Bitcoin experienced a sharp decline today, falling below the $90,000 mark and triggering over $340.6 million in long liquidations. This unexpected drop occurred without any significant negative news or major market events. Notably, traditional markets such as the Nasdaq, Silver, and the S&P 500 all saw gains while Bitcoin struggled to maintain its value.

Unusual Market Behavior: Bitcoin Falls While Traditional Markets Rise

This divergence in performance is particularly noteworthy as it marks the first time in nearly a decade that Bitcoin has moved counter to major markets like Silver and the S&P 500. Historically, Bitcoin has largely moved in correlation with these broader market indicators for the past ten years, making its current independent decline an anomaly.

Nasdaq is up, Silver is up, S&P500 is up

— Ash Crypto (@AshCrypto) December 6, 2025

But Bitcoin dropped -6%

With 0 negative news pic.twitter.com/EjLDPPp8vB

Market observers suggest that this unusual price action could indicate deliberate manipulation by large market participants aiming to induce liquidations across both long and short positions.

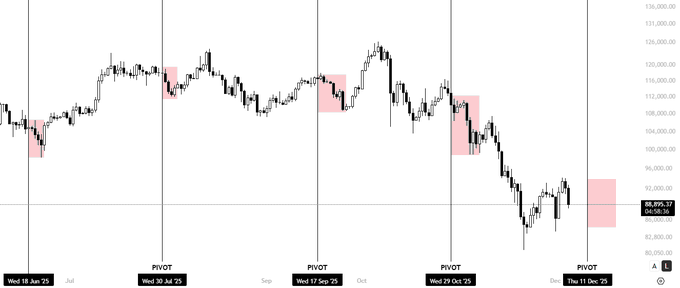

Trader Identifies Pattern Around FOMC Pivot Dates

Crypto trader KillaXBT has observed that Bitcoin appears to be adhering to a consistent pattern following each recent FOMC (Federal Reserve) week. According to this pattern, after a recent pivot, Bitcoin initially surged above $95,000 before experiencing a subsequent drop of approximately 5%, settling near $90,000.

KillaXBT anticipates that a similar price movement may occur around December 10–11, potentially leading to another 5–7% decrease in Bitcoin's value, mirroring previous post-FOMC behavior.

The critical support level for Bitcoin currently lies between $87,000 and $88,000. This area has historically provided a strong floor, and ongoing strong ETF buying activity coupled with the excitement surrounding the halving event could potentially offer protection against deeper declines.

However, if the observed pattern continues, Bitcoin might see a further dip towards the $83,000 mark.

Growing Bearish Sentiment: Analysts Warn of Further Downside

A growing number of analysts are expressing concerns about further price depreciation for Bitcoin, with some suggesting that the market has not yet reached its bottom. Popular chart analyst Ali Martinez has highlighted another concerning indicator: Bitcoin has fallen below its 730-day simple moving average (SMA).

Historically, breaking below this level has often signaled the beginning of extended bearish periods. The current 730-day SMA is situated around $82,150. A sustained close below this support could lead to an even more negative outlook for the charts, potentially pushing the price towards the $76,000 region.

Extended downtrends often begin when Bitcoin $BTC falls below its 730-day SMA.

— Ali (@ali_charts) December 5, 2025

That level is $82,150 right now! pic.twitter.com/fa1JFX7orR

Further compounding the bearish sentiment, crypto trader Doctor Profit has stated that the market is currently exhibiting characteristics of a bear market, a condition that could persist until 2026. Doctor Profit maintains a short position opened at the $120,000 level, anticipating further declines before any substantial recovery takes hold.

Bitcoin ETF Inflows Offer a Glimmer of Bullish Hope

Despite the prevailing negative sentiment, there are still some positive indicators within the market. Notably, the state of Texas has made an investment of $5 million into a Bitcoin ETF.

Many traders are looking towards potential interest rate cuts in the coming year, and Bitcoin ETF inflows have remained robust. On December 5, Bitcoin ETFs recorded a net inflow of $54.8 million.

Currently, Bitcoin is trading at approximately $89,551, reflecting a 2% decrease over the past 24 hours. The price action around the December 10–11 pivot will be a critical determinant in assessing whether this downturn represents a temporary correction or the formation of a sustainable bottom.

Frequently Asked Questions

Bitcoin is down today due to large market moves and liquidations, even without major news, causing a 6% drop below $90,000.

Not this time. While Nasdaq, S&P 500, and Silver rose, Bitcoin fell, showing an unusual divergence from traditional markets.

Yes. Analysts warn BTC may dip further, following bearish patterns, possibly continuing until a true bottom forms in 2026.

Yes. Strong ETF inflows, Texas investing $5M in a Bitcoin ETF, and halving excitement may help stabilize BTC around current levels.