Ethereum has demonstrated signs of renewed momentum, experiencing a 6.7% climb over the past week and briefly surpassing the $3,400 level on Wednesday, January 14. As of early January 17, around 2:30 a.m. EST, the price has seen a slight pullback to $3,291. The 24-hour trading volume has dropped by 21% to $20.5 billion, indicating a quieter day of activity as the market consolidates.

This recent upward trend is occurring against a backdrop of sustained institutional interest in Ethereum, which could potentially drive further gains in the short term.

Ethereum Attracts Significant Institutional and ETF Inflows

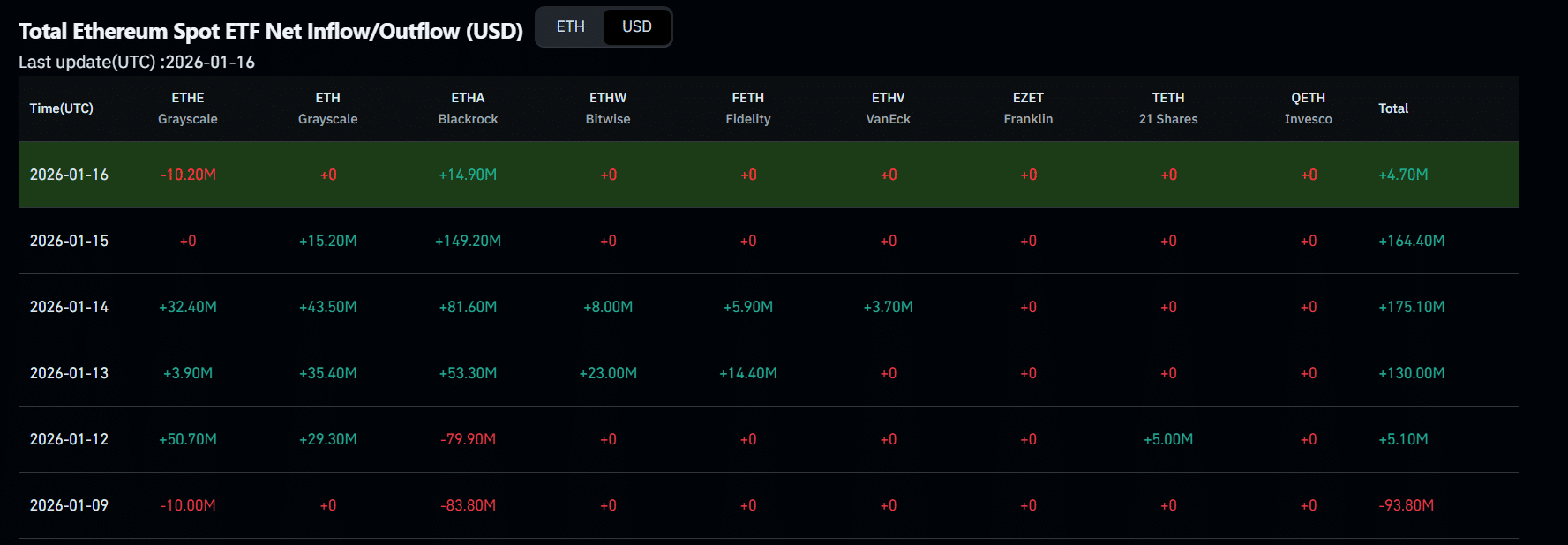

Ethereum continues to garner substantial interest from institutional investors. Spot Ethereum exchange-traded funds (ETFs) have recorded nearly $500 million in inflows over the last week, according to data from Coinglass.

Wednesday alone saw inflows totaling $175.1 million, marking the largest single-day ETF inflow for 2026 and the highest recorded since December 2025.

Despite a dip in weekly and daily trading volumes, certain firms, such as Bitmine, led by Wall Street Strategist Tom Lee, are actively increasing their Ethereum holdings.

Bitmine’s most recent purchase amounted to $65 million worth of Ethereum, underscoring a growing institutional confidence in the cryptocurrency.

JUST IN: 🔥 🇺🇸 Tom Lee’s Bitmine just purchased $65,000,000 worth of $ETH.

Bullish for Ethereum. pic.twitter.com/zD3bMf41K7

— Crypto Rover (@cryptorover) January 17, 2026

This action by Tom Lee’s crypto infrastructure firm highlights Ethereum's expanding appeal beyond its foundational smart contract capabilities. It is gaining traction across decentralized finance (DeFi), non-fungible tokens (NFTs), and tokenized assets.

Furthermore, this acquisition reflects a broader trend of institutional engagement with Ethereum, which is increasingly viewed as a versatile asset with potential for scalability enhancements and future demand, particularly with the prospect of a spot ETH ETF.

Such institutional activity has the potential to bolster Ethereum's price stability, especially during periods of market volatility.

