The Federal Reserve's decision to cut rates was made against a backdrop of steadily declining inflation and observable signs of cooling in the labor market. The core objective guiding this policy move was to rebalance economic growth and labor-market risks, rather than solely aiming to stimulate the economy.

In its latest policy decision, the emphasis placed on "employment risks" notably surpassed warnings about "inflation pressure" for the first time. This shift indicates a widening divergence within the Federal Open Market Committee (FOMC), signaling that policymakers do not hold a unified consensus on the future direction of monetary policy.

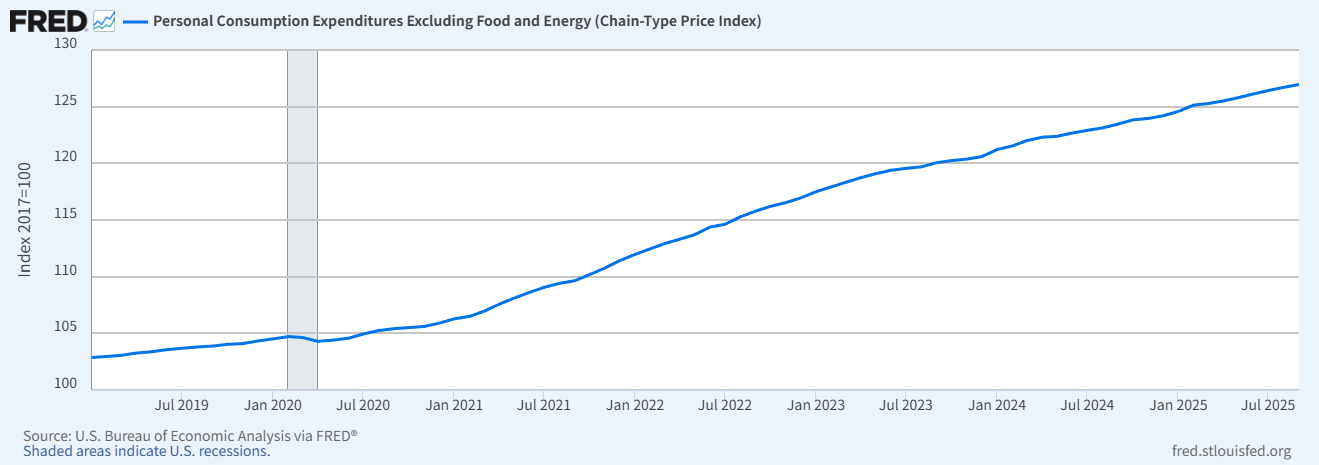

The trajectory of monetary policy will be fully determined by incoming economic data. Should the unemployment rate continue to rise, rate cuts may accelerate. Conversely, any rebound in core Personal Consumption Expenditures (PCE) inflation could lead the Federal Reserve to pause its easing efforts at any point.

The Federal Reserve's rate cut in 2025 does not signify a transition into a full monetary easing cycle. Instead, it represents a risk rebalancing initiative driven by moderating inflation and weakening employment. This adjustment is entirely guided by the latest economic data.

The Fed's Rate Cut is Confirmed, Bringing Interest Rates to a Three-Year Low

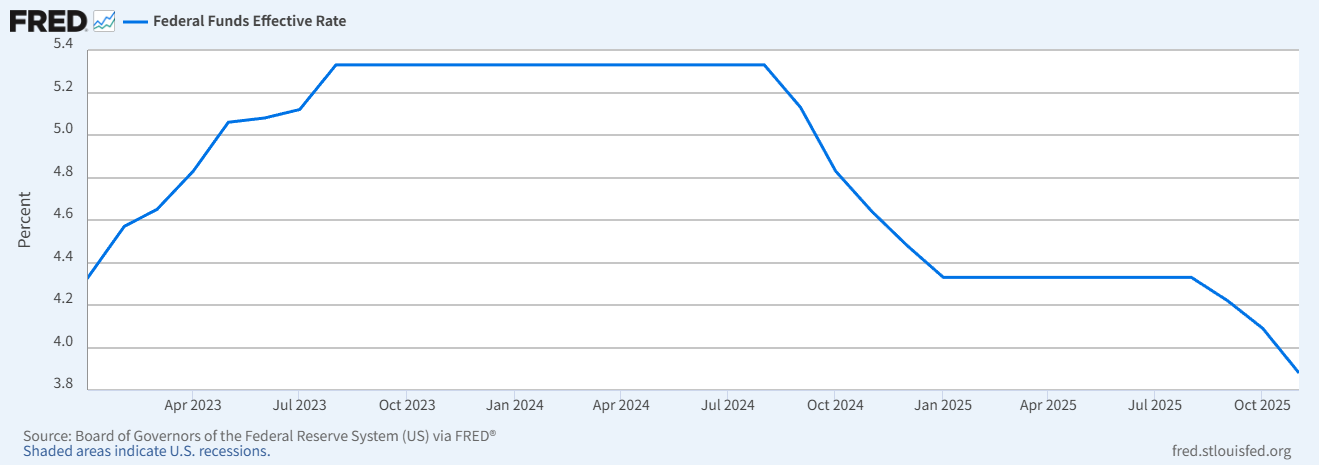

At its meeting on December 10, 2025, the Federal Reserve announced a 25-basis-point reduction in the federal funds rate target range, bringing it to 3.50%–3.75%. This marks the third rate cut of the year and represents the lowest level the rate has been in the past three years. While market speculation regarding the timing of rate cuts had been ongoing for months, the underlying reasons for this policy move have been discernible in the Fed's official statements and economic data for some time.

