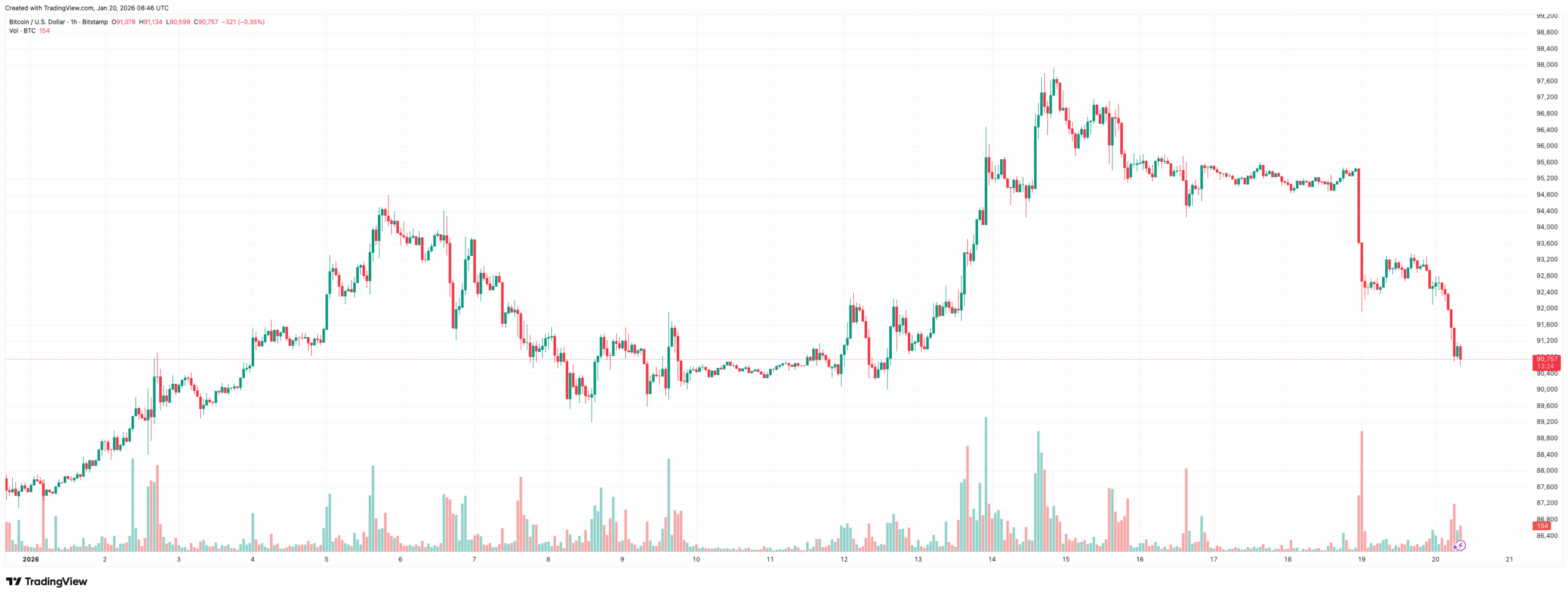

Bitcoin's price has experienced a decline of 2.6% over the past 24 hours, reaching a low point of approximately $90,600. This downturn has resulted in the cryptocurrency losing all of its gains from January 14th, returning to levels last seen on the 12th.

