XRP spot ETFs have locked in 11 straight days of inflows, marking one of the strongest demand streaks since their launch.

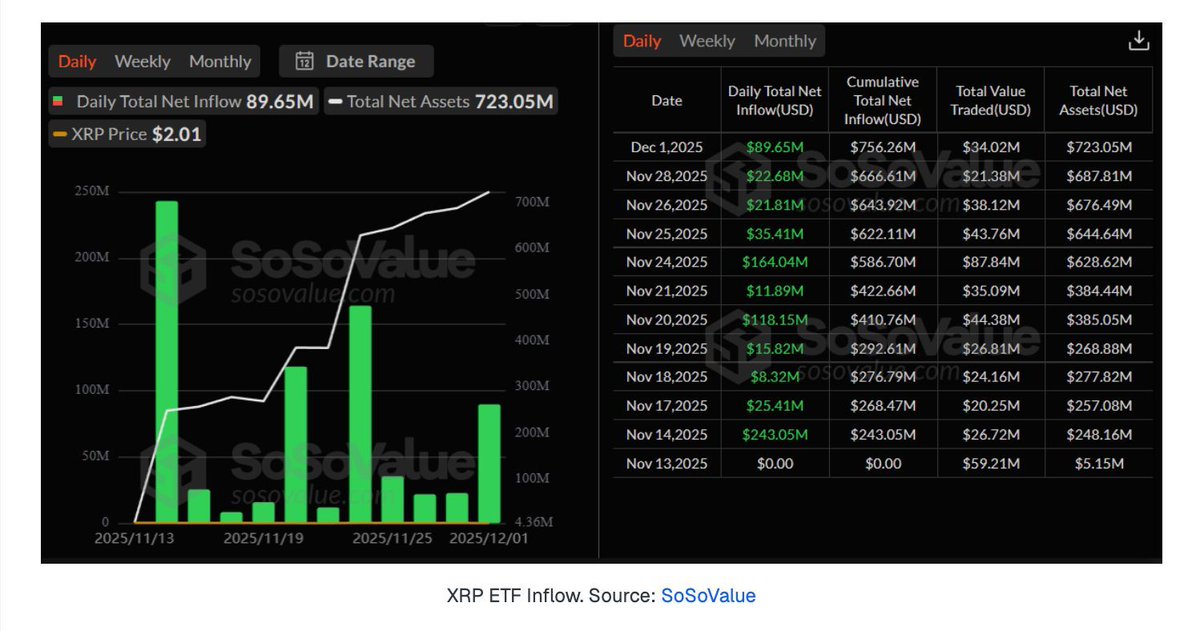

New data from SoSo Value shows cumulative inflows reaching $756.26 million as of December 1, putting the category on a rapid trajectory toward the $1 billion milestone.

Steady Inflows Drive Category Toward A Major Asset Landmark

Total net assets across all XRP ETFs now stand at $723.05 million, a level that reflects both sustained investor interest and strengthening market conditions. The momentum accelerated at the start of the week, with $89.65 million entering the products on Monday alone. Franklin Templeton’s XR PZ led the day’s activity, followed by continued participation from Grayscale’s fund.

Analysts tracking the flows note that if current demand continues, XRP ETFs could cross $1 billion in assets within days, placing them among the fastest-growing digital-asset ETFs introduced in 2025.

Chart Shows Strong Flow Accumulation and Rising Prices

The accompanying chart highlights a consistent build-up in net assets through the second half of November, alongside daily inflow spikes that mirror broader upticks in XRP price. The data indicates that ETF demand has remained stable even during periods of market volatility, reflecting a growing base of institutional and retail participants allocating through regulated products.

XRP itself is up 9% today, reinforcing the feedback loop often seen between spot price strength and ETF inflow acceleration.

A Rapidly Expanding ETF Segment

After 11 consecutive trading sessions of positive flows, XRP ETFs have established themselves as one of the standout performers among this year’s digital asset products. With cumulative inflows now approaching the billion-dollar threshold, the segment is gaining the kind of scale that could cement it as a long-term fixture in crypto-linked investment offerings.