Bitcoin is currently experiencing a period of consolidation following a significant price surge. However, the most dynamic activity is occurring on its second layers.

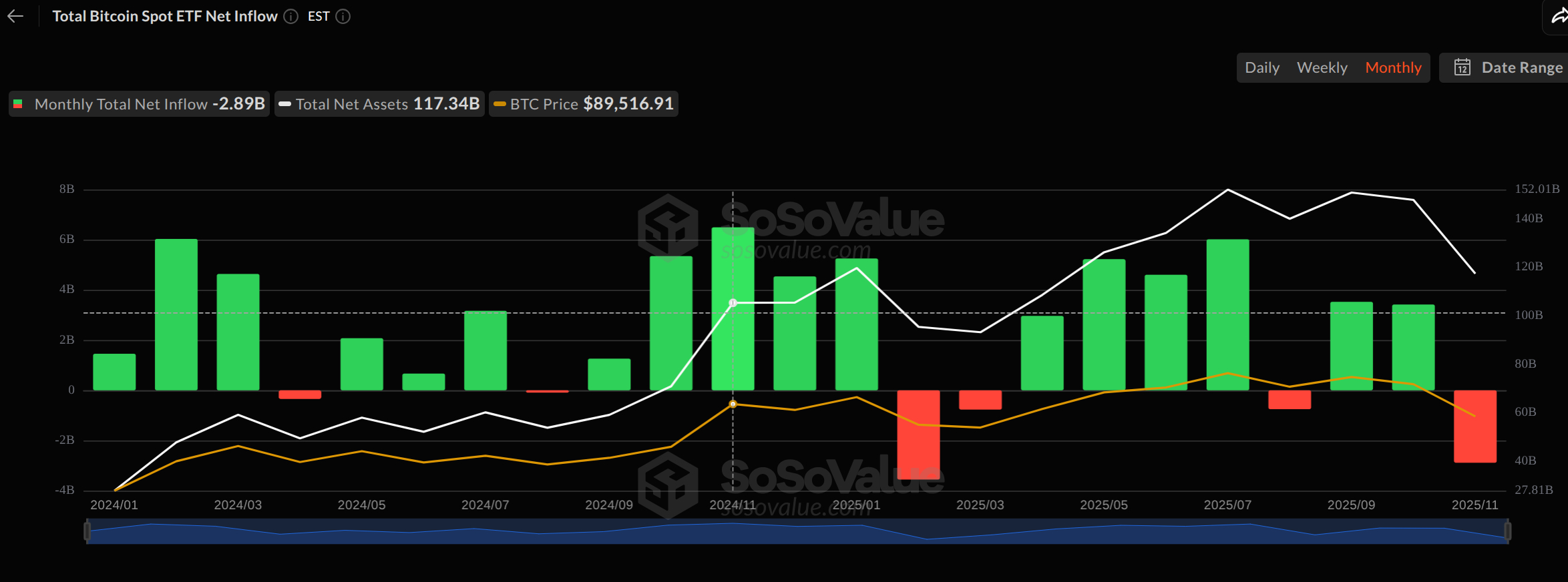

While spot Bitcoin ETFs are trading more than 20% below their recent highs, capital is being strategically reallocated into the infrastructure designed to enhance Bitcoin's scalability and usability.

This capital rotation is prominently reflected in the presale of Bitcoin Hyper ($HYPER), a Bitcoin Layer-2 solution. In a span of just a few months, this project has amassed over $28 million, positioning it as a leading presale among the current wave of Bitcoin scaling initiatives.

The narrative surrounding Bitcoin Layer-2s has gained substantial traction this cycle. As network activity increases, the demand for base-layer blockspace leads to higher fees and slower transaction times. Layer-2 solutions, which bundle transactions off-chain and then settle them to the Bitcoin network, offer a promising solution by providing faster, cheaper transactions while leveraging Bitcoin's inherent security.

