Key Developments in Visa's Stablecoin Initiative

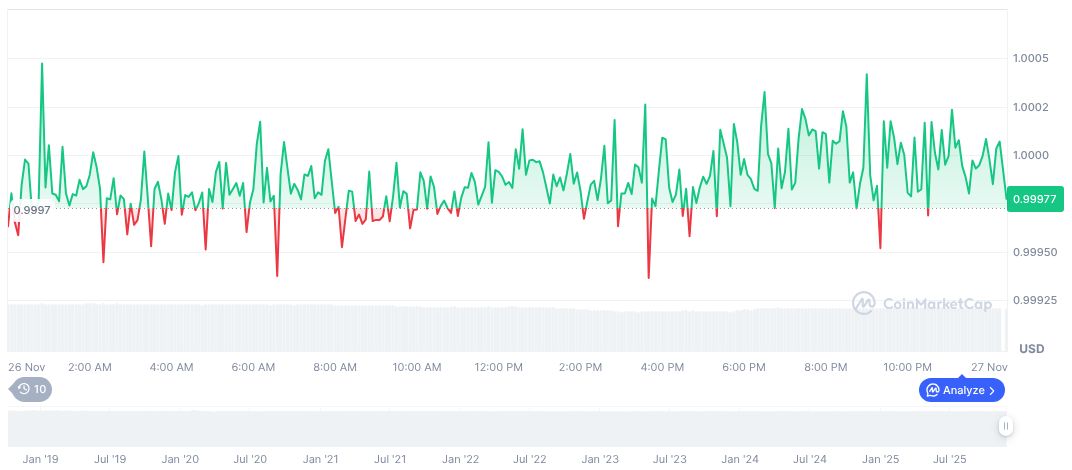

Visa has partnered with Aquanow to facilitate stablecoin settlements within the Central and Eastern Europe, Middle East, and Africa (CEMEA) region. This collaboration is designed to enhance payment processes by reducing friction and speeding up settlement times. The initiative has already led to a significant annual run rate of $2.5 billion in USDC settlements.

Visa-Aquanow Collaboration Targets $2.5 Billion USDC Flow Annually

Visa's collaboration with Aquanow enables faster settlements utilizing USDC stablecoins. This venture aims to improve the operational efficiency of cross-border payments throughout the CEMEA region by leveraging Aquanow’s liquidity solutions. Godfrey Sullivan, Visa's Head of Product and Solutions for CEMEA, emphasized the potential for reduced costs and settlement friction.

Through this initiative, Visa's financial partners can expect accelerated settlement processes. The partnership aligns with Visa’s strategic objective to modernize payment infrastructures by integrating digital assets into traditional systems. Godfrey Sullivan stated, "By harnessing the power of stablecoins and pairing them with our trusted global technology, we are enabling financial institutions in CEMEA to experience faster and simpler settlements. Our partnership with Aquanow is another key step in modernizing the back-end rails of payments, reducing reliance on traditional systems with multiple intermediaries, and preparing institutions for the future of money movement."

Industry reactions have been positive, underscoring the partnership's implications for broader stablecoin adoption. Phil Sham, CEO of Aquanow, highlighted the synergistic relationship between Visa’s extensive global payment framework and Aquanow’s specialized infrastructure.

Stablecoin Integration Expected to Transform Payment Dynamics

Visa's engagement with stablecoin settlements began in 2023, marking a significant precedent as one of the first major payment networks to adopt digital assets for transaction enhancements.

Coincu analysts suggest that the increasing integration of stablecoins could instigate widespread changes within payment systems. As institutions adopt these digital currencies, potential regulatory adjustments are anticipated, fostering innovation in financial technologies and frameworks.