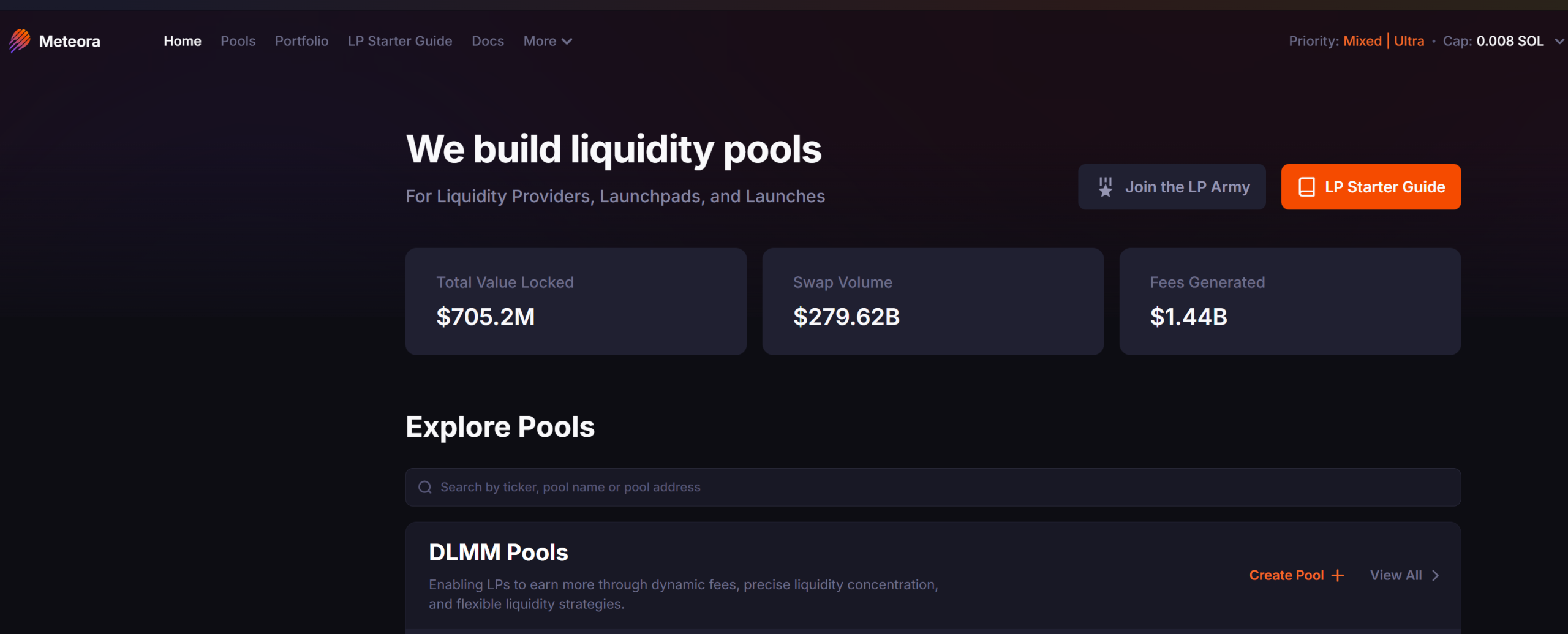

Introducing Meteora and the MET Token

Meteora is transforming the Solana meme-coin landscape with dynamic liquidity, fair launches, and revenue-sharing incentives, while MET powers governance, staking, and long-term ecosystem alignment.

Meteora addresses the inherent challenges within the memecoin economy by focusing on fair launches, dynamic fee structures, and permanent revenue-sharing mechanisms. Its sophisticated liquidity engine is designed to foster sustainable markets through the implementation of Dynamic Automated Market Makers (AMMs) and automated vaults. The native token, MET, plays a crucial role in driving governance, enabling staking rewards, and fostering long-term ecosystem incentives across the entire Meteora platform.

What is Meteora?

