For a long time, building a crypto portfolio meant one thing: buy BTC, add some ETH, chase DeFi yields, and hope the market runs. But heading into Q1 2026, that playbook is starting to feel limited.

So here’s the real question many top crypto holders are asking now: what comes after BTC, ETH, and DeFi yields? Where does new growth come from when public markets are crowded and noisy?

One emerging answer is tokenized private markets. In January 2026, tokenization is becoming a core theme as investors look beyond speculation. IPO Genie ($IPO) is designed to make that access possible inside a crypto portfolio, not outside it. Let’s explore how this changes global crypto portfolio building in 2026.

Highlights

Early access today beats catching up later |

What Are “Tokenized Private Markets”?

Tokenized private markets are a way to invest in private companies using blockchain technology. These are businesses that are not listed on stock exchanges yet, such as pre-IPO companies. Instead of needing large amounts of money or special access, the investment is turned into digital tokens that people can hold on-chain.

The main benefit is access. Tokenization allows fractional ownership, so everyday investors can take part without needing huge capital. It can also make these investments easier to manage compared to traditional private equity, where money is often locked away for years.

This is different from DeFi or buying regular top crypto tokens. Here, the focus is on owning a piece of real businesses, not trading price movements. Blockchain simply makes these private investments easier to access and understand.

What IPO Genie Brings To The Table

For a long time, private markets were never meant for normal people. Early access to companies like Apple, Uber, or Airbnb was limited to venture capital firms and wealthy insiders. Everyday workers could only watch as these companies grew and later went public at much higher values. That system has always been unfair.

IPO Genie is built to change that. It acts as a gateway to tokenized private markets, opening access that was once reserved for the top 1%. Instead of needing huge capital or elite connections, investors can participate with smaller or larger amounts, all on the same platform.

The platform uses AI-powered deal sourcing and vetting, focusing on data-driven opportunities rather than hype. Through tokenized ownership, users can invest in private and pre-IPO deals in a more accessible way. Unlike traditional private equity, there are no forced lock-ins. Investors keep control, with the freedom to exit when liquidity is available.

IPO Genie aims to make unfair access fair, giving everyday people a real seat at the table.

Why This Can Be A Helpful Addition To A Crypto Portfolio In 2026

Most crypto portfolios move together. When the market is up, everything feels green. When sentiment turns, prices fall across the board. This heavy dependence on market cycles is why many investors are now looking for something different.

Tokenized private markets can help change that. Private companies grow on their own timelines, driven by business progress rather than daily price action. Adding this kind of exposure can diversify both what drives top crypto returns and how long capital is invested.

There is also growing interest from institutions and research firms in tokenized private assets, suggesting stronger infrastructure ahead. Instead of relying only on speculation, tokenization introduces equity-style growth into a crypto portfolio, making it more balanced and forward-looking in 2026.

How To Actually Use IPO Genie In A Crypto Portfolio

The process of using IPO Genie for a global crypto portfolio is simple and easy to follow. See how everyday users can interact with what many see as a top crypto of 2026 without needing prior experience in private markets.

Step 1: Hold $IPO

$IPO is the token that gives access to IPO Genie. It is not meant to be just another coin to trade. Holding $IPO allows users to enter the platform and participate in private and pre-IPO investment opportunities that are usually unavailable in public crypto markets.

