Significant Minting Event on Solana

Circle's USDC Treasury minted 750 million USDC on the Solana blockchain on November 27, following three consecutive transactions, as reported by Whale Alert. This minting event is significant as it bolsters Solana's Decentralized Finance (DeFi) liquidity, reflecting an increased demand for stablecoins within the ecosystem. Such events typically enhance Solana's trading and yield farming opportunities, providing a more robust environment for users.

Historical Trends and Market Dynamics

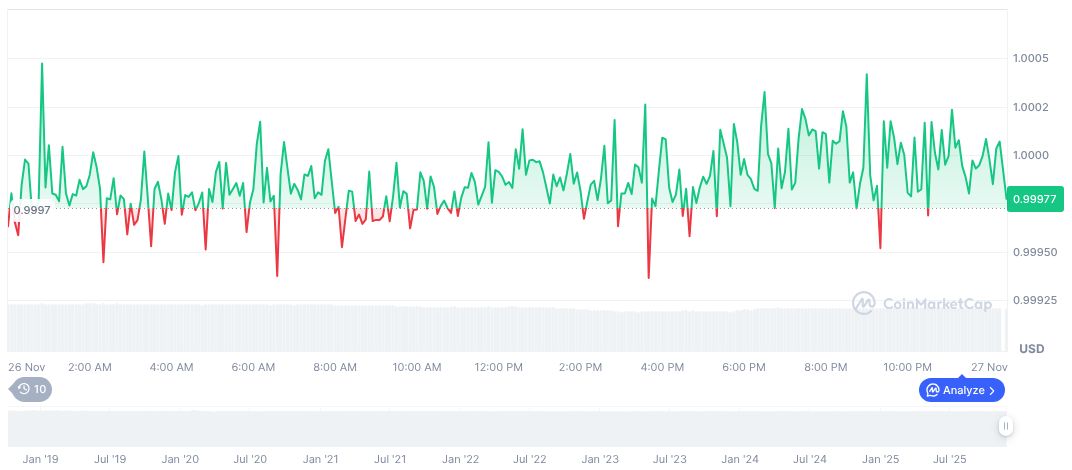

The recent minting events are a clear indication of the growing demand for USDC within the Solana ecosystem, underpinning efforts to support DeFi and trading. USDC maintains a stable price at $1.00, with a circulating supply of 76,060,617,362 and a market cap of $76.03 billion. Despite a slight dip in 24 hours, USDC continues to exhibit strong market presence. Sustained financial interest in Solana's protocols is anticipated, driven by USDC-induced liquidity gains and enhanced stablecoin availability. Technological robustness and regulatory alignment contribute to Circle's reputation in the stablecoin sector.

"The recent minting events are a clear indication of the growing demand for USDC within the Solana ecosystem, underpinning our efforts to support DeFi and trading." — Caryn Marooney, President, Circle

Market Data and Impact on Solana

Large USDC mints on Solana often follow market fluctuations, historically linking to improved trading opportunities and liquidity, reinforcing Solana's DeFi strength. Circle's USDC Treasury mints have significantly contributed to Solana's liquidity, enhancing trading opportunities and market dynamics.

Analysts suggest that the recent minting actions will likely lead to increased trading volumes and a more robust DeFi environment on Solana, as the community embraces the liquidity boost. This influx of liquidity is expected to further solidify Solana's position as a key player in the cryptocurrency market, supporting innovation and growth across its various decentralized applications.