Bitcoin Hyper aims to capture this market by utilizing a Solana-style execution layer, a canonical Bitcoin bridge, and offering staking rewards for presale participants. The project is presenting itself as a high-throughput, yield-generating platform to facilitate the next phase of Bitcoin adoption.

Bitcoin Hyper Layer-2 Targets Enhanced Utility for Bitcoin

Bitcoin Hyper ($HYPER) is designed to function as an "efficiency layer" built on top of the Bitcoin network.

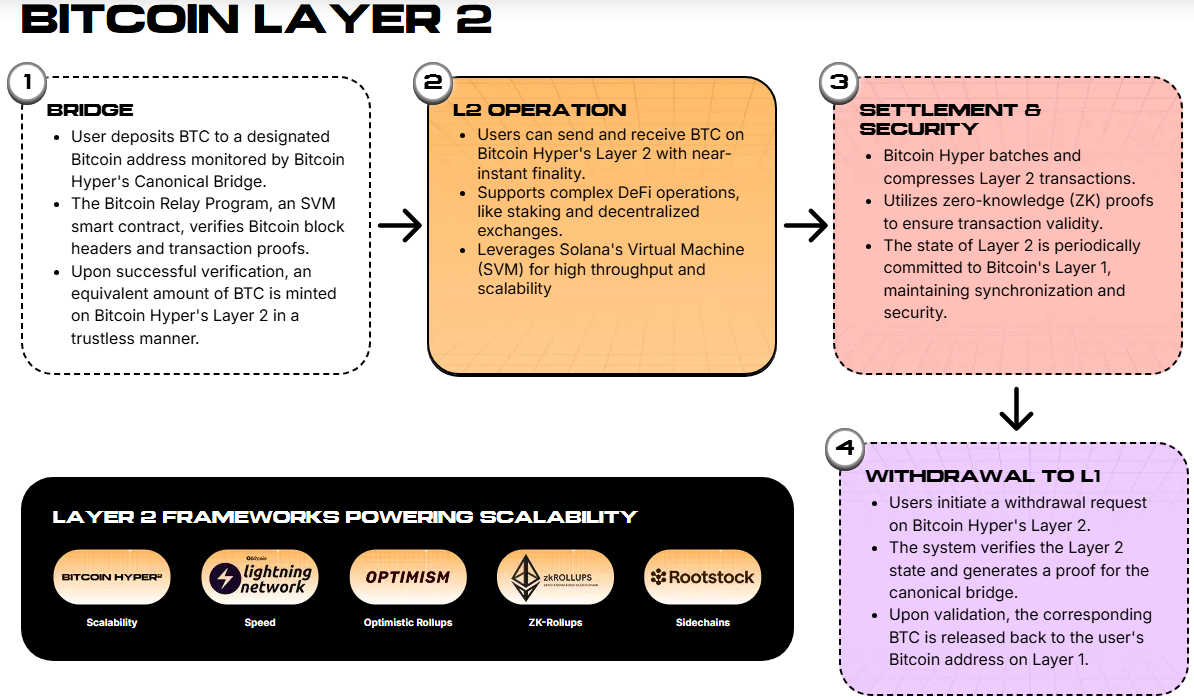

In this architecture, the Bitcoin base chain serves as the ultimate settlement layer, while all high-speed transactions are processed on Hyper's Layer-2. Transactions are executed within a Solana Virtual Machine (SVM) environment. Subsequently, these transactions are batched into rollups and periodically committed to the Bitcoin network utilizing zero-knowledge proofs.

The project's objective is to transform Bitcoin into a fully functional Web3 platform.

The SVM is engineered to support Rust-based smart contracts, enabling the development of decentralized finance (DeFi) protocols, NFT marketplaces, and gaming applications. These applications will utilize wrapped Bitcoin ($BTC) that is bridged onto the Layer-2 via Hyper's canonical bridge.

The bridging process involves users depositing $BTC to a monitored address. The bridge then verifies block headers and proofs before minting an equivalent amount of $BTC on the Layer-2 in a trustless manner.

