Venezuela Output Near 1M bpd Limits Bitcoin Mining Impact

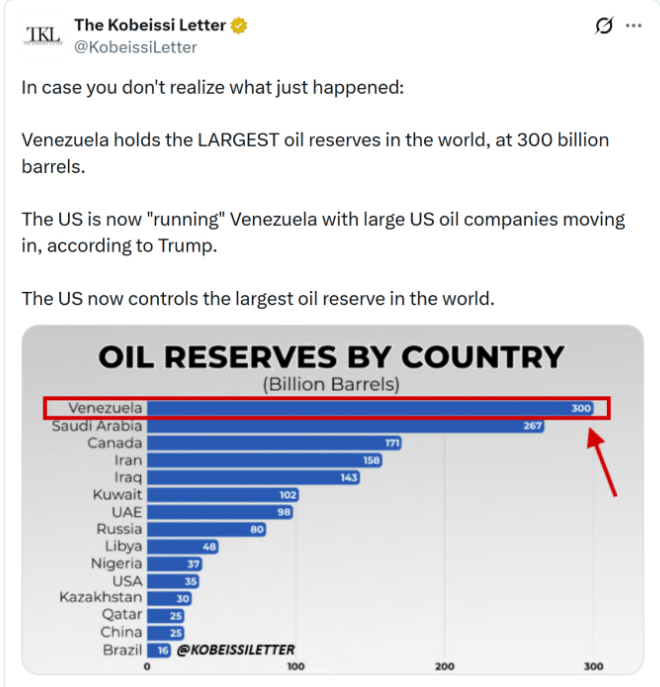

Bitcoin mining is increasingly treating Venezuela less as a cheap-power shortcut and more as a long-term energy variable. The country holds about 303 billion barrels of proven oil reserves, which keeps it on global energy watchlists. Yet large reserves do not guarantee near-term supply. Output remains far below historical peaks.

Venezuela’s production is estimated around 1 million barrels per day. That is far under the multi-million bpd levels it once sustained. Analysts link the decline to underinvestment and degraded infrastructure. They also point to the difficulty of extracting and transporting extra-heavy crude. A recent report citing Bitfinex analysts framed Venezuela as a long-horizon factor for Bitcoin mining economics. The analysts said bigger supply could lower energy costs in some markets over time.

Hashprice and Power Costs Define Bitcoin Mining Profitability

Bitcoin mining margins depend on revenue per unit of hashpower minus operating costs. Miners track revenue using hashprice, a benchmark popularized by Luxor. Hashprice estimates the daily value of 1 terahash per second of hashing power. Electricity remains the main recurring cost for Bitcoin mining. The University of Cambridge mining methodology notes that power represents a large share of operating expenses. That is why operators focus heavily on energy efficiency and facility uptime.

Proven Reserves Do Not Equal Fast Output

Venezuela’s 303 billion barrel reserve figure is real. It explains why the country stays in long-term energy forecasts. Estimates place Venezuela near 1 million bpd, down sharply from output above 3 million bpd in earlier decades. The gap matters for Bitcoin mining planning. Cheap energy depends on steady supply, functioning infrastructure, and stable exports. Venezuela’s reserve size does not solve those constraints. That is why analysts treat the story as long duration.