Crypto Markets Face Downturn

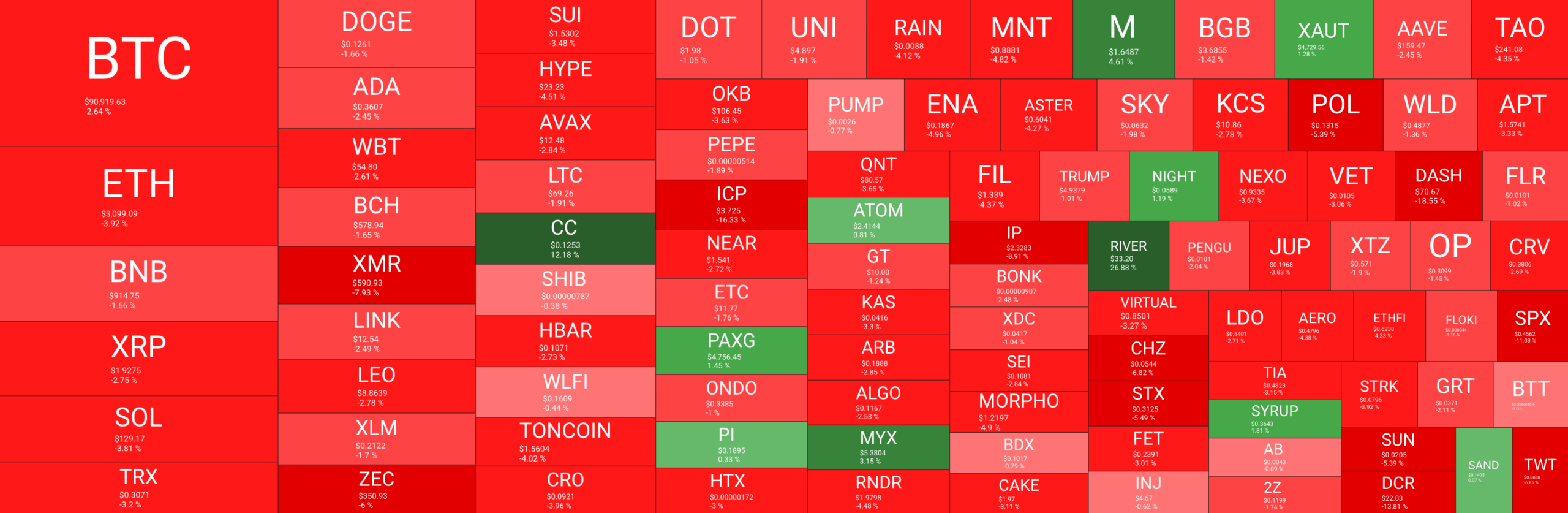

Bitcoin is not the only cryptocurrency experiencing a downward trend; the broader crypto market is also suffering. Among the top 100 cryptocurrencies by market capitalization, only a few are currently trading in positive territory.

Ethereum has seen a 3.5% decrease, XRP is down by nearly 3%, and SOL has declined by 3.7%. Similarly, TRX has dropped by 3.2%, among other significant decreases across the board. The total market capitalization currently stands at $3.16 trillion, with a daily trading volume of $109 billion, which is consistent with the average over the past three months. Market sentiment has shifted back to "Fear," indicated by a score of 32, reflecting the indecisiveness and uncertainty prevalent in the cryptocurrency industry recently.

Geopolitical Factors Impacting Prices

The recent geopolitical developments over the past 24 hours appear to be directly influencing cryptocurrency prices. Bitcoin is often categorized as a risk-on asset, and current investor sentiment suggests a reluctance to take on significant risk. This observation is further supported by the rising prices of gold, which recently reached a new all-time high above $4,700 per ounce.

Earlier, the President of the United States issued a White House statement expressing a strong stance on Greenland, indicating the U.S. intention to pursue control over the autonomous territory within the Kingdom of Denmark.

“Denmark cannot protect the land [read: Greenland] from Russian or China, and why do they have a “right of ownership” anyway? There are no written documents, it’s only that a boat landed there hundreds of years ago, but we had boats landing there, also. […] The World is not secure unless we have Complete and Total Control of Greenland.”