Within the burgeoning Solana ecosystem, Meteora has rapidly evolved beyond its initial perception as a mere Decentralized Exchange (DEX) or a memecoin launchpad. It has emerged as a critical component of the liquidity infrastructure. Launched in 2024, Meteora's core mission is to rectify the flawed incentive models that have historically plagued memecoin economics. Eschewing the trend of hype-driven launches that inevitably collapse once liquidity evaporates, Meteora strategically aligns the interests of creators, token holders, and liquidity providers. This alignment is achieved through the generation of continuous fees and the establishment of a more sustainable liquidity model. In essence, Meteora aims not to stifle the creation of meme-coins, but rather to provide them with a viable path to survival beyond their initial viral surge.

The Core Architecture of Meteora

To fully grasp what distinguishes Meteora, it is essential to examine its three foundational components:

Dynamic AMMs (DLMM / DAMM)

Traditional AMMs often falter during periods of high volatility, leading to significant slippage and inefficient deployment of liquidity that remains in irrelevant price ranges. This issue is particularly acute in the memecoin market, where prices can experience rapid and dramatic fluctuations. Meteora's Dynamic AMMs proactively adjust liquidity ranges in real-time, mirroring market movements. This intelligent adjustment enhances trade execution quality and optimizes the deployment of liquidity provider capital.

Dynamic Vaults

Unlike passive yield-generating products, Dynamic Vaults are sophisticated automated liquidity strategies. Capital within these vaults is dynamically shifted to areas of peak trading activity, ensuring that liquidity is actively utilized rather than remaining dormant. For liquidity providers, this translates to superior capital efficiency, increased fee capture, and a yield model that adapts to market dynamics rather than operating in opposition to them.

Fair Token Launch Mechanisms (Alpha Vaults, Bonding Curve, etc.)

A common and significant criticism of memecoin launches revolves around unfair entry points, where bots engage in front-running, insiders exploit advantages, and liquidity vanishes shortly after the initial hype. Meteora's launch system introduces structured price discovery, robust anti-bot protections, and fair participation mechanics. These features are designed to mitigate the risk of "rug pulls" and cultivate healthier early-stage liquidity conditions for new tokens.

Why Meteora Matters

The synergistic interplay of these three systems elevates Meteora beyond a mere product; it transforms it into a potent liquidity engine. This engine is instrumental in powering token creation, facilitating trading, and managing long-term liquidity across the Solana network. Meteora is meticulously engineered for fast-paced markets, a highly social trading culture, and an economic landscape where attention spans are fleeting. Rather than viewing liquidity as a transient boost, Meteora is constructing a robust framework where liquidity is cultivated as a sustainable resource, moving away from its traditional role as a temporary marketing spike.

How Meteora Solves the Biggest Challenges in the Meme-Coin Market

The memecoin market is characterized by its excitement, inherent chaos, and unpredictability. However, beneath the surface of the hype lie fundamental structural issues that contribute to the short lifespan of most tokens. Price surges frequently do not translate into robust ecosystems, liquidity often dissipates post-launch, and users are left questioning whether a promising meme-coin represents a genuine community asset or a sophisticated exit strategy. This is precisely where Meteora intervenes. Its objective is not to suppress speculation, but rather to fundamentally redesign the incentive framework, thereby enabling creativity, liquidity, and community to coexist harmoniously and sustainably.

The Core Problems in the Meme-Coin Market

Before delving into Meteora's solutions, it is crucial to acknowledge the recurring challenges that memecoins consistently face:

Pump-and-Dump Cycles

The trajectory of most memecoins follows a predictable pattern: an initial viral launch, followed by extreme Fear Of Missing Out (FOMO), culminating in a harsh market correction as early investors realize their profits. This scenario invariably leaves later participants as the "exit liquidity," leading to a collapse in community trust and the premature demise of the token before it has a chance to mature.

Misaligned Incentives

Creators frequently derive immediate financial gains through marketing strategies, pre-allocated tokens, or leveraging stealth advantages. Meanwhile, token holders bear the brunt of long-term volatility without commensurate upside participation. In the absence of aligned incentives, genuine investment in the project's sustainability is lacking.

Permanent Locked Liquidity With No Yield

Many memecoins opt to lock their liquidity permanently as a measure to build trust and signal that they are not susceptible to "rug pulls." While this practice fosters confidence, it simultaneously eliminates a potential revenue stream that could otherwise fund development, marketing initiatives, and ongoing contributions to the project. This leaves creators with diminished motivation to remain engaged once the initial hype subsides.