Step 2: Stake $IPO

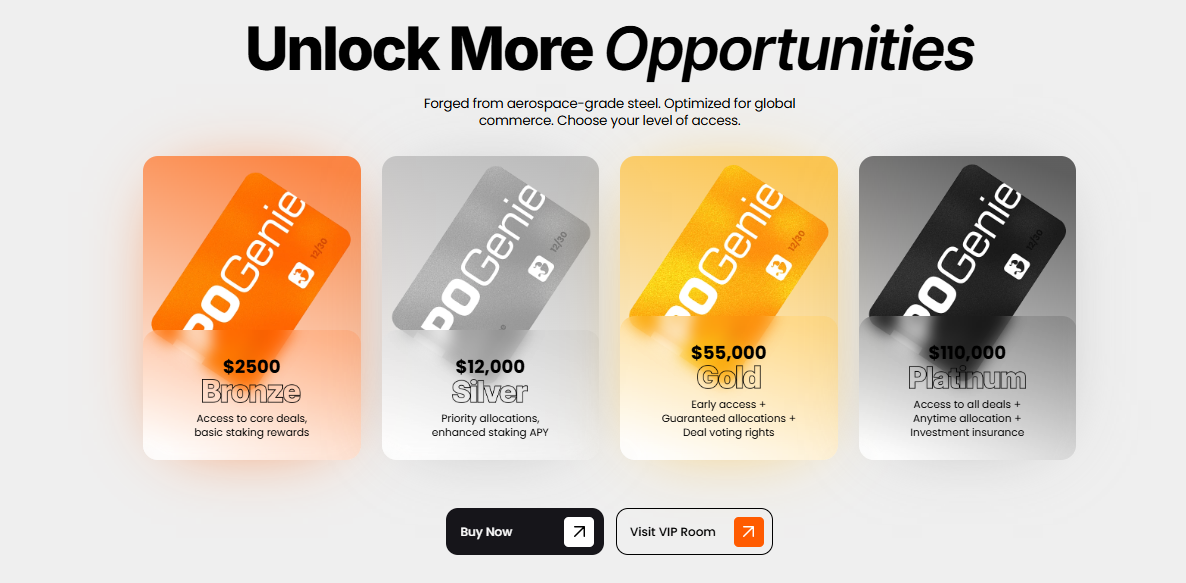

$IPO can be staked on the platform to unlock access tiers. These tiers decide which private deals a user can view and invest in. Staking also offers reward incentives and is designed so both small and large investors can take part.

Step 3: Choose Private Deals

Once access is unlocked, users can browse curated private and pre-IPO deals. Each opportunity is reviewed using AI-based analysis. Investments are made through tokenized ownership, meaning users own a small on-chain share of the private investment.

Step 4: Exit When Liquidity Is Available

IPO Genie is built with secondary liquidity options in mind. When available, holders can exit or trade their positions. There are no forced long-term lockups like traditional private equity.

Step 5: Portfolio Placement

IPO Genie works best as a small, intentional allocation alongside BTC, ETH, and DeFi. It adds private-market exposure to a crypto portfolio and is one reason many investors view it as a potential top crypto of 2026.

See which crypto category analysts are quietly backing for 2026?

The Real Benefits Of Adding IPO Genie In 2026

Early Access To Growth Before The Crowd

Most investors only discover companies after they go public, when much of the growth is already priced in. IPO Genie gives you access to private and pre-IPO opportunities, letting you participate earlier instead of watching value build from the sidelines.

A Portfolio That Does Not Depend Only On Market Hype

Public crypto markets move fast and often move together. IPO Genie adds exposure to business-driven growth, where returns depend on company progress, not daily price sentiment. This gives your portfolio a different engine for growth.

The Ability To Invest Without Being “Elite”

Private markets traditionally favor institutions and wealthy insiders. IPO Genie removes that wall. Whether you invest small or large, you gain access to the same private-market ecosystem. This creates fair participation, not insider privilege.

Clear Ownership And On-Chain Transparency

When you invest through IPO Genie, you receive tokenized ownership recorded on the blockchain. You always know what you own, and you do not rely on hidden agreements or closed systems common in traditional private equity.

Freedom To Exit When Opportunities Arise

Traditional private investments lock capital for years. IPO Genie keeps control with the holder. When liquidity becomes available, you decide whether to hold or exit. This flexibility makes private-market exposure easier to manage.

A Smarter, More Complete Crypto Portfolio

By adding tokenized private markets, you move beyond trading-only strategies. You combine liquid crypto assets with long-term private growth, creating a more balanced portfolio designed for how crypto investing evolves in 2026.

Thinking Beyond Public Tokens In 2026

By 2026, crypto portfolios will not all look the same. Some investors will stay focused only on public tokens, while others will quietly build exposure to private markets that were never meant for everyday people. IPO Genie sits at this turning point, bringing private-market investing into crypto in a way that feels simple, fair, and in your control.

As tokenization becomes more mainstream, early movers gain an edge that latecomers cannot easily replicate. Opportunities like this rarely stay open forever. If you’re looking for promising crypto opportunities beyond crowded markets, IPO Genie helps you get in early with lower minimums (only $10), before everyone else catches on.

Join the IPO Genie’s Presale Now