Outlook for Ethereum's Price Movement

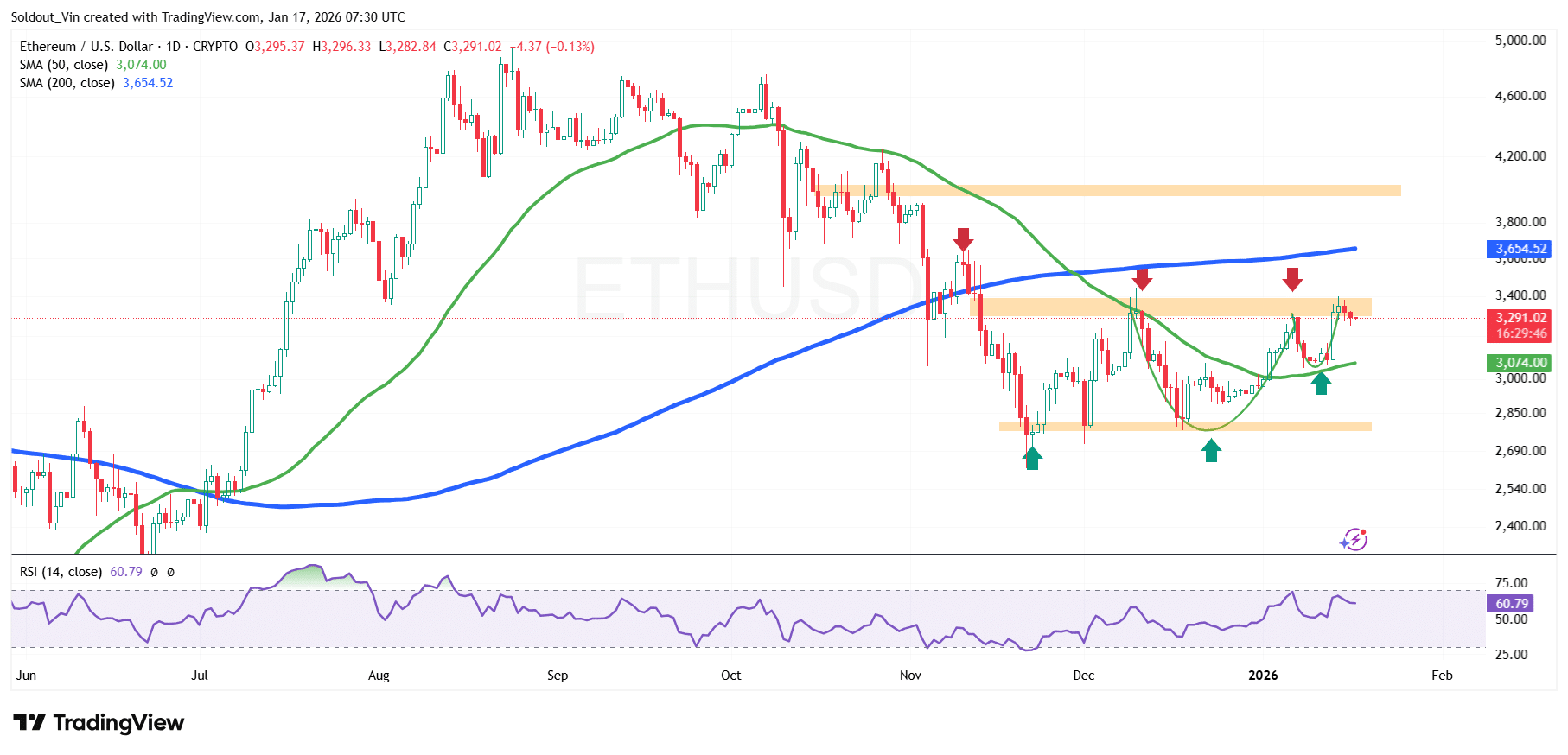

Ethereum's price is currently consolidating above the $3,070 support zone, which closely aligns with the 50-day Simple Moving Average (SMA). The recent recovery from the $2,750–$2,850 demand area indicates active defense by buyers, forming a higher low on the daily chart.

Consequently, ETH has successfully reclaimed the 50-day SMA at $3,074, supporting a short-term bullish outlook. However, the 200-day SMA, positioned at $3,654, remains a critical overhead resistance. Repeated rejections near this level suggest persistent seller activity, making it a significant barrier for continued trend advancement.

Ethereum's Relative Strength Index (RSI) is currently around 60.79. This reading is above the neutral 50 level but below the threshold for overbought conditions, indicating building bullish momentum while still allowing for further upside before the market becomes overheated.

The current price structure exhibits a rounded bottom formation and improving momentum, signaling a potential phase of trend transition rather than a confirmed breakout.

Analysis of the 1-day ETH/USD chart suggests that Ethereum may attempt to move towards the $3,350–$3,450 resistance zone, an area that previously served as support. A daily close above this level could pave the way for a retest of the 200-day SMA near $3,650, which represents the next significant upside target.

Conversely, if Ethereum's price fails to hold above the 50-day SMA, short-term profit-taking could lead to a price retracement back toward the $2,850 support zone, where buyers have previously intervened.

In summary, Ethereum is displaying early indications of recovery. However, sustained bullish continuation will necessitate a clear break and acceptance above the 200-day SMA.