According to on-chain data analyzed by CryptoQuant, Bitcoin's current market structure is characterized less by panic and more by a fragile equilibrium.

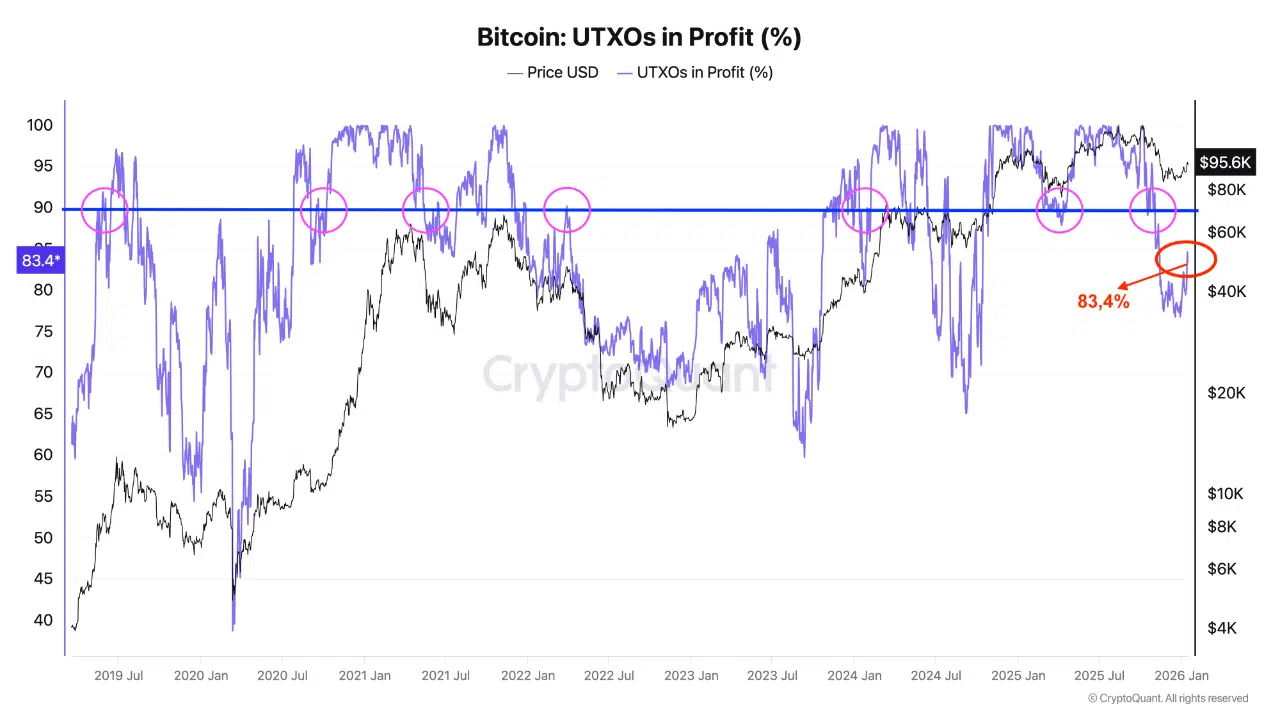

The UTXOs in Profit (%) metric, which tracks the share of Bitcoin supply held at a profit, is currently hovering around 83–84%. This level indicates that a clear majority of market participants remain in profit, even after recent price weakness.

Historically, periods when UTXOs in Profit remain elevated but fail to expand toward the 90% zone often coincide with transitional phases rather than full market breakdowns. These phases tend to reflect redistribution and momentum exhaustion, not broad capitulation. The repeated failures to sustain readings above the upper threshold suggest that upside momentum is becoming increasingly delicate.

The $95,000 Threshold and Market Psychology

The analysis highlights $95,000 as a critical inflection level. This price zone aligns with the cost basis of short-term UTXOs, making it a psychological and structural pivot for the market. When Bitcoin trades above this level, the UTXOs in Profit ratio historically expands toward the 90% range, reinforcing confidence and supporting stronger trend continuation.

Conversely, the current structure shows repeated rejection below $95,000, keeping the UTXOs in Profit ratio suppressed near the low-80% range. This dynamic implies that a growing portion of short-term holders risks slipping back into loss if downside pressure persists. Rather than triggering panic, the data suggests a slow erosion of confidence, characteristic of extended consolidation or a “mini bear” environment.

What the On-Chain Structure Is Signaling Now

Based on the on-chain data, the market appears to be in a prolonged reset phase. Most holders are still in profit, but the inability to reclaim and hold $95,000 prevents a broader recovery in profitability. This keeps sentiment fragile and limits aggressive upside follow-through.

The charts do not signal full capitulation. Instead, they point to a market waiting for resolution: either a sustained reclaim above $95,000 that restores profitability toward the 90% zone, or continued rejection that gradually pushes more supply back into loss and extends consolidation.

In summary, the on-chain structure frames $95,000 as the dividing line between renewed confidence and prolonged redistribution. Until that level is decisively reclaimed, Bitcoin’s recovery remains structurally constrained despite most of the supply still sitting in profit, according to data shared by CryptoQuant.