space.

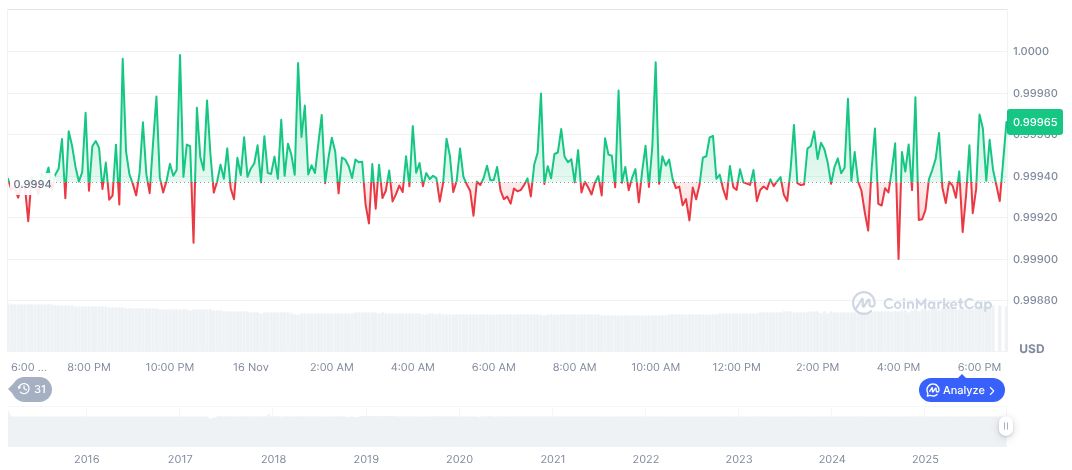

According to available market data, Tether USDt (USDT) has maintained a stable value of $1.00. Its market capitalization stands at approximately $184 billion, representing 5.74% of the total cryptocurrency market dominance. The 24-hour trading volume for USDT has exceeded $102 billion, showing a slight decrease of 1.14%. The token's price has seen a positive adjustment of 2.14% over the past 24 hours, despite a minor decline over the last 60 days.

This forfeiture action is seen by some analysts as a potential catalyst for strengthening regulatory frameworks within the cryptocurrency industry. Such measures could encourage exchanges to implement more robust cybersecurity protocols, reflecting a broader trend of increased scrutiny on state-sponsored cyber threats in the digital asset sector.