How Meteora Fixes These Issues

Meteora implements a scalable, revenue-sharing model that prioritizes sustainability and fairness, moving beyond superficial fixes or temporary incentives.

Permanent Fee Generation

Within the Meteora ecosystem, locked liquidity is not static; it actively generates fees from every transaction. This ongoing revenue stream benefits both creators and key token holders, effectively transforming liquidity into a valuable asset rather than a mere marketing expenditure. The consequence is a fundamental reorientation of incentives, aligning them with long-term project viability rather than opportunistic exit strategies.

Dynamic Fee Model (0.15%–15%)

Meteora deviates from a fixed transaction fee structure by dynamically adjusting fees based on prevailing market activity. During periods of high volatility, fees are increased to capture revenue and safeguard liquidity. Conversely, when price action is stable, fees are reduced to encourage trading and facilitate user onboarding. This balanced approach ensures the ecosystem remains accessible while generating sustainable income.

Referral-Based Ecosystem Growth

To accelerate adoption, Meteora allocates 20% of its dynamic fees to trading bots, aggregators, and ecosystem partners that actively drive trading volume. This creates a virtuous cycle: increased integrations lead to heightened activity, which in turn generates more fees. These fees then serve to strengthen liquidity and foster greater community participation.

The Impact of Meteora’s Model

By addressing the fundamental design of incentives rather than merely the superficial user experience, Meteora fundamentally reshapes the memecoin economy. Trading evolves into a long-term ecosystem rather than a fleeting hype cycle. Creators are provided with compelling reasons to continue building beyond the initial launch phase. Holders transition from mere speculators to active participants in a shared economy. Consequently, instead of questioning the longevity of a project, Meteora establishes a framework where memecoins possess a realistic opportunity to evolve into enduring on-chain cultural assets.

What is MET?

The MET token serves as the central coordinating mechanism within the Meteora ecosystem, designed to align users, creators, and the ongoing development of the protocol. More than just a utility token, MET is engineered to reinforce the protocol's sustainability, reward long-term engagement, and bolster the liquidity layers that are fundamental to Meteora's operation.

Here's how MET functions within the ecosystem:

1. Governance Utility

Possession of MET tokens grants holders a direct voice in shaping the future trajectory of Meteora. Token holders are empowered to vote on critical aspects, including protocol upgrades, fee distribution policies, incentive parameter adjustments, and allocations for treasury and ecosystem development. This participatory governance structure ensures that protocol evolution is a reflection of community consensus rather than centralized control.

2. Staking and Revenue Sharing

Staking MET tokens unlocks a spectrum of additional benefits, encompassing a share of the revenue generated by the platform, reduced protocol fees, and preferential access to select vaults, launch opportunities, or experimental features. This model incentivizes active participation by directly linking it to tangible economic rewards, moving beyond passive token holding.

3. Liquidity Incentives

To fortify Meteora's liquidity engine, MET tokens are strategically employed to incentivize various aspects of liquidity provision. This includes encouraging LP participation in DLMM/DAMM pools, fostering depth in new token launches and early markets, and promoting cross-protocol collaborations and integrations. This creates a continuous feedback loop: enhanced liquidity leads to superior trade execution, which attracts more users, thereby increasing protocol fees distributed to stakers.

4. Tokenomics and Emissions

The design of MET adheres to a "Phoenix Rising" release model, carefully balancing accessibility with long-term sustainability. Key structural elements include: 48% of the total supply becoming liquid at listing, with the remaining supply being gradually released over time. This schedule is specifically designed to prevent aggressive early dumping and ensures that allocations support builders, contributors, and ecosystem growth. This structure effectively mitigates immediate sell pressure and encourages participants to grow in tandem with the protocol, rather than exiting prematurely.

Market Adoption

In 2025, MET achieved a significant milestone with its listing on Binance, accompanied by the "Seed Tag" designation. This recognition by one of the largest exchanges signals that the token is in an early yet high-potential developmental stage. In summary, MET transcends the role of a mere reward token; it functions as the essential coordination mechanism that drives governance, staking, liquidity, and overall ecosystem expansion within Meteora. As the protocol continues to integrate across Solana's liquidity stack, MET's importance as the connective layer between utility, incentives, and long-term alignment is set to grow substantially.