Key Developments in Cryptocurrency Regulation

The White House is reportedly considering retracting its support for a cryptocurrency market structure bill. This potential shift is attributed to an alleged "unilateral action" taken by Coinbase, which reportedly occurred without prior notification or negotiation with the administration. This move has allegedly caused discontent among both the White House and industry stakeholders.

Such a decision by the White House could significantly alter the future of cryptocurrency regulation in the United States. Actions taken by major financial players often highlight the importance of engaging with established financial sectors before advancing new protocols or agreements. The future support for the bill remains uncertain, pending official confirmation and further communication.

While there have been no official statements from industry leaders or government officials to verify these claims, the situation has the potential to influence political and market dynamics. Reports from journalist Eleanor Terrett have indicated discontent from the White House, but these have not been echoed in direct statements. Key figures within the industry have remained silent regarding the alleged claims.

Potential Regulatory Shifts and Market Impact

Instances of disagreements between government bodies and industry players have previously impacted cryptocurrency legislation. For example, in 2023, the FIT21 Act experienced delays due to industry dissent, which subsequently affected temporary pricing structures for altcoins.

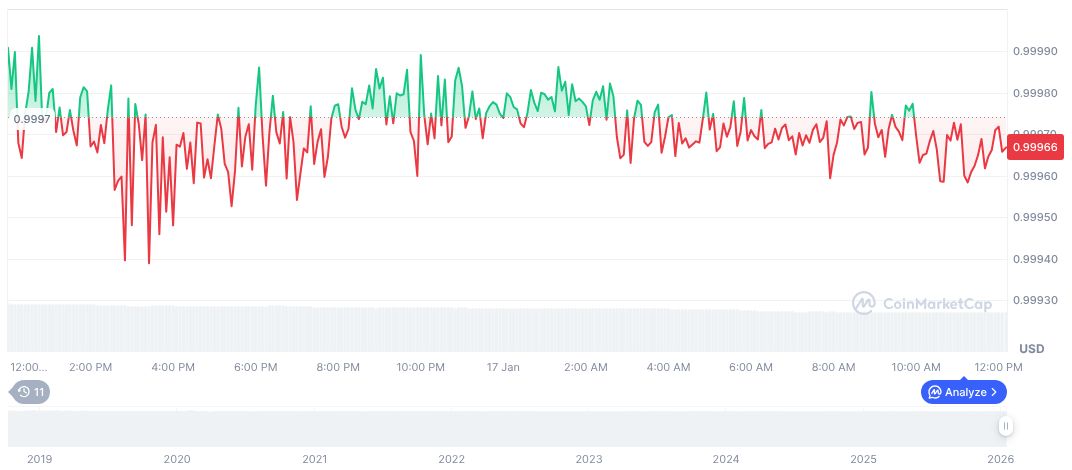

As of the latest available information, USDC maintains a stable price of $1.00. Its market capitalization stands at $76.00 billion, according to data from CoinMarketCap. The 24-hour trading volume for USDC is $7.17 billion, indicating a decrease of 35.77%. Over the past 90 days, USDC's price has seen a variation of -1.49%.

Research from the Coincu research team suggests that potential regulatory shifts could significantly impact stablecoins. If the White House proceeds with policy changes, there may be increased pressure on liquidity and market support for stablecoins. Historical trends indicate that adjustments in Decentralized Finance (DeFi) and staking activities are likely to occur within regulated financial environments.

Brian Armstrong, CEO of Coinbase, has stated, "We're committed to working with regulators to ensure that we have a framework that supports innovation and consumer protection." This sentiment reflects a broader industry desire for clear and supportive regulatory guidelines.