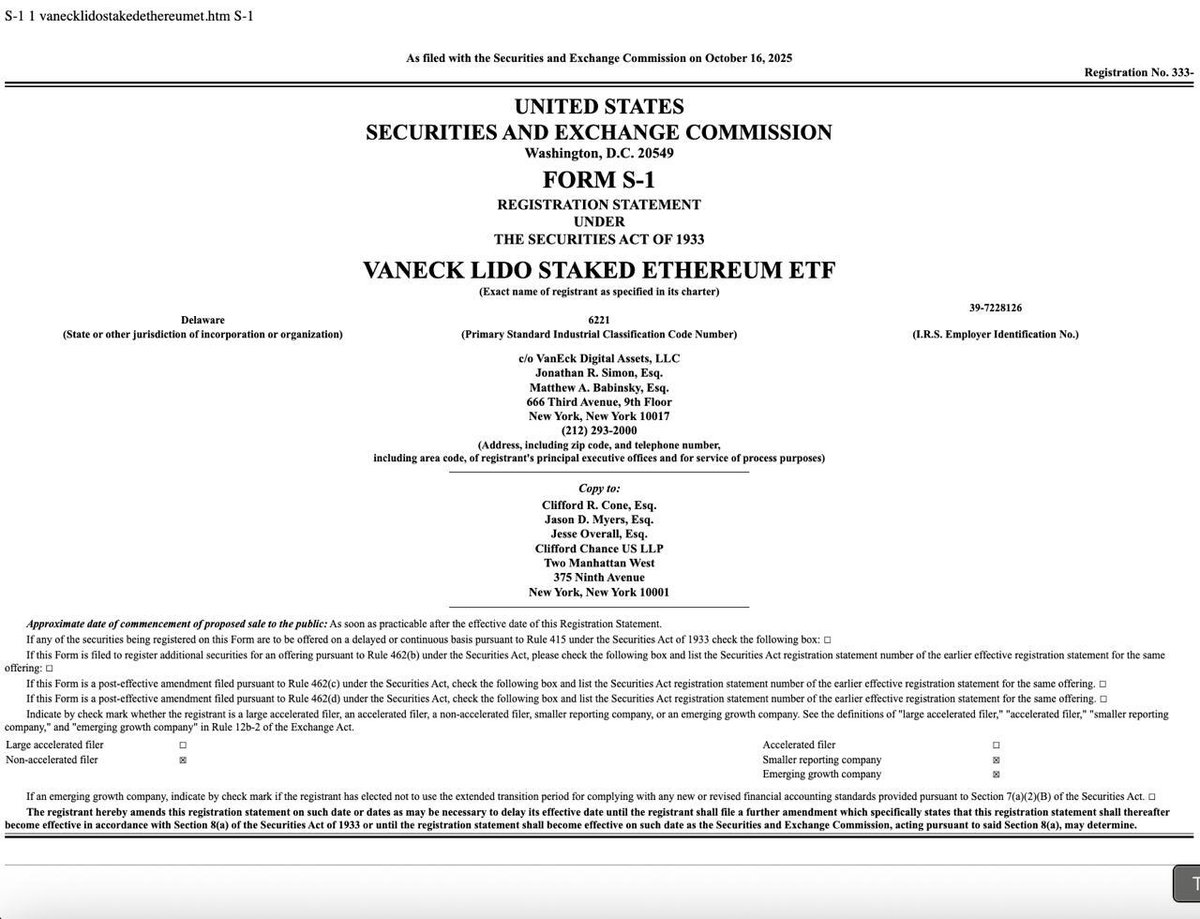

VanEck has officially submitted an S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) for the VanEck Lido Staked Ethereum ETF. This marks the first U.S. exchange-traded fund proposal designed to provide investors with exposure to Lido’s stETH, which represents Ethereum staked via the leading liquid staking protocol.

The filing outlines a product that would hold stETH, thereby allowing investors to gain regulated access to Ethereum staking yields without the necessity of managing validator operations directly. VanEck emphasizes that stETH combines decentralization, deep liquidity, and institutional-grade security, positioning it as a reliable foundation for onchain investment products.

Kean Gilbert, Head of Institutional Relations at the Lido Ecosystem Foundation, described the move as “a milestone for mainstream adoption.” He further added that the proposal demonstrates how liquid staking and institutional standards can coexist.

Potential Benefits and Market Impact

If approved, the ETF would offer investors daily liquidity, onchain transparency, and tax-efficient exposure to Ethereum’s staking economy. Lido currently holds nearly $40 billion in total value locked and has distributed over $2 billion in staking rewards since its launch.

The submission of this filing brings liquid staking one step closer to regulated financial markets, reinforcing Ethereum’s growing role in institutional portfolios.