Ethena Labs’ yield-paying stablecoin USDe briefly lost its one-dollar peg on Friday, after a sudden crypto market crash just hours after U.S. President Donald Trump announced a new 100% tariff on China,

This news led to panic selling across the market, making trading sell their assets to move to gold and U.S. Treasuries. On Binance, USDe fell as low as 65 cents before bouncing back to its intended value. The token, described as a “synthetic dollar,” is the third‑largest stablecoin with a market cap near $14 billion.

Massive Selloff Wipes $16 Billion from the Market

According to data from Coinglass, over $16 billion worth of bullish crypto positions were liquidated in 24 hours. More than 1.6 million traders were affected. This is one of the largest liquidation events in crypto history.

Binance said it is reviewing the situation and will assess “appropriate compensation measures” for affected users. The exchange confirmed that three stablecoins, including USDe, briefly lost their pegs during the chaos.

Ethena Labs, the project behind USDe, said the token remained “over‑collateralized” and that all mint and redeem operations were fully functional during the volatility. “We can confirm the mint and redeem functionality has remained operational throughout with no downtime experienced, and USDe remains overcollateralised,” the company wrote in a post on X. The team attributed the dip to “turbulent market conditions and widespread liquidations” but stressed that the system worked as designed.

Yields Tested as Traders Watch Closely

USDe offers holders a 5.5% yield, supported by a trading method known as the “basis trade,” which profits from differences between spot and futures markets. This approach allows returns to rise when trading activity is high but can be tested when markets crash. During the sell‑off, the hourly funding rate for Ether fell to its lowest level since the 2024 yen‑carry trade unwind, while cutting into returns for USDe holders.

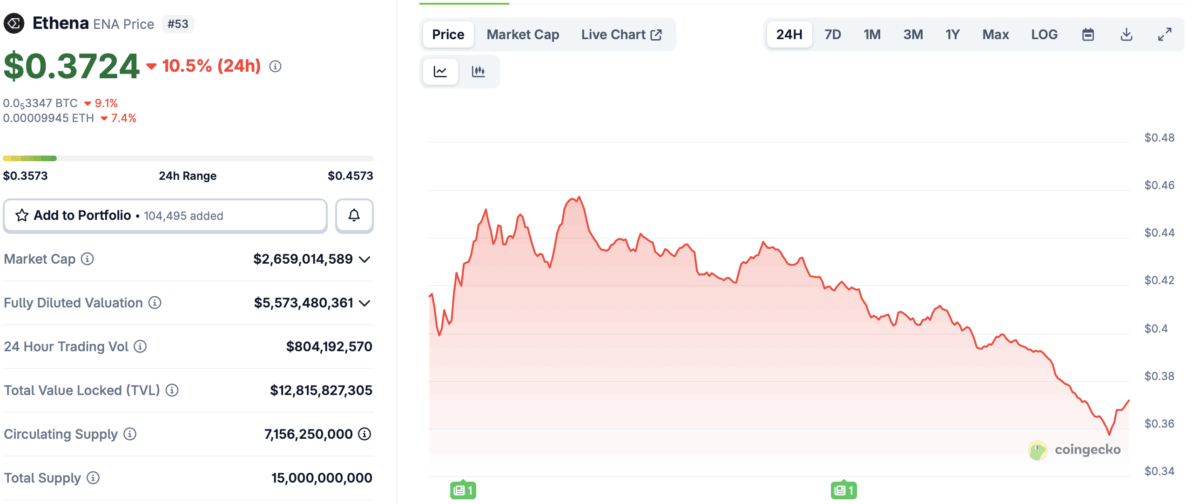

Meanwhiel, Ethena’s governance token, ENA, dropped as much as 43% in the same period, according to CoinGecko data. However, the price has recovered a bit. At the time of writing, the token is down $0.3724, but still down 10% from 24 hours.

Despite the rebound, the short‑lived depeg stirred concern among investors who depend on stablecoins for security and stability in digital markets.