SEI is experiencing a significant upward trend today, outperforming most altcoins that remain in sideways consolidation. This notable price movement is attributed to a confluence of major news, positive technical indicators, and increasing trader engagement.

Binance Joins SEI as a Validator

The primary catalyst for the SEI rally is the official announcement of Binance joining the SEI network as a validator on November 6. This development serves as a substantial confidence booster for the project. As one of the world's largest cryptocurrency exchanges, Binance's participation as a validator signals strong institutional interest and trust in the SEI ecosystem.

Beyond its validator role, Binance has also launched a staking reward program offering 1.5 million SEI tokens, which will continue until January 2026. This initiative encourages token holders to lock up their SEI, thereby reducing selling pressure and providing additional support for price appreciation.

An increase in staking participation and a rise in SEI's total value locked, currently around $260 million, could attract further investment, reinforcing the perception of SEI as a credible long-term project.

SEI Chart Exhibits a Clear Technical Breakout

The technical analysis of the SEI chart further supports the current bullish momentum. Analysts have identified an inverse head-and-shoulders pattern that has been forming over the past few weeks, with a potential breakout target projected around $0.35.

Momentum indicators are showing improvement. The MACD histogram has turned positive, indicating strengthening buying pressure. The Relative Strength Index (RSI) is currently positioned around 42, suggesting ample room for further price growth before reaching overbought territory.

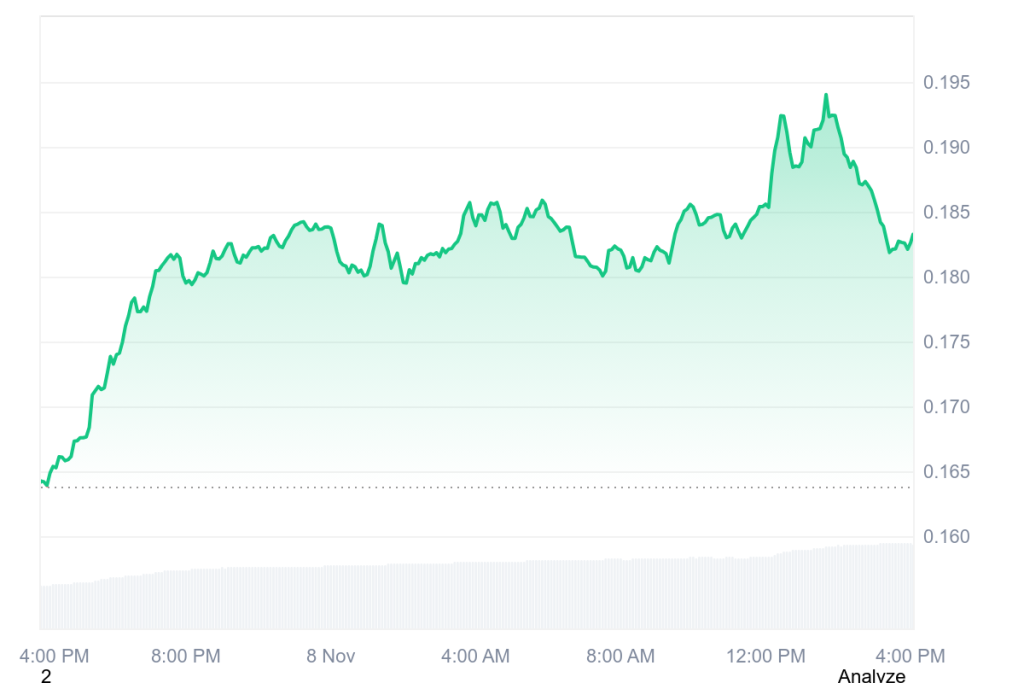

The SEI price has been consolidating within the range of $0.16 to $0.18. The current price action appears poised to test the next resistance level near $0.20. This level is a critical focal point for traders, and a decisive breakout above it could confirm a trend reversal.

Renewed Trader Interest in SEI

Trading volume figures also highlight the renewed interest in SEI. The 24-hour trading volume for SEI has surged by 97% to $241 million, a clear indication of increased trader activity. Despite the crypto market's Fear & Greed Index currently standing at 25, reflecting a "Fear" sentiment, SEI is demonstrating superior performance compared to most other altcoins.

Furthermore, the SEI turnover ratio, calculated as volume relative to market capitalization, is approximately 21%. This suggests healthy liquidity, which is a positive sign for the sustainability of the current rally.

Future Outlook for SEI

The immediate focus for SEI is the $0.20 resistance level. A sustained close above this price point could accelerate momentum, potentially driving the price towards the $0.25–$0.30 range in the short term. Conversely, a rejection at this level might lead to a cooling-off period, with a retest of the $0.18 area before another breakout attempt.

On a broader scale, Binance's involvement and the implemented staking incentives provide SEI with a robust foundation, especially during a period where many altcoins are struggling to maintain key price levels.

The current surge in SEI's price is not merely a speculative event. It is underpinned by tangible developments, including Binance's validator integration, a favorable chart pattern, and growing trader interest. Should staking participation continue to expand and the SEI price remain above $0.18, further upward movement may be imminent.

A successful break above $0.20 could position SEI as a significant altcoin to monitor closely during the next market rotation phase.