Market Overview and Visa's Dominance

Cryptocurrency cards have achieved a significant milestone, reaching $18 billion in annual transaction volume. Visa holds a commanding 90% market share in this rapidly expanding sector, according to a recent Artemis report. This substantial market penetration highlights Visa's strategic focus on leveraging stablecoin transactions within the digital payment landscape.

The impressive growth in crypto card transactions is closely linked to an increased reliance on stablecoins, which are actively fostering broader cryptocurrency adoption. Despite this momentum, Artemis analysts project that cryptocurrencies are unlikely to displace traditional card networks in the short term, suggesting that existing financial structures will remain largely intact.

While the transaction volumes are notable, there have been no official comments from key industry figures or regulatory bodies regarding the impact of this burgeoning market. Sentiment within the community remains cautious, largely due to ongoing regulatory uncertainties surrounding specific stablecoins, such as USDT.

Stablecoin Transactions as a Growth Driver

Visa processed over $3.5 billion in stablecoin-linked transactions by the end of 2025, demonstrating a substantial 460% year-over-year increase. This surge underscores the growing acceptance and utility of stablecoins in mainstream payment systems.

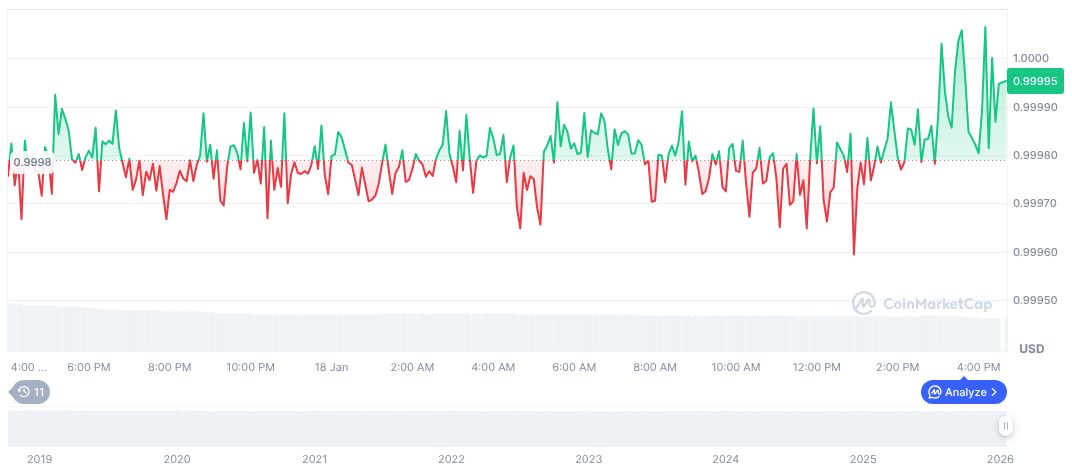

As of January 19, 2026, 02:38 UTC, USDC was trading at $1.00, with a market capitalization of $76.01 billion and a 24-hour trading volume of $10.01 billion. Over the preceding 90 days, USDC experienced a price shift of -1.75%.

Experts from the Coincu research team identify stablecoins as a crucial bridge for cryptocurrency payments. However, they also point out existing challenges, including technical limitations and the inherent reliance on fiat ecosystems. Furthermore, persistent regulatory uncertainty could potentially impact future adoption levels. A Coincu analyst noted, "Stablecoins remain a double-edged sword, fostering innovation while demanding cautious regulatory oversight to mitigate risks."