Following a promising start to October, Bitcoin's price has experienced a significant decline in the subsequent weeks, dropping by approximately 30% and falling below $90,000 yesterday. This sharp downturn has led some analysts to suggest that a bear market may be underway, prompting an inquiry into the perspectives of two prominent AI-powered chatbots.

ChatGPT's Cautious Outlook

ChatGPT indicated that while there are strong signs pointing towards a bear market, it is premature to definitively declare the end of Bitcoin's bull run. The chatbot acknowledged the recent double-digit price drop over the past week but emphasized that such corrections can be temporary and do not necessarily guarantee a sustained bear market.

Bear markets typically involve sustained declines over months or even years, along with broad investor capitulation – we may only be in the early phase.

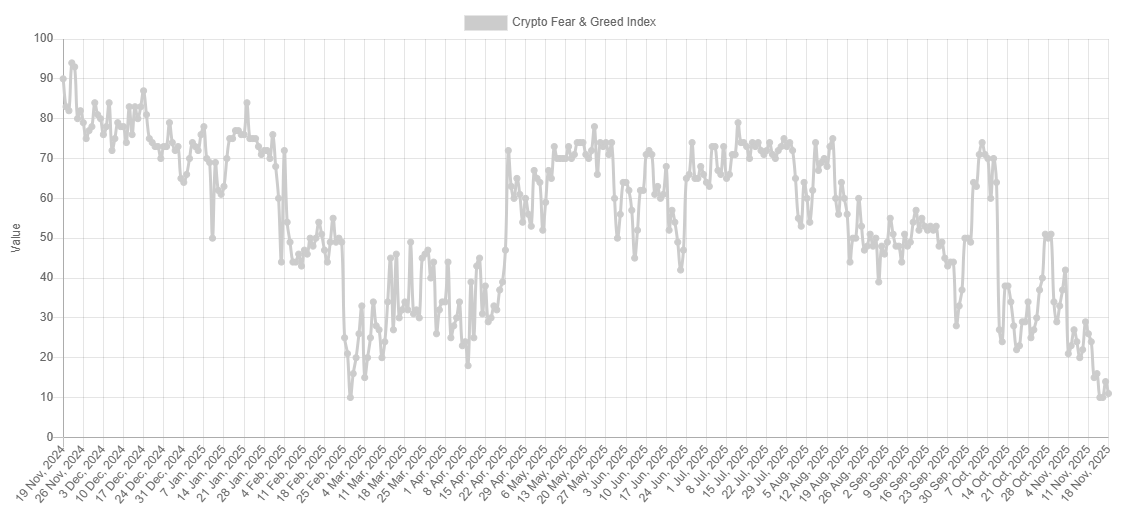

Further concerns were raised by ChatGPT regarding weak institutional demand, outflows from spot Bitcoin ETFs, and heightened investor panic. The Fear and Greed Index recently plummeted to 10, a level indicating "Extreme Fear" and the lowest point observed since February of this year.

While this situation may appear concerning, it could also represent a significant opportunity. Historically, some of the most advantageous buying opportunities have emerged during periods of widespread investor capitulation. The "Extreme Fear" sentiment might suggest that the market has overreacted to the downside, creating a situation where the asset is temporarily undervalued relative to its long-term potential.

In such market conditions, the wisdom of legendary investor Warren Buffett often resonates: "Be fearful when others are greedy and greedy when others are fearful."

Gemini's Technical Bear Market Assessment

Google's Gemini chatbot observed that Bitcoin's price has fallen by nearly 30% from its all-time high of over $126,000 last month, a decline that aligns with the conventional definition of entering a bear market.

A drop of 20% or more from a peak is the conventional definition of entering bear market territory.

Gemini also highlighted several technical indicators that support this bearish thesis. These include the price breaching the significant psychological level of $100,000 and the formation of a "death cross" pattern on price charts.

In its conclusion, Gemini posited that Bitcoin has technically entered bear market territory due to the significant price collapse and the breakdown of key technical indicators. The chatbot suggested that it remains to be seen whether this trend will develop into a prolonged crypto winter.