Market Downturn and Contributing Factors

Bitcoin (BTC) and altcoins have experienced a difficult start to December, failing to recover from a late November downturn. This decline is attributed to growing concerns about global liquidity withdrawals. The Bank of Japan's hints at an interest rate hike have raised the possibility of a decrease in yen-based carry trades, a factor that has influenced the market.

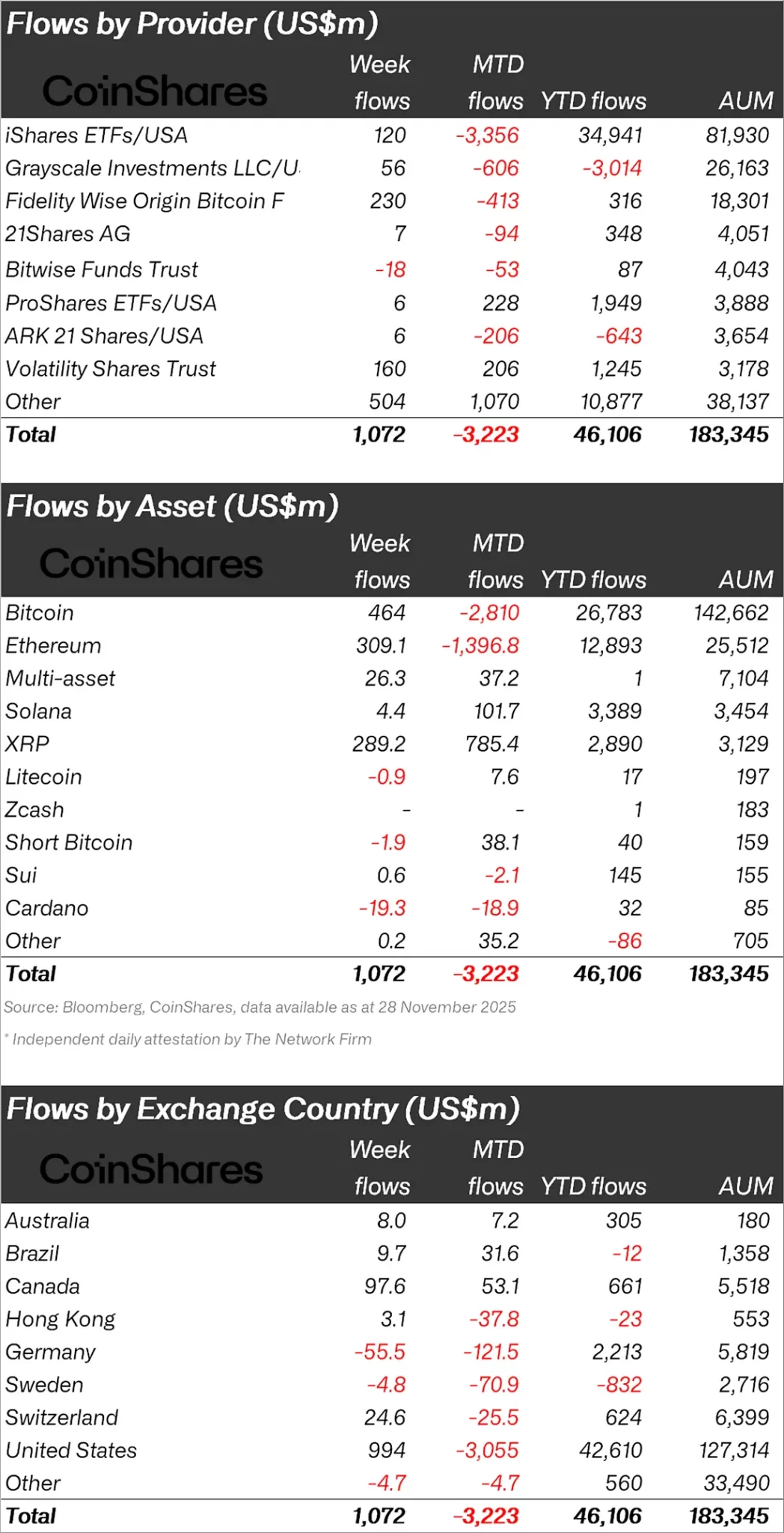

Cryptocurrency Investment Product Inflows

Despite the market's decline, Coinshares released its weekly cryptocurrency report, detailing significant inflows into investment products. The report stated that there was an inflow of $1.07 billion last week, marking a positive shift after four weeks of heavy outflows. This resurgence in investment is partly linked to increased hopes for a US interest rate cut, following comments made by FOMC member John Williams.

Cryptocurrency investment products saw an inflow of $1.07 billion after four weeks of heavy outflows, as hopes for a US interest rate cut rose following comments by FOMC member John Williams.

Individual Crypto Fund Performance

Analyzing individual crypto funds reveals that the majority of these inflows were directed towards Bitcoin. Bitcoin experienced an inflow of $464 million. Ethereum (ETH) also saw substantial investment, with an inflow of $309 million.

Other altcoins, notably Solana (SOL) and XRP, also benefited from inflows, partly influenced by the performance of Exchange-Traded Funds (ETFs). XRP recorded an inflow of $289.2 million, while Solana saw an inflow of $4.4 million. In contrast, Cardano (ADA) experienced an outflow of $19.3 million.

“Bitcoin saw inflows of $464 million last week. Ethereum also benefited from improving market sentiment with $309 million in inflows last week. XRP recorded record weekly inflows of $289 million. The latest six-week wave of inflows represents 29% of assets under management (AuM), likely linked to recent US ETF launches. In comparison, Cardano (ADA) recorded $19.3 million in outflows, equivalent to 23% of its assets under management (AuM).

Regional Fund Inflows and Outflows

Geographically, the United States led in fund inflows, with a total of $994 million. Following the USA, Canada reported an inflow of $97.6 million, and Switzerland saw an inflow of $24.6 million. On the other hand, Germany experienced minor outflows amounting to $55.5 million, and Sweden had outflows of $4.8 million.