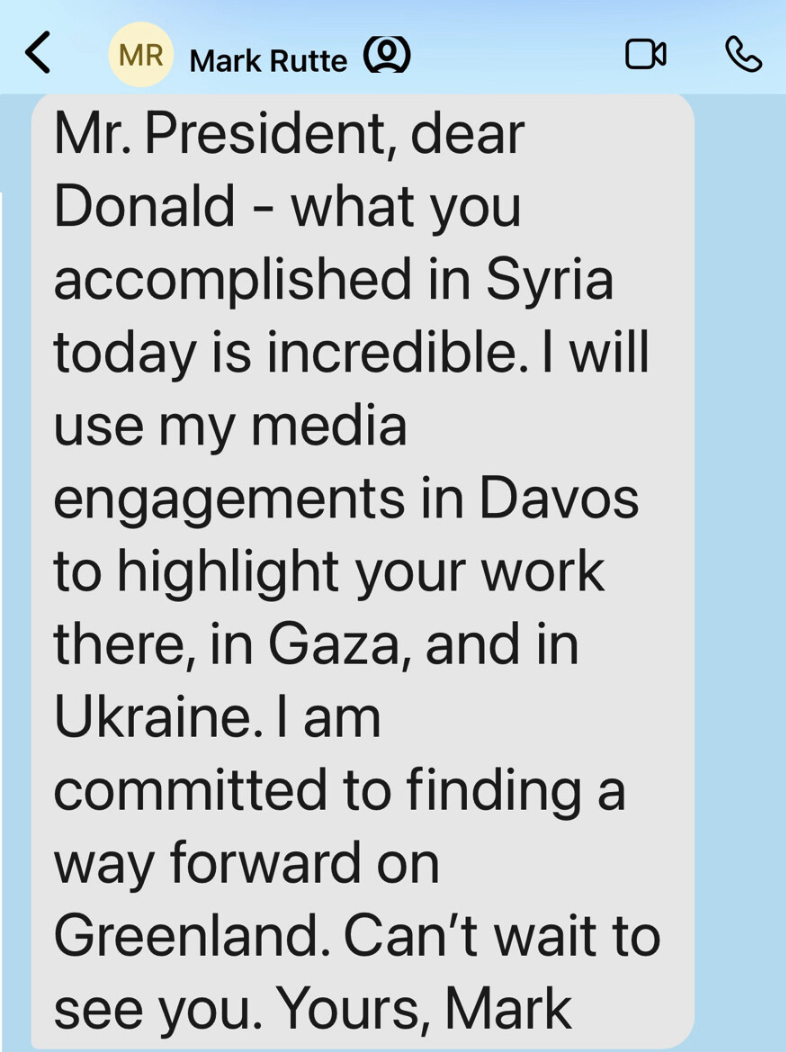

In response, China has urged the U.S. President to cease using them as a pretext for pursuing self-interest. The President himself confirmed that NATO Secretary General Mark Rutte would be meeting with him in Davos.

The uncertainty arises from Greenland's status as an official member of the European Union and NATO. The U.S. indication of seeking control over the country has raised concerns among investors regarding the potential ramifications for international relations. While the U.S. is also a member of NATO, President Trump has emphasized a "U.S. interests first" approach, stating that NATO should reciprocate the support it has received from the United States.

President Trump also shared an image of himself planting the U.S. flag in Greenland.

French President Emmanuel Macron has also communicated with President Trump, expressing confusion regarding the U.S. actions on Greenland, despite aligning on other international matters.

“My friend, we are totally in line on Syria. We can do great things on Iran. I do not understand what you are doing on Greenland…” Macron texted.

Market Outlook and Potential Developments

The Kobeissi Letter has provided a detailed analysis of potential future events, which are currently unfolding as predicted. According to their assessment, President Trump is expected to engage in discussions with leaders of countries recently subjected to tariffs, aiming for a resolution. Expedited negotiations for a trade deal concerning Greenland are anticipated, with a subsequent market rally expected upon its announcement.

The analysis suggests that the current tariffs are scheduled to take effect from February 1st. This timing indicates a strategic approach by President Trump, where the tariffs serve as leverage to facilitate a trade agreement rather than being implemented permanently.

President Trump’s entire negotiation strategy is centered around timing and pressure. He provides 2-3 weeks of lead time before his tariffs go into effect to allow for a deal to be reached. Trump’s goal is for these tariffs to NEVER actually go live, he wants a deal.

While the outcome of these developments remains uncertain, the current period is marked by significant volatility, necessitating careful planning and consideration.