The Producer Price Index (PPI) report for November 2025, released by the U.S. Bureau of Labor Statistics, showed producer-level inflation firming modestly, driven primarily by a sharp rebound in energy prices, while underlying inflation pressures continued to build.

PPI Rises 0.2% in November as Energy Prices Surge

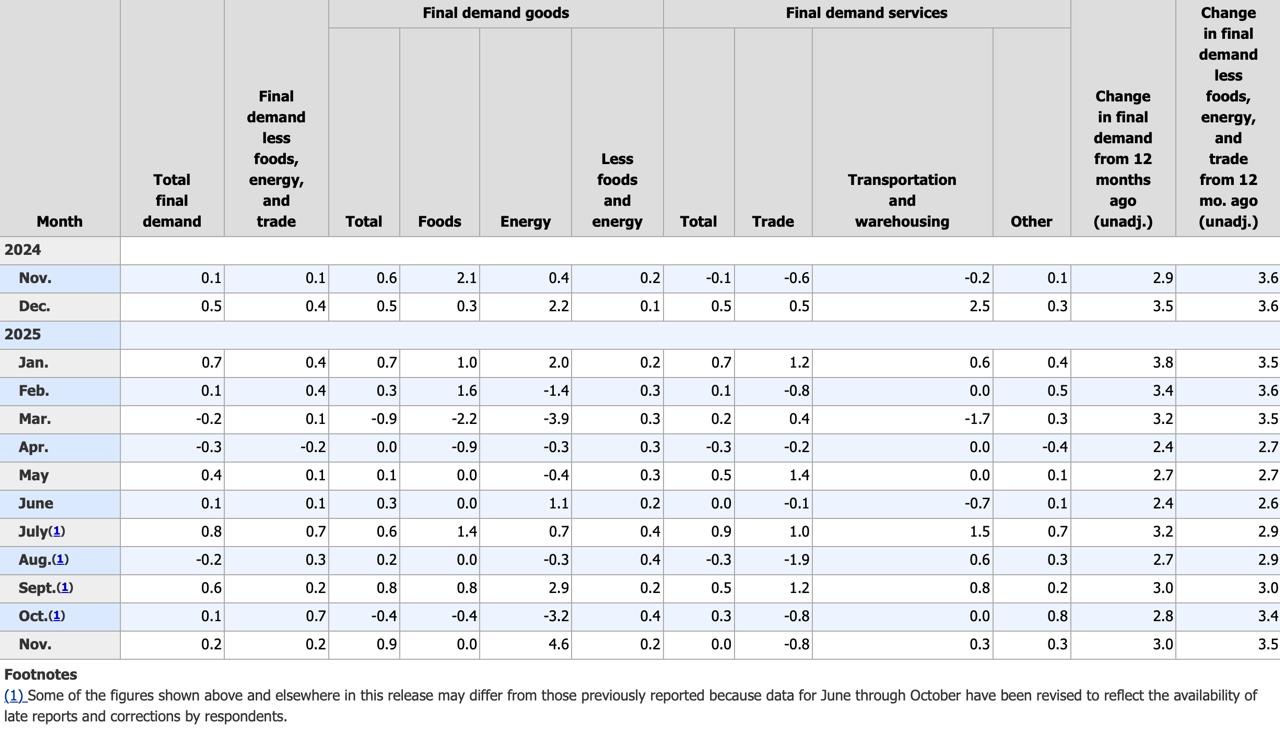

The PPI for final demand increased 0.2% month over month in November, following a 0.1% gain in October and a stronger 0.6% rise in September. On a year-over-year basis, final demand prices were up 3.0%, signaling that producer inflation remains elevated heading into the end of 2025.

The monthly increase was entirely driven by goods prices, while services prices were flat, highlighting a clear divergence in inflation dynamics.

Energy Dominates the Goods Inflation Picture

Prices for final demand goods jumped 0.9%, marking the largest monthly increase since February 2024. More than 80% of this rise came from energy prices, which surged 4.6%.

Key contributors included:

- •Gasoline: +10.5%

- •Electric power and diesel fuel: solid increases

- •Jet fuel and light motor trucks: higher prices

By contrast, food prices were unchanged, and goods excluding food and energy rose a more modest 0.2%, suggesting energy remains the primary short-term inflation driver.

Core PPI Continues to Climb

The closely watched PPI excluding food, energy, and trade services rose 0.2% in November after a strong 0.7% increase in October. On a 12-month basis, this core measure climbed 3.5%, matching the largest annual increase since March.

This persistence in core producer inflation may concern policymakers, as it points to ongoing cost pressures beyond volatile energy components.

Trade Margins Weigh on Services Prices

While final demand services were unchanged overall, the underlying picture was mixed:

- •Transportation and warehousing services: +0.3%

- •Services excluding trade, transportation, and warehousing: +0.3%

- •Trade services margins: −0.8%

Falling retail and wholesale margins, including a 4.3% drop in health, beauty, and optical goods retailing, offset gains in areas such as telecommunications access services and portfolio management.

Intermediate Demand Signals Cost Pressures Ahead

At earlier stages of production:

- •Processed goods for intermediate demand: +0.6% (largest increase since July)

- •Unprocessed goods: +0.4%

- •Intermediate services: +0.2%

Energy again played a central role, with diesel fuel prices up 12.4% at the processed level and natural gas up 10.8% among unprocessed goods. These increases could feed into consumer prices in coming months if sustained.

What It Means Going Forward

The November PPI report suggests inflation at the producer level is not cooling decisively, especially once volatile trade margins are stripped out. While energy drove much of the headline move, the continued rise in core PPI indicates underlying cost pressures remain sticky.

For markets and policymakers, the data reinforces expectations that inflation risks persist into early 2026, even as headline readings fluctuate with energy prices.