Extra-Heavy Crude Limits Quick Growth

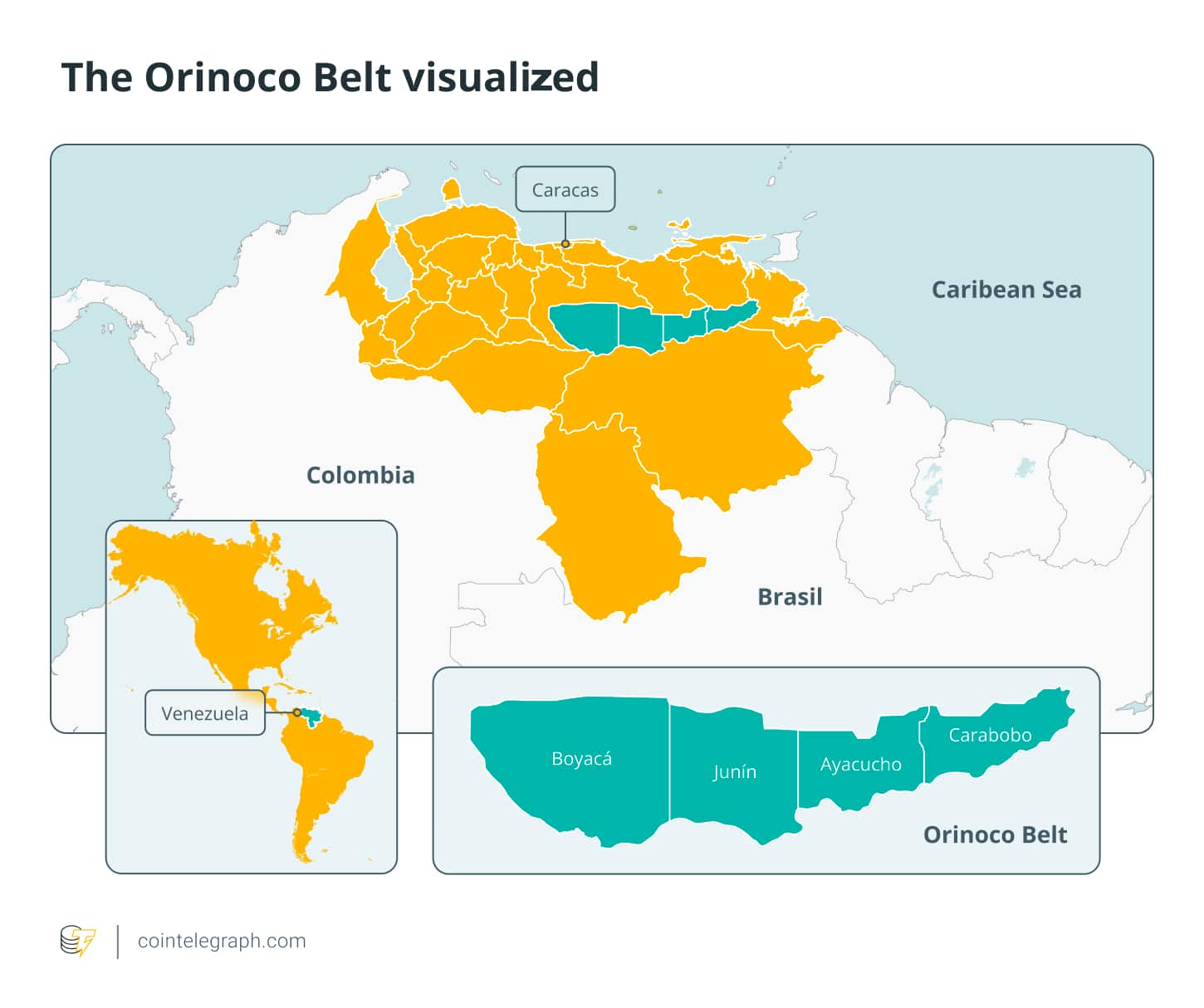

Much of Venezuela’s oil is extra-heavy, especially in the Orinoco Belt. Extra-heavy crude is harder to lift and transport than lighter oil. It often requires diluents such as naphtha to thin the crude. That makes logistics more complex and more expensive. Processing is also harder. Extra-heavy crude requires specialized handling at refineries. Pipelines and equipment must stay operational for consistent flows. These limits reduce the chance of rapid output gains. For Bitcoin mining, this pushes the timeline outward.

Oil Can Still Influence Power Prices

Still, fuel markets can influence wholesale power through generation costs. In many systems, fossil generation sets the marginal price of electricity. Research briefs from the UK Parliament describe how marginal-cost pricing can allow gas-fired power to set the wholesale rate. Reuters reporting on power markets often points to fuel costs as key drivers of price swings. That link can matter for Bitcoin mining. It matters most for miners exposed to spot rates. Long-term pricing contracts can reduce this sensitivity.

PPAs Bring Stability but Need Reliable Conditions

Many operators prefer power purchase agreements to reduce volatility. PPAs can lock in pricing over multi-year terms. A legal primer on PPAs describes pricing structure and contract tenure as core negotiation points. Yet Venezuela is not a simple PPA environment. Restoring upstream output would take years. Heavy-oil logistics would need major investment. Grid performance and legal stability would also need improvement. Without that foundation, bankable contracts remain difficult.

Stranded Energy and Flare Gas Offer Another Path

Oil-field development can increase associated gas volumes. Some of that gas is flared when it cannot be transported. In other regions, operators have used flare gas to generate onsite power for Bitcoin mining. Texas A&M University has profiled flare-gas mining projects. Firms such as Crusoe have described deploying mobile data centers near oil and gas sites. This model can reduce wasted energy while powering compute. If Venezuela’s energy sector stabilizes, stranded energy could become relevant. But permitting and infrastructure still matter.

Grid Reliability and Policy Risk Remain Obstacles

Power reliability is a major blocker. Venezuela has faced repeated large-scale outages. A nationwide blackout was reported on Aug. 30, 2024, affecting Caracas and other regions before gradual restoration. Uptime is critical for Bitcoin mining profitability. Policy risk is also unusually direct. In May 2024, Venezuela’s Ministry of Electric Power announced a plan to disconnect cryptocurrency mining farms from the national grid as part of load control efforts.

Conclusion

Venezuela matters to Bitcoin mining mainly as a long-duration energy variable. Reserve size alone does not translate into fast output recovery or stable power. Analysts expect timelines measured in years, not months. Miners are likely to track sustained production growth, easing heavy-oil constraints, realistic multi-year power contracts, and clearer policy signals.

Appendix Glossary of Keyterms

Hashprice: Estimated daily revenue per 1 TH/s of mining power

Hashrate: Total computing power securing the Bitcoin network

TH/s: Terahash per second, a unit of mining machine performance

PPA (Power Purchase Agreement): Long-term contract for fixed electricity pricing

Marginal Pricing: Wholesale power price set by the marginal generator

Extra-Heavy Crude: Dense oil that needs special handling and transport methods

Orinoco Belt: Venezuela’s primary region for extra-heavy oil production

Stranded Energy: Unused energy supply due to weak grid access or logistics

Frequently Asked Questions About Bitcoin Mining

1- Can Venezuela lower Bitcoin mining power costs soon?

Analysts do not expect fast impact. Production recovery is likely to take years.

2- Why do reserves not guarantee cheaper electricity?

Reserves show resource size. Electricity pricing depends on output, logistics, and grid reliability.

3- What signals should miners watch?

Sustained output growth, improved heavy-oil logistics, bankable PPAs, and stable mining policy.

4- What risks make Venezuela difficult for miners right now?

Grid outages and policy actions can disrupt operations and contracts.