Nigeria’s fintech scene, the largest in Africa, is now eyeing French‑speaking markets, where a new frontier of customers awaits. Homegrown players like Flutterwave, Paystack (Stripe), PalmPay and others have announced moves into Côte d’Ivoire, Senegal, Cameroon and beyond.

Nigeria already accounts for about 217 fintech startups (32% of Africa’s total) as of 2023, but that number has supposedly increased to over 430 as of early 2025. That makes it a “breeding ground” for innovation.

Saturation at home and naira volatility are pushing firms abroad. As Flutterwave CEO GB Agboola puts it:

“It is necessary to make payments as easy as possible across Africa. The continent is brimming with business opportunities, and Senegal…has the potential to be at the forefront, radically contributing to the growth of Africa’s digital economy.”

Nigeria’s own digital market is enormous but crowded. Estimates show Nigeria’s fintech count has massively increased from 74 in 2017. In 2023, more than half of Africa’s big funding rounds went into Nigeria, and by mid‑2025, Nigerian fintech entities had raised over $1 billion in the past two years.

About 63% of Nigerian adults now hold a financial account, a sharp increase from past years, but still leaving room for inclusion. The government has hailed Nigeria as the AfCFTA Digital Trade Champion, with Vice President Kashim Shettima noting that “our innovations in mobile payments have transformed cross‑border payments, financial inclusion, and digital transactions across the continent.”

The African Continental Free Trade Area (AfCFTA) aims to raise intra‑African trade from 18% (2022) to 50% by 2030, and initiatives like PAPSS (Pan‑African Payment & Settlement System) are making remittances faster.

With Africa’s cross‑border payments market projected to triple to $1 trillion by 2035, Nigeria’s fintech companies, already experts in domestic payments, see huge opportunities in facilitating regional commerce.

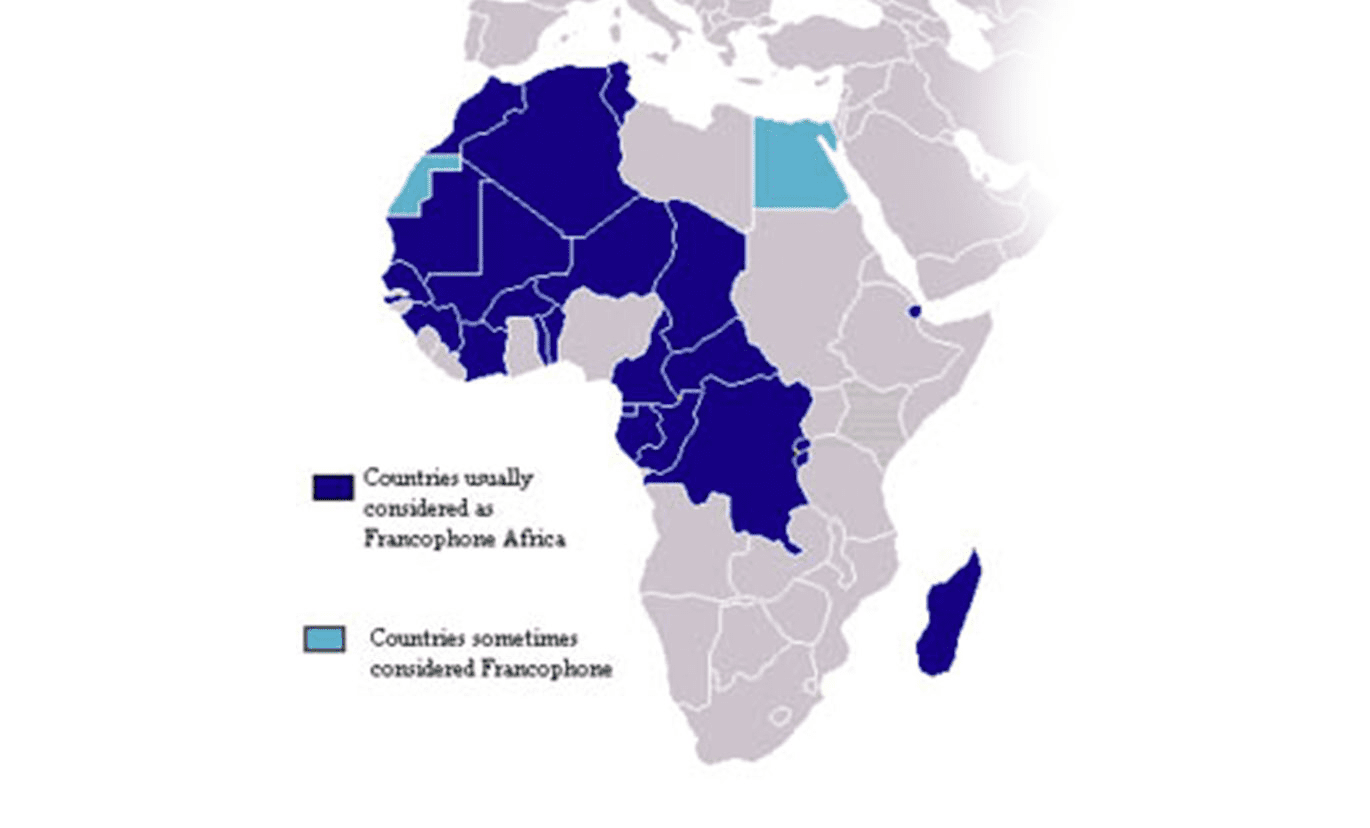

Economic and strategic appeal of Francophone fintech markets

Francophone Africa offers compelling economics. Countries like Senegal (pop. ~18.0 million) and Côte d’Ivoire (pop. ~31.9 million) are young and increasingly connected.

In Senegal, 60.0% of adults use the internet, and there are 21.9 million active mobile subscriptions – 122% of the population.