Key Insights

- •Long liquidations have contributed to XRP's recent price decline, with traders exhibiting caution and a lack of new short positions.

- •While the number of whale wallets has decreased, the remaining large holders have increased their XRP holdings to a seven-year high.

- •XRP is currently testing crucial mid-band support, with a weekly close above $2.12 being essential to avert further losses.

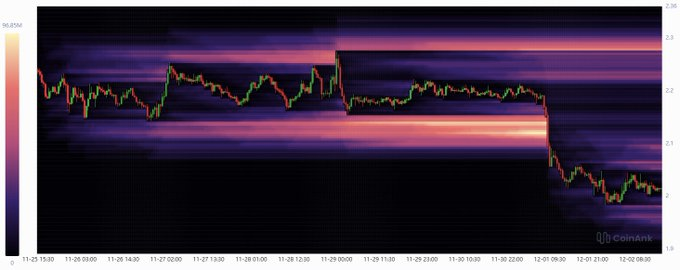

XRP has experienced a notable price decrease after a period of trading sideways between $2.10 and $2.20. This decline commenced around December 1 and has been attributed to the liquidation of a substantial number of long positions, pushing bullish traders out of the market as prices fell.

The current price of XRP stands at approximately $2.01, reflecting a 1.9% loss over the past 24 hours and a weekly decrease exceeding 9%. Despite this downturn, there has been no significant increase in short positions, indicating that sell-side pressure has not intensified at current levels, and no substantial clusters of new short entries have emerged during this price movement.

Key Resistance at $2.30

The $2.30 level continues to represent a significant area of resistance on the XRP chart. Liquidity data indicates that this zone is attracting sell orders, and it has previously acted as a barrier to price increases. Traders are closely observing whether the price will attempt to re-enter this level or face another rejection.

While long positions have been largely unwound, there has been minimal evidence of traders initiating aggressive short positions. This has resulted in the $2.30 level remaining unchallenged since the recent price drop.

One analyst commented on the market sentiment, stating:

“There’s a wall around $2.3, but not much action nearby.”

Shifting Whale Dynamics: Fewer Wallets, Higher Holdings

Recent data from Santiment highlights a reduction in the number of large XRP wallets. Over the past eight weeks, 569 wallets that previously held more than 100 million XRP have fallen below this threshold, representing a 20.6% decrease in the count of large holders.

Despite this decline in the number of large wallets, the remaining holders have increased their XRP holdings. Their combined total has now reached 48 billion XRP, marking the highest level observed in seven years. This trend suggests that a smaller cohort of high-balance holders has been accumulating more XRP in recent weeks.

Focus on Mid-Channel Support at $2.12

XRP continues to trade within its broader range, which spans from $1.80 to $3.80. The cryptocurrency is currently positioned near the middle of this range, aligning with the midline of a technical channel frequently utilized by analysts.

Traders are placing significant emphasis on the $2.12 level. A weekly closing price above this mark is considered critical for the maintenance of support. Failure to achieve this close could lead to increased downward pressure on the lower end of the trading range.

A chart analyst highlighted the current market juncture:

“We’re at a make-or-break point. $2.12 matters.”