New ETF Inflows Signal Potential Bullish Turn for SOL

Recent developments in the Solana ecosystem, particularly the debut of Solana ETFs by Fidelity and Canary Capital, coincide with a potential turning point for the SOL cryptocurrency. After experiencing bearish pressure that briefly pushed it into oversold territory, the SOL price may be on the verge of a recovery.

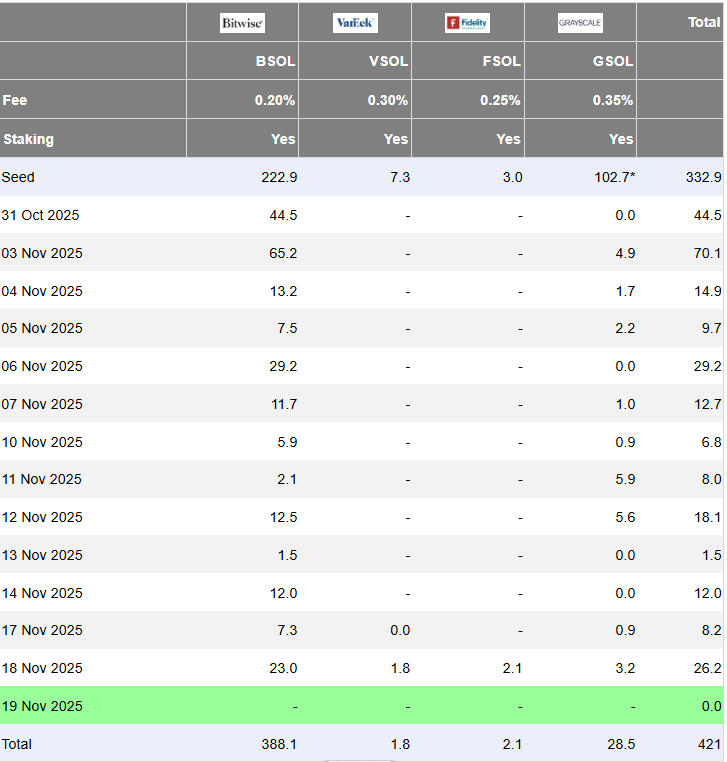

Earlier in November, ETFs from Bitwise and Grayscale maintained positive flows despite prevailing bearish market conditions. However, their impact on SOL price was relatively limited due to weak demand. This week has seen an expansion of interest with the launch of Solana ETFs from Fidelity, VanEck, and Canary Capital.

On Tuesday, VanEck and Fidelity alone contributed to $3.9 million in SOL demand. This influx was part of a larger daily total of over $26 million in Solana ETF inflows, marking the fourth-largest inflow day for Solana ETFs.

Factors Suggesting a Bullish Relief for SOL Price

Solana ETFs have consistently recorded positive flows since their inception, indicating that ETF issuers have continued to purchase SOL even as prices declined. This sustained demand could help rebuild market confidence, especially following recent price discounts. Beyond the ETF market, SOL price has shown signs of liquidity injection after its latest dip.

SOL price began the week in oversold territory on Monday, dropping to a low of $128. The Money Flow Index (MFI) indicator registered a slight uptick, suggesting a notable increase in demand near its recent lows.

On-chain data for SOL indicated relatively weak demand from large holders, though this aligns with the recent accumulation observed through the MFI. Meanwhile, liquidation data suggests a bias favoring a bullish pivot. Approximately $25 million worth of SOL long positions would be liquidated if the price were to fall to $130. Conversely, over $127 million in short positions would be liquidated if SOL price rises back above $145.

The SOL liquidation map indicates a higher risk of short position liquidations compared to long positions, suggesting an upside incentive. However, market movements are not solely driven by incentives, making it crucial to also examine demand and supply characteristics.

SOL spot flows reveal a decline in sell pressure as prices have fallen. However, it also shows that bulls have been hesitant to capitalize on these lower prices, likely due to prevailing market uncertainty and fear.

Solana Network Health Snapshot

The recent bearish market conditions have had a notable impact on the Solana network over the past few weeks. For instance, its Total Value Locked (TVL) has decreased by almost $2 billion from its September peak. The network's stablecoin supply has also seen a decline, with approximately $3 billion in outflows since its October peak.

Despite these challenges, the cryptocurrency has experienced significant liquidity inflows. SOL price has shown a notable spike in inflows since mid-November.

While net inflows have been positive in the first half of this week, certain key data sets indicate that activity is still lagging. For example, weekly address activity has fallen to a 12-month low. This weak address activity mirrors the broader bearish market conditions, as Solana network activity typically improves during bullish phases. Consequently, recent market conditions have also been suppressing SOL's price potential.