The implementation of this Layer-2 solution promises significantly faster and cheaper Bitcoin transactions, with finality times reduced from minutes or hours to mere seconds. This dramatically improves performance and scalability, creating an ecosystem that is compatible with mainstream adoption and suitable for both institutional and retail investors.

Bitcoin Hyper ($HYPER) Presale Momentum Continues to Accelerate

The presale figures for $HYPER demonstrate strong investor confidence.

The project has successfully raised over $28 million, with the current token price at $0.013305. This represents an approximate 15% increase from the initial offering price, with subsequent price tiers implemented as allocation stages are completed.

The substantial capital raised includes significant contributions from large investors. One notable transaction involved an investment of approximately $500,000, while another investor acquired roughly $379,000 earlier in the campaign. Several periods have also seen fresh inflows from large investors totaling nearly $500,000 within a single week.

Beyond its utility, the staking mechanism is a key driver of investor interest.

Presale buyers have the option to immediately stake their $HYPER tokens and earn an Annual Percentage Yield (APY) of 41% based on current parameters. This APY is designed to decrease as more tokens are staked, rewarding early participants for their commitment rather than attempting to time the market.

The tiered pricing structure of the presale ensures that early participants benefit from a lower cost basis compared to later investors. Stakers further enhance their returns through these rewards, compounding their initial advantage.

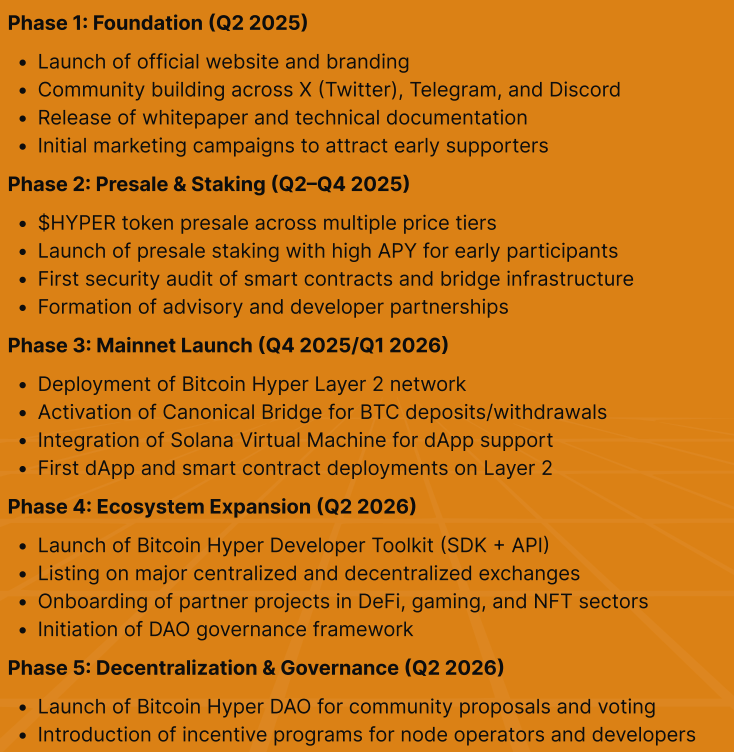

Looking ahead, $HYPER exhibits significant growth potential, contingent upon the successful implementation of the project's roadmap and effective marketing strategies.

Key factors for success will include the robust execution of the canonical bridge, the efficiency of the ZK rollup process, and the stability of the mainnet. Post-launch liquidity and listing depth will also be critical. The project's whitepaper provides a comprehensive overview of the developmental roadmap from its inception.

If these critical components are successfully delivered, the combination of a $28 million development fund, sustained accumulation by large investors, and an active staking program could lead to a compelling first year of trading for $HYPER.

It is important to note that Bitcoin Hyper ($HYPER) is targeting a release window between the fourth quarter of 2025 and the first quarter of 2026, indicating that the presale period may conclude relatively soon.