Crypto markets are regaining strength as cleaner positioning and rising liquidity create a solid base for renewed upside in November, according to Wintermute, a renowned crypto trading and market making firm.

In its latest analysis, the market maker believes that softer U.S. inflation data and improving U.S.–China relations have reignited risk appetite across global markets.

https://t.co/PRcmZRw0Y3

— Wintermute (@wintermute_t) October 28, 2025

Bitcoin Reclaims $115K Amidst ETF Inflows and Short Squeeze

Bitcoin reclaimed $115,000 after strong ETF inflows and a sharp short squeeze, signaling a clear return of investor confidence. The rebound follows weeks of volatility triggered by global uncertainty and rate concerns. However, easing treasury yields and renewed optimism around the upcoming Trump–Xi summit in Seoul have restored a positive market tone.

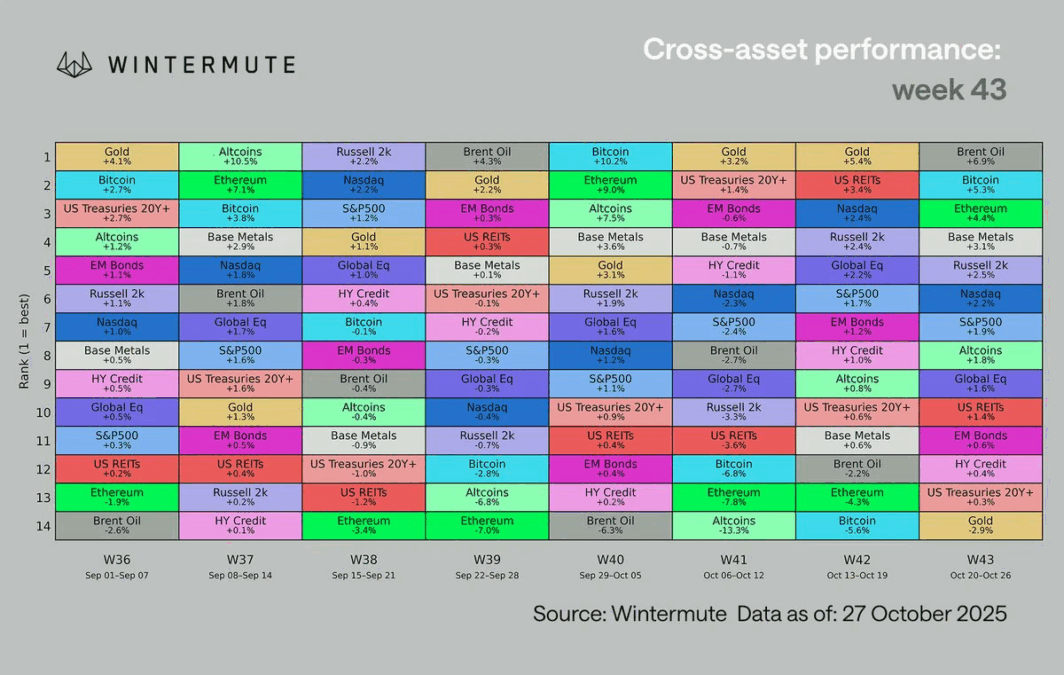

Wintermute noted that Bitcoin’s 5.3% weekly rise occurred after $160 million in shorts were liquidated, marking one of the most aggressive squeezes this month. Ethereum also climbed toward $4,200, while gold slipped 7% as capital rotated from defensive assets into crypto and equities.

Broader Rotation Across Sectors Fuels Market Growth

Apart from Bitcoin and Ethereum, investors also shifted toward DeFi and AI-related tokens. Wintermute observed this move was driven by these projects demonstrating stronger earnings and increased activity on their networks. Utility and infrastructure tokens also garnered interest, bolstered by new Layer-2 launches and restaking projects that attracted fresh liquidity.

Funding rates turned positive across major perpetual markets, indicating that sidelined capital is returning to the market. Stablecoin supply began to rise for the first time since September, a clear signal that fresh inflows are building. ETF flows remained steady throughout the week, reinforcing structural demand for Bitcoin and supporting a healthier derivatives market.

Market Confidence Rebuilding After October Turmoil

Two weeks prior to this resurgence, Wintermute temporarily halted trading during a flash crash that erased $19 billion from the crypto market. The firm clarified that this action was taken because its internal trading rules were breached amid the market chaos.

Evgeny Gaevoy, the CEO of Wintermute, addressed and dismissed rumors that the crash had "collapsed" the company. He stated that operations were "business as usual" and that Wintermute was "perfectly fine."

Sorry to disappoint you, but Wintermute is perfectly fine, business as usual

— wishful_cynic (@EvgenyGaevoy) October 11, 2025

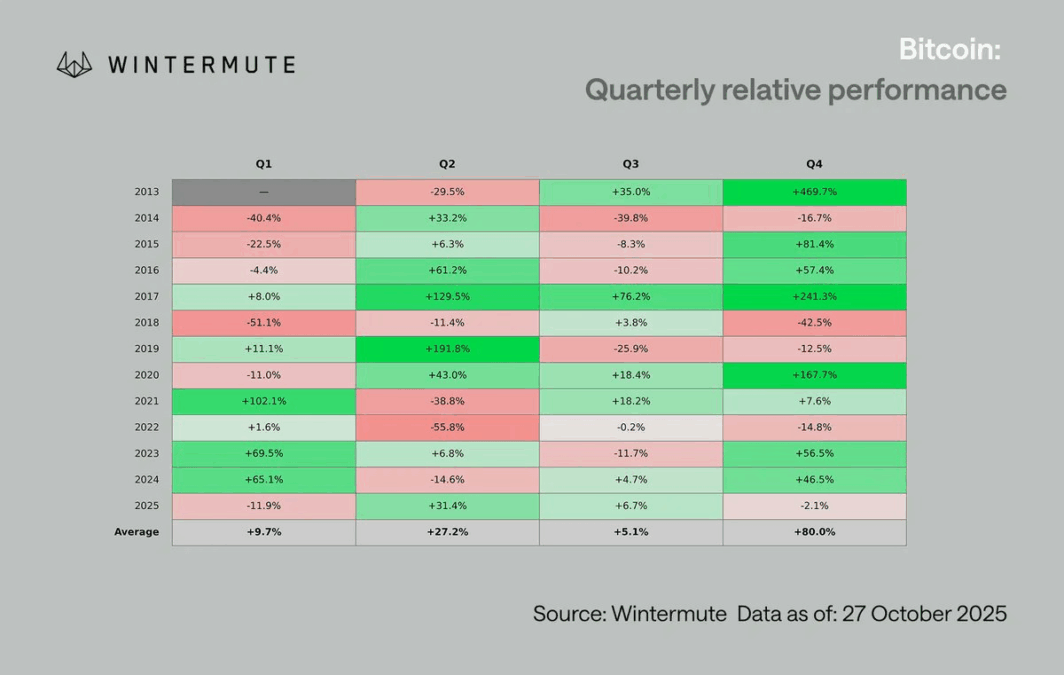

As macroeconomic headwinds fade, investors appear ready to rotate back into crypto. Factors such as cooling inflation, improved diplomacy, and an anticipated Federal Reserve pivot are contributing to this optimism. Consequently, Wintermute believes the market setup heading into November and the fourth quarter remains constructive, with cleaner leverage and calmer volatility supporting continued risk-on momentum.