Subtle Shifts in Official Wording: Moderation in Inflation and Rising Attention to Employment

Federal Reserve policy operates on a traceable, data-driven basis, rather than being driven by emotion. Since mid-year, subtle but consistent changes have appeared in official documents. Descriptions of inflation have gradually become more moderate, while the focus on the labor market has continuously increased. Particularly as the third quarter progressed, employment data began showing clear signs of slowing. Figures from the U.S. Department of Labor indicated that nonfarm payroll additions decreased from 180,000 in July to 119,000 in September. Furthermore, the unemployment rate rose to 4.4% as of September, prompting the "risk balance" policy framework to begin tilting.

Rising Employment Risks Prompt a Policy Rebalancing

In its most recent decision, the Federal Reserve explicitly stated that "recent employment gains have slowed and the unemployment rate has risen slightly." This type of assessment has been infrequent in past communications and signifies that the previously characterized "very strong" labor market is, for the first time, acknowledged in official language as facing downside pressure. In contrast, although inflation remains above the long-term 2% target, November's core PCE year-over-year growth stood at 3.1% (according to Federal Reserve data). This led officials to describe it as "still elevated," a less forceful characterization than terms such as "stubborn" or "persistently above target." This linguistic difference is sufficient to demonstrate a shift in policymakers' prioritization of economic risks.

In essence, this rate cut can be understood as a "rebalancing" act. Following two years of monetary tightening, the elevated policy rate has begun to exert pressure on the economy, particularly impacting businesses and consumers facing high financing costs. The Fed is not easing policy because inflation has been fully eradicated; rather, subtle shifts in employment data, such as the unemployment rate reaching 4.4% in September, necessitated an adjustment in the pace of policy. This move is not the "full easing cycle" that some market participants had anticipated, but rather a step taken to find a more balanced position between current economic data and prevailing risks.

A Flexible Pace of Rate Adjustment, with the Future Dependent on Economic Data

Regarding the future policy path, the Federal Reserve maintained a cautious stance. The official statement repeatedly emphasized that future rate adjustments "will depend on incoming data and risk assessments," rather than adhering to a predetermined schedule. This open-ended wording preserves flexibility for future responses while also moderating market expectations for consecutive rate cuts or aggressive easing measures. In other words, the Fed has not committed to a path toward significantly lower interest rates; its intention is for each policy step to be guided by actual economic conditions as they unfold.

Voting Divergence Reveals Differing Views on the Economic Outlook

The voting outcome at the FOMC meeting also conveyed a significant signal: nine votes in favor of the rate cut and three against represent a notable level of disagreement, which is uncommon in recent years. The dissenting opinions did not necessarily oppose the general direction of policy but reflected increasingly divergent assessments of the economic outlook. Federal Reserve Governor Adrian advocated for a 50-basis-point cut, while Chicago Fed President Goolsbee and Kansas City Fed President Schmid preferred to maintain current interest rates. This internal divergence serves as a reminder that the Fed does not perceive conditions as sufficiently clear to establish a single, definitive policy trajectory. Consequently, future adjustments may involve shifts in direction rather than a continuous, one-sided trend.

Market Focus Shifts from the Timing of the Cut to the Risks Behind It

In summary, this rate cut is primarily a response to evolving economic realities rather than an attempt to provide comfort to financial markets. Inflation has not yet reached the Fed's target, but November's core PCE print of 3.1% year-over-year indicates a continuous downward trend. The labor market, while remaining resilient, no longer exhibits the robust strength seen in the previous two years. Economic growth is still solid, but uncertainty persists. Operating under these multiple constraints, the Fed has opted for a balancing adjustment: aiming to avoid prolonged economic pressure from high interest rates while simultaneously guarding against excessive easing that could reignite inflation.

For financial markets, the crucial message is not simply that "a rate cut occurred," but rather why it occurred at this particular moment. The frequency of the word "risk" in the official statement saw a significant increase, underscoring that future decision-making will rely more heavily on incoming data than on expectations or forward guidance. The pace of policy adjustments is expected to remain cautious.

Data-Driven Outlook for Future Monetary Policy

This policy adjustment represents both a cyclical inflection point and an important signal, reflecting policymakers' nuanced assessment of the economy and their efforts to maintain equilibrium amidst prevailing uncertainties. The future trajectory of U.S. monetary policy will hinge on the interplay of employment, inflation, and economic growth data. If the unemployment rate rises to 4.5% in the first quarter of next year, approaching the Fed's median projection for the end of 2025, the pace of rate cuts could accelerate. Conversely, if core PCE inflation rebounds above 3.5%, policy easing may be paused. Every forthcoming data point will be critical in determining the next move in interest rates.