Market Performance and Privacy Coin Dynamics

DASH price has surged by 28% today, trading near $75.38. The trading volume has seen an increase of over 200%, positioning DASH as the top gainer in the market at the time of this report. This upward movement is attributed to a rotation of capital into privacy assets as overall market conditions improve, leading to sharp valuation increases across the sector.

Privacy coins, including DASH, experienced a rise of approximately 15% on November 1. This trend follows an increased demand for financial anonymity amidst the ongoing development of Central Bank Digital Currencies (CBDCs) and stricter regulatory environments.

Dash's optional PrivateSend feature has contributed to its positioning as a preferred hedge within the privacy segment. The total market capitalization of privacy coins reached $24.3 billion, its highest point since 2022. Short-term market sentiment remains strongly bullish, although regulatory responses continue to be uncertain.

Furthermore, open interest has surged by 55% to $45.65 million. The long/short ratio has turned positive for the first time since October, indicating that traders are increasing their leveraged long exposure in anticipation of continued price appreciation.

However, the funding rate has moved above zero, currently at +0.0087%, which increases the cost of holding long positions. Approximately $4.32 million in realized gains entered the market during the rally, suggesting that volatility risk remains elevated should momentum begin to slow.

DASH Price Chart Analysis

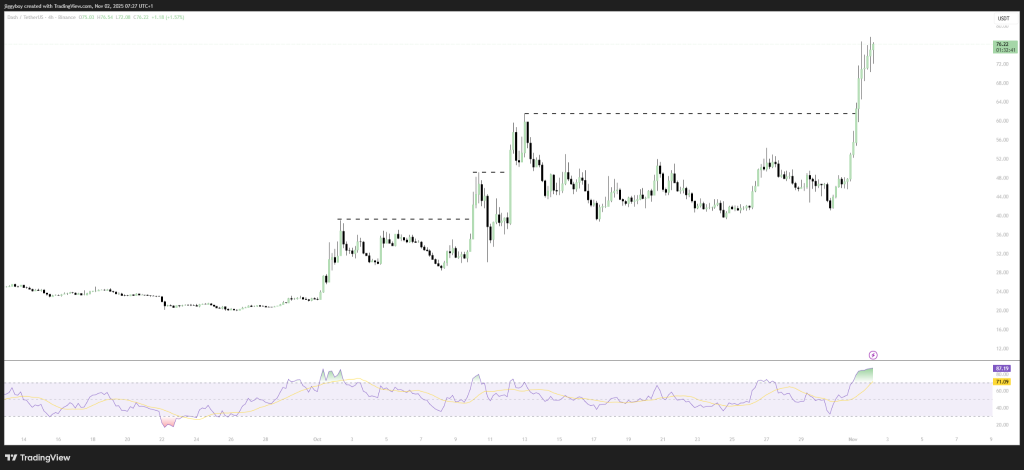

The 4-hour chart reveals a clear multi-stage breakout. The price has moved above previous resistance levels at $44, $55, and $64, before accelerating above $72 to reach its current highs. The structure of the breakout candles reflects strong momentum with aggressive buyer entry.

The DASH price has now reached levels above $76 with minimal consolidation, signaling a powerful continuation move from a prolonged base.

Each prior consolidation zone has successfully transitioned into support, forming a steep upward staircase trend. As long as the price remains above $72, buyers are maintaining clear control of the market structure.

The Relative Strength Index (RSI) on the 4-hour timeframe registered 87.19. This indicates that DASH is deeply within overbought conditions, reflecting strong momentum but also suggesting a potential for a cooling-off period.

Volume expansion confirms that the breakout is supported by robust participation rather than thin liquidity. Dash continues to follow a healthy trend characterized by higher highs and higher lows.

Short-Term Outlook for DASH Price

If the current strength persists, the price could target $82 next. Surpassing this level would open a clear path toward $90, where significant supply was previously observed. Should sentiment weaken, the initial support level is at $72. A break below this point could lead to a deeper retracement towards the prior breakout region near $64.

The overall trend remains constructive as long as the DASH price stays above $72. With sector rotation favoring privacy coins and derivative activity supporting upside potential, DASH enters this week with a strong bullish tailwind.