Concerns Over CLARITY Act Draft

Alex Thorn, head of firmwide research at Galaxy Digital, has shared a new warning about the CLARITY Act.

If the draft of the bill currently circulating in the Senate Banking Committee becomes a law, it would lead to the biggest expansion of financial surveillance since the USA PATRIOT Act, a veteran analyst warned.

Thorn wrote in a report published on Jan. 13 that the discussion draft of the crypto market structure legislation grants authorities to the U.S. Treasury that exceed those mentioned in the Digital Asset Market Structure Clarity (CLARITY) Act, The Block reported.

The House of Representatives passed the CLARITY Act with overwhelming bipartisan support in July 2025.

The draft of the market structure bill forcefully expands federal illicit-finance and surveillance powers, Thorn wrote in the Galaxy Digital report.

"On balance, were the powers outlined in the Senate Banking draft to become law, we believe they would represent the single largest expansion to financial surveillance authorities since the USA PATRIOT Act."

Understanding the USA PATRIOT Act

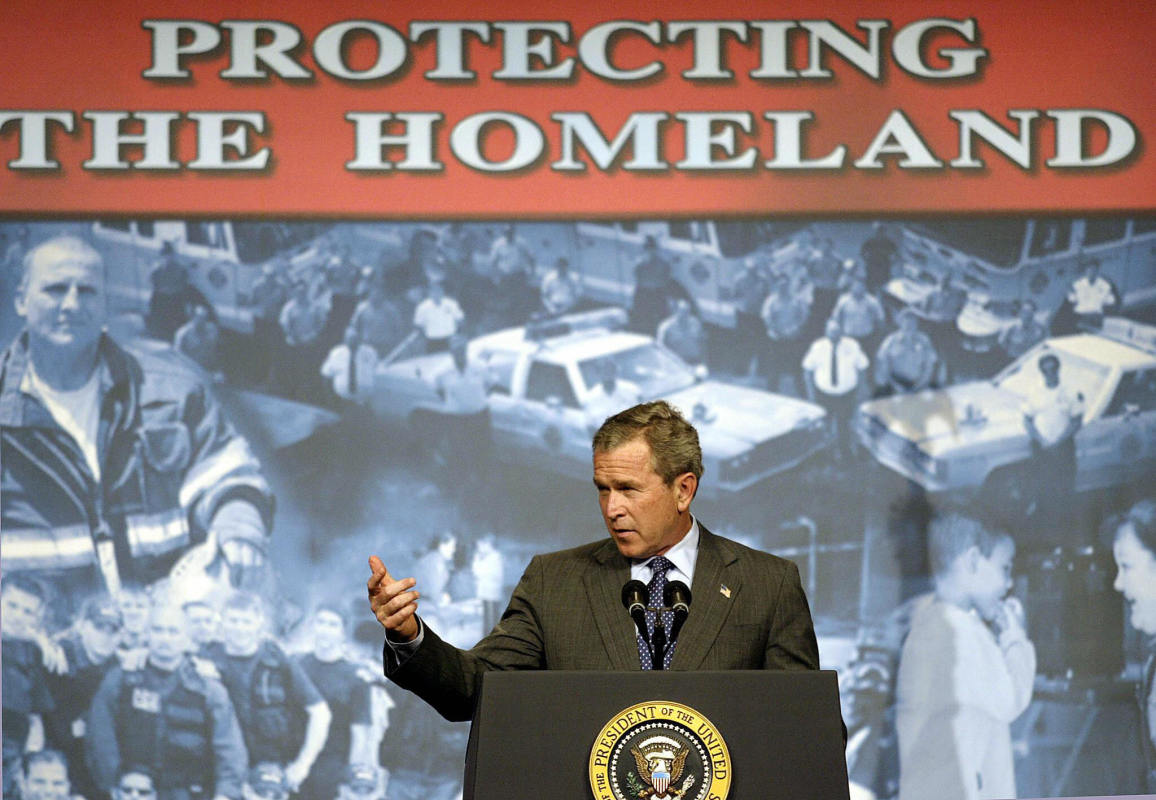

The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism (USA PATRIOT) Act of 2001 is a landmark act of the U.S. Congress.

President George W. Bush signed it into law following the terror attacks in the U.S. by al-Qaeda on Sep. 11, 2001.

The PATRIOT Act attracted widespread criticism because it grants sweeping authorities to federal agencies to track financial transactions and invade an individual's privacy.

Draft Bill's Sweeping Controls

Though the draft of the crypto market structure bill upholds the right to self-custody, grants protection to developers, and distinguishes the jurisdictions of market regulatory bodies, there is a problem with how it addresses illicit finance, Thorn wrote.

A provision mentioned in the draft grants new tools to the U.S. Treasury as a “special measure” to exercise authority over crypto transactions deemed to pose money laundering risks, Thorn wrote.

It also introduces a "temporary hold" provision that allows authorities to freeze crypto transactions without a court order.

It also expands sanctions and anti-money laundering norms to blockchain front ends.

Thorn warned further that, in addition, the draft introduces a framework to apply the Bank Secrecy Act compliance to what the draft refers to as "non-decentralized" decentralized finance (DeFi) protocols and introduces new information-sharing and interdiction programs between government agencies and private companies.

Even though the draft includes core reforms sought by the Republicans, it grants major concessions concerning illicit finance to Democrats, the report highlighted.

In fact, some lawmakers are battling to add even more expansive enforcement provisions to the draft, Thorn warned.

This is an unforeseen development, given the fact that the House of Representatives passed the Anti-CBDC Surveillance State Act in July 2025.

Signaling the Donald Trump administration's apparent resistance to state surveillance, the legislation blocks the Federal Reserve from issuing or testing a central bank digital currency (CBDC) without explicit congressional approval.

Legislative Mark-up Expected Soon

The Senate Banking Committee is expected to mark up and vote on the crypto market structure bill on Jan. 15.

The Senate Agriculture Committee has delayed its markup on the bill to the last week of the month.

The final legislation would need to satisfy both the committees and require at least 60 votes in the Senate to clear.