Key Economic Indicators and Market Reactions

The U.S. Department of Labor reported 236,000 initial jobless claims for the week ending December 6, 2025. This figure represents the highest level since early September 2025 and exceeded the consensus expectation of 220,000 claims.

This unexpected increase in unemployment claims could influence Federal Reserve policy and impact financial markets. Analysts are closely observing these developments for potential shifts in monetary strategy and economic forecasting.

"In the week ending December 6, the advance figure for seasonally adjusted initial claims was 236,000, an increase of 44,000 from the previous week's revised level." — U.S. Department of Labor, Employment and Training Administration

Jobless Claims Data and Historical Context

The reported jobless claims of 236,000 for the week ending December 6 mark the highest figure since September 2025. This number surpassed expectations and showed a notable increase from the previous week's revised 192,000 claims. The U.S. Department of Labor, as the official data source, highlighted this significant uptick in initial claims.

In historical context, jobless claims reached an all-time high of 6.137 million in April 2020, demonstrating the profound labor market fluctuations that can occur in response to economic indicators.

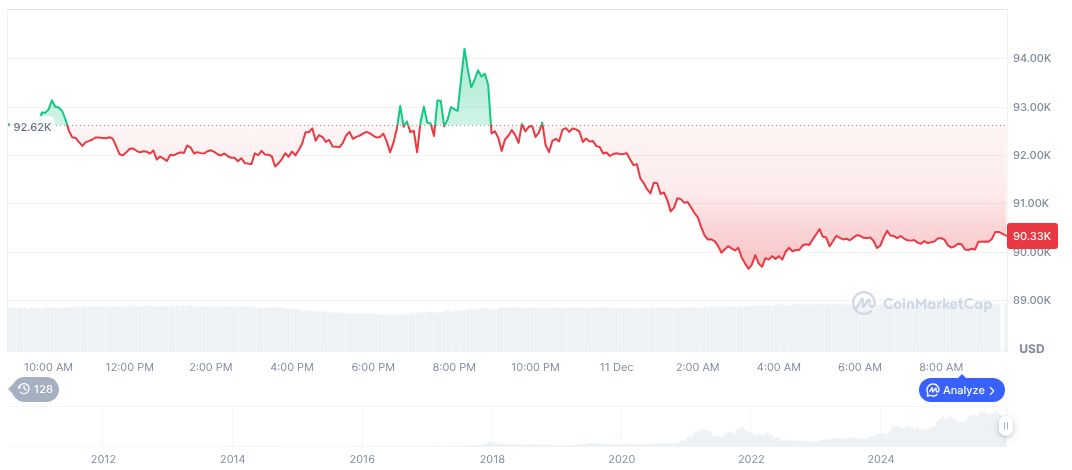

Impact on Bitcoin and Cryptocurrency Markets

Bitcoin, currently priced at $90,124.79, has experienced a 2.11% decline over the past 24 hours. With a market capitalization of $1.80 trillion and a 24-hour trading volume of $67.36 billion, the leading cryptocurrency has seen a 21.81% decrease over the last 90 days.

Financial insights suggest potential shifts in investment strategies as the impacts of jobless claims are assessed. Historical trends indicate that economic indicators like unemployment data may prompt regulatory discussions, emphasizing the balance between labor market health and technological advancement.