Key Developments in Aave's USDT Market

A significant cryptocurrency investor, identified by wallet 0x540C, withdrew $114.9 million USDT from Aave's main market. This action caused the USDT utilization rate to surpass its optimal threshold.

The increased borrowing costs are a direct result of this event, aligning with Aave's established risk management mechanisms. These mechanisms are designed to stabilize liquidity and incentivize further deposit supply, highlighting the potential for volatility within decentralized finance markets.

Aave's Utilization Rate Reaches 92.83%

Following the substantial USDT withdrawal, Aave's utilization rate climbed to 92.83%, exceeding its optimal threshold. This surge has led to a significant increase in interest rates, as detailed in Aave's official documentation. The heightened rates are intended to manage borrowing activities and encourage new deposits to rebalance liquidity.

As of the latest reports, there have been no official statements released by Aave's leadership team concerning this particular event.

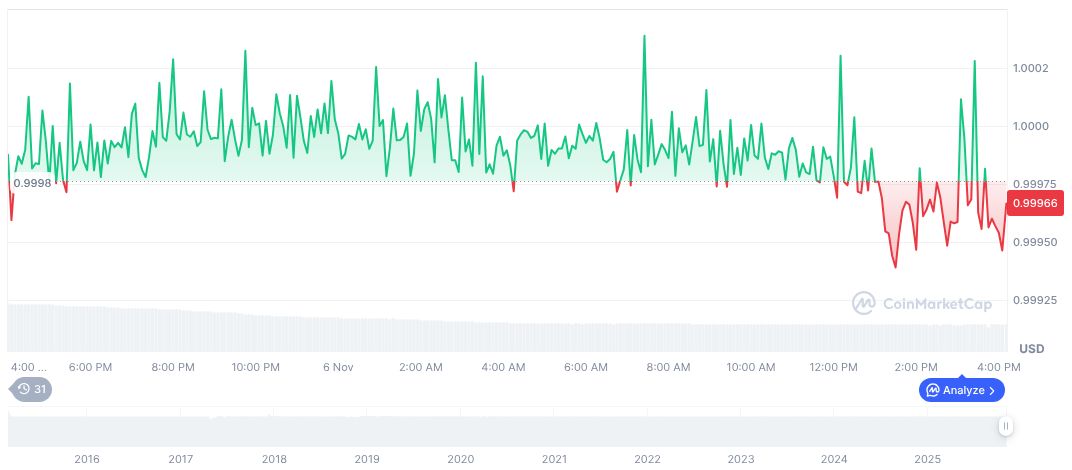

Tether (USDT) is currently trading at $1.00, according to CoinMarketCap. It holds a market capitalization of $183.37 billion and represents 5.37% of the total market dominance. The trading volume for USDT reached $139.37 billion in the past 24 hours, with a minor price change of -0.04% during this period. Over the last 90 days, USDT has experienced minimal price fluctuations, with a decrease of 0.06%.

"When utilization exceeds this point, Slope 2 kicks in, sharply increasing interest rates to discourage excessive borrowing and protect the remaining liquidity.” — Aave Documentation, Official Documentation Team, Aave

Analysis of DeFi Market Dynamics and Price Movements

Did you know? In March 2023, a comparable situation occurred where Aave's DAI market approached 100% utilization, resulting in a spike in interest rates and an incentive for new deposits.

The Coincu research team emphasizes the evolving borrowing and lending dynamics within the decentralized finance ecosystem. They stress the critical importance of market stability mechanisms, particularly during periods of high utilization.