Pi Network’s native token experienced a significant price surge in the past couple of weeks. It climbed from its October 10 all-time low of $0.172 to approximately $0.29 before settling around $0.25 as October concluded. This impressive rally followed months of prolonged correction and was bolstered by several positive developments within the Pi Network ecosystem, including new updates, features, and AI implementations.

November Outlook

With the year drawing to a close, all attention is now focused on November. The central question is whether PI has the potential to sustain its recent upward trend and continue its price recovery efforts.

AI Predictions for PI in November

Before providing its forecast for the upcoming 30 days, the AI chatbot identified two key drivers behind PI’s 50% surge in late October: “renewed community activity (AI and utility-app pilots) and a pickup in off-exchange trading volume.”

The AI remains cautiously optimistic about the asset for November, assigning a 60% probability to a "base case" scenario where PI continues to climb slowly and gradually. In this most likely scenario, the current price level would represent the lower boundary of a broader range, estimated between $0.24 and $0.34. The AI described this scenario as a “modest continuation as ecosystem headlines keep interest alive but liquidity remains thin.”

For those anticipating a more substantial and sustainable increase, potentially pushing PI beyond $0.40, the AI provided a 25% chance. This bullish case hinges on PI breaking the $0.35 resistance level, which could be triggered by listings on new exchanges or further, more tangible improvements within the ecosystem.

ChatGPT’s bear case, with a 15% probability, envisions a potential drop below $0.20, possibly retesting the all-time low if “hype fades and no network-progress news lands before mid-month.”

Key Factors to Monitor

The AI chatbot highlighted several factors that could influence PI’s price in the coming month:

- •

App-ecosystem traction: The introduction of new Pi-based applications or AI integrations could help sustain the current recovery trend.

- •

Liquidity & listings: Trading volumes remain relatively low and are predominantly over-the-counter (OTC). Broader exchange support would likely serve as the most significant bullish catalyst.

- •

Broader market mood: A stronger recovery in Bitcoin (BTC) and other altcoins during November could amplify any positive movement in PI.

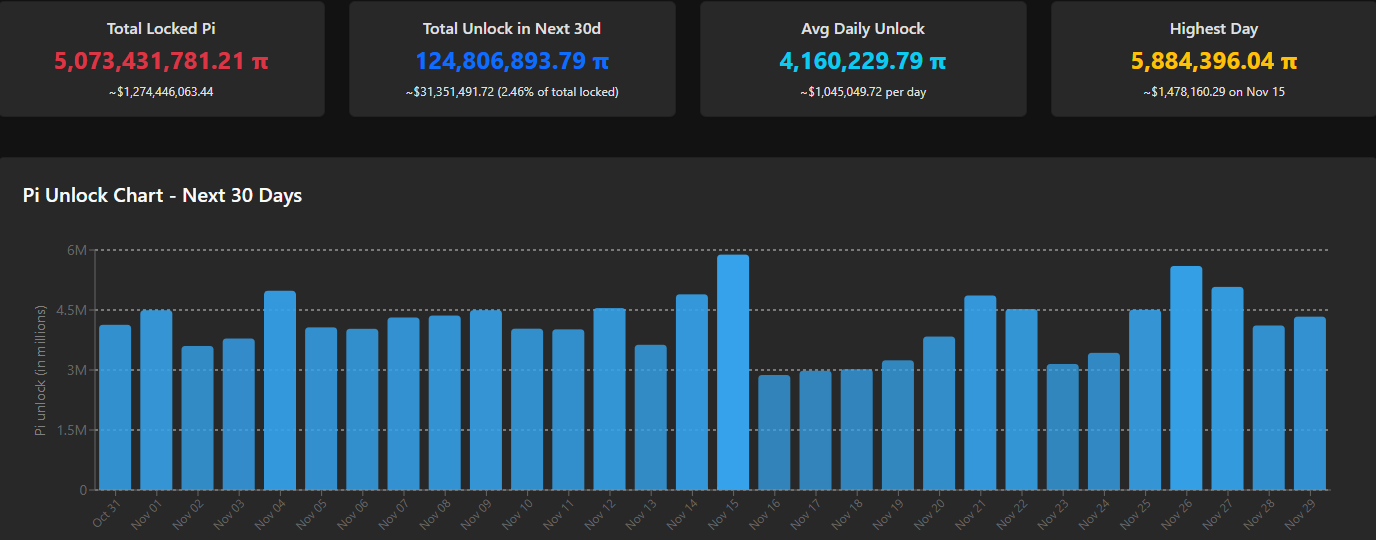

Additionally, the token unlock schedule provides insight into the number of coins set to be released in the following month. This data can help assess whether potential selling pressure from investors awaiting their tokens might ease or increase. Current data from PiScan indicates an average daily unlock of approximately 4.160 million tokens. This figure is considerably lower than the 8-9 million tokens unlocked daily during the summer. Consequently, this reduced unlock rate could alleviate immediate selling pressure, potentially allowing the asset to stabilize in November as predicted.