Solana has emerged as the next major asset for treasuries, following in the footsteps of Bitcoin and Ethereum. The blockchain has become a favorite for treasuries due to its scalability, cost-effectiveness, redundancy, decentralized control, and popularity within crypto markets.

This article explores five key reasons why Solana is the natural choice for Digital Asset Treasuries after Bitcoin and Ethereum.

Highly Scalable Blockchain

Solana boasts a highly scalable blockchain, capable of processing an average of 5,000 transactions per second in real-time. It can be easily scaled to handle up to 65,000 transactions per second without additional effort. This high scalability allows for transactions to be processed at a cost of less than one cent ($0.01).

Solana's scalability does not come at the expense of its security or decentralization. The blockchain is recognized as one of the most secure after Bitcoin and Ethereum. Furthermore, its decentralized nature is supported by over 850 active validators distributed globally.

Understanding Solana’s Alpenglow Protocol: Reducing Block Finality Time by 99%

Highly Decentralized Ecosystem

Solana features one of the most decentralized ecosystems, with decentralization maintained across governance, validator operations, and token ownership.

Governance is managed through stakeholder voting, which helps to prevent the concentration of power.

Moreover, the presence of more than 850 validators ensures the blockchain's continued functionality against various threats. In comparison, the BNB chain operates with only 21 validators.

Token ownership on Solana is predominantly held by retail investors, rather than whales or large treasuries. Even when aggregated, all treasuries combined hold only 3.65% of the total SOL supply.

Thoroughly Tested Performance

The Solana blockchain has undergone rigorous testing under both normal and extreme conditions. It performs reliably during its regular operations and has successfully managed high traffic volumes without issues, notably during the memecoin surge from late 2024 to early 2025.

The blockchain faced its most significant stress test during the launch of Trump coin, processing approximately 750 million transactions per week.

This proven resilience reduces the probability of blockchain failures, which typically lead to token price crashes.

Most Visited Blockchain

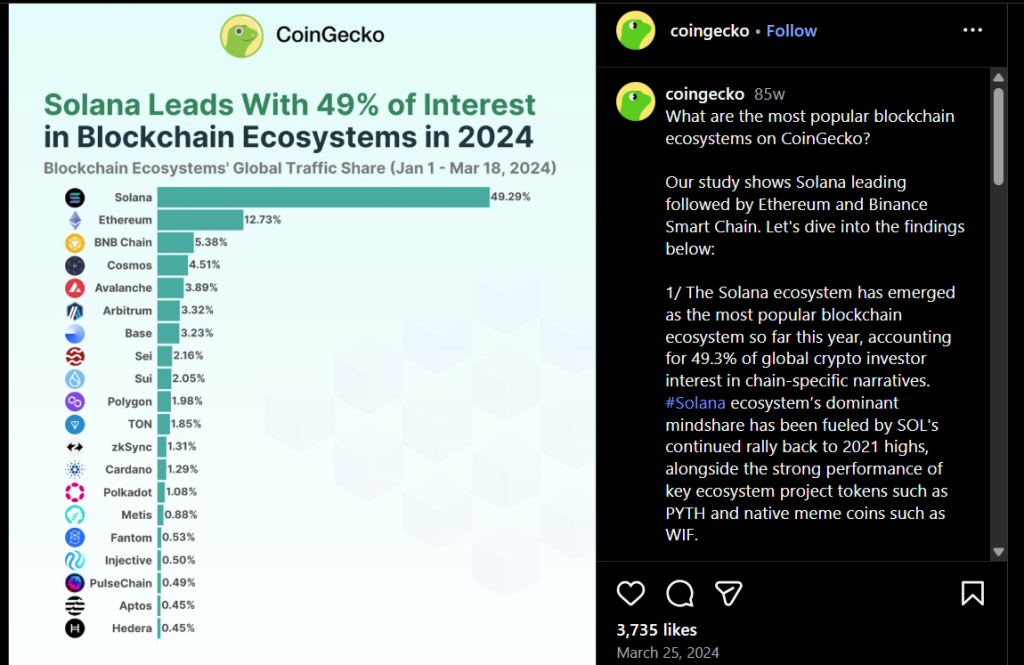

According to Coingecko, Solana was the most visited blockchain in 2024, attracting nearly half the attention of all other chains combined.

Consequently, when a treasury includes SOL in its portfolio, its publicly listed shares have a higher potential to attract retail investors. Increased popularity of investment assets can also enhance investor confidence.

Solana vs Ethereum: A Detailed Comparison of Two Leading Blockchains

Highly Liquid Market Pairs

Solana consistently demonstrates strong liquidity across cryptocurrency markets, exchanges, DeFi protocols, and DEXs, driven by high demand. This facilitates the easy purchase and sale of tokens by investors, allowing for greater flexibility in cashing in and out of SOL.

Further evidence of its high liquidity is the presence of the fourth-largest on-chain stablecoin reserve. While marginally lower than BSC on average, it is significantly larger than Base, its closest competitor, by three to four times.

High liquidity is crucial for treasuries, enabling them to invest and divest assets efficiently when needed. In challenging market conditions, such as liquidations, high liquidity can also minimize losses during distressed asset sales.

Don’t want to invest in treasuries? Here are the Top 5 Solana Wallets to Store Your $SOL in 2025