XRP derivatives traders faced a sharp reset on January 18, as forced liquidations surged across major exchanges, according to data shared by Amr Taha using CryptoQuant metrics. The event marked one of the largest single-day liquidation clusters for XRP this month, with long positions bearing the brunt of the damage.

Massive Long Liquidation Cluster Hits XRP

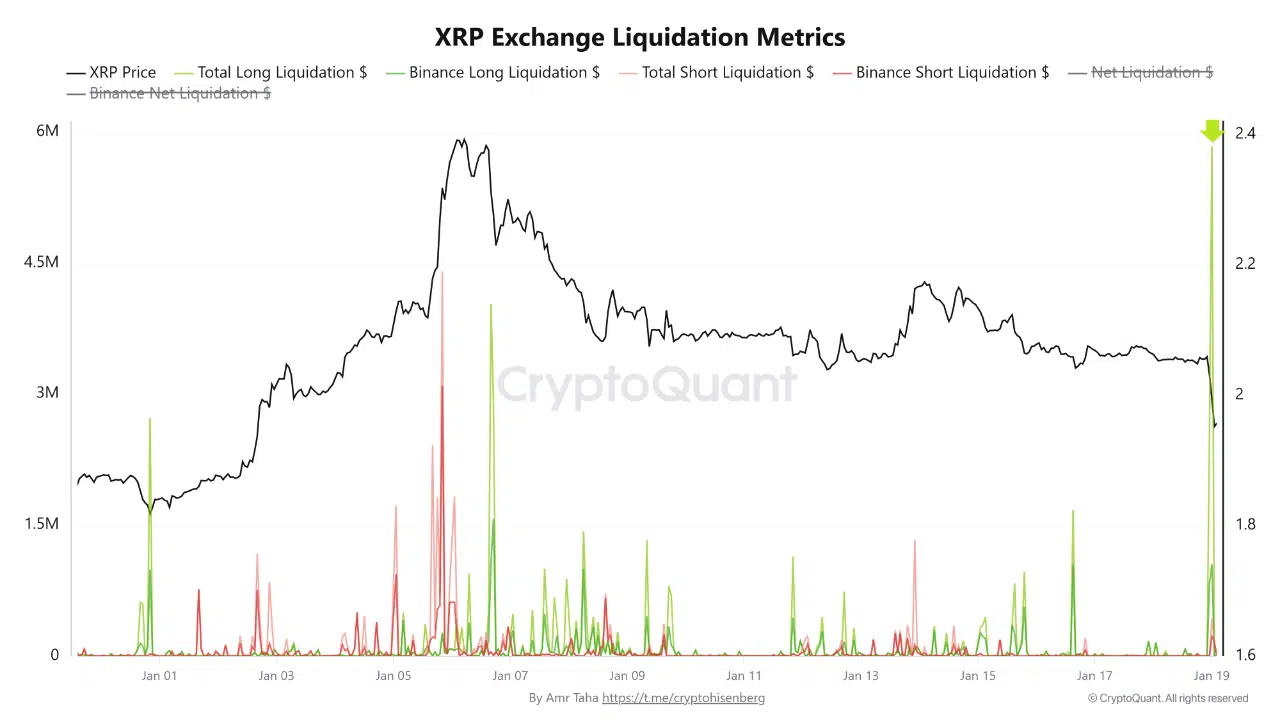

CryptoQuant’s XRP Exchange Liquidation Metrics chart shows a clear spike in long liquidations on January 18, coinciding with a sharp downside move in XRP price. Total long liquidations exceeded $5 million in a single day, highlighting how aggressively leveraged bullish positions were flushed from the market.

Binance played a major role in this event. Data indicates that approximately $1.05 million of the forced long closures originated from Binance alone, making it the largest single contributor among tracked exchanges. This suggests that a high concentration of leveraged long exposure was positioned there ahead of the move.

Unlike volume or open interest, liquidation data reflects positions that were closed involuntarily. In this case, traders were caught leaning too heavily to the upside as price moved against them, triggering cascading margin calls.

Price Action Reflects Leverage Unwind

The chart shows XRP price topping earlier in the month before entering a period of distribution and gradual decline. As price failed to reclaim higher levels, liquidation spikes intensified, particularly during sharp intraday drops. The largest liquidation cluster aligns closely with a sudden downside acceleration, confirming that leverage, rather than spot selling alone, amplified the move.

Following the liquidation event, XRP price stabilized, suggesting that much of the excessive long-side leverage had already been cleared from the system.

Macro Pressure Adds Fuel to the Move

According to the report cited by Amr Taha, the liquidation wave did not occur in isolation. On the same day, Financial Times reported escalating geopolitical and trade tensions, including the possibility of up to €93 billion ($107.7B) in European tariffs or restrictions targeting the United States. These developments followed renewed rhetoric from President Trump toward NATO allies over Greenland.

In response, broader risk markets sold off. The crypto market moved in tandem, with Bitcoin dropping from above $95,000 to below $93,000, adding downside pressure across altcoins and accelerating liquidations in XRP derivatives.

What the Data Signals Going Forward

The scale of the January 18 liquidation suggests a meaningful leverage reset for XRP. With over $5 million in long positions forcibly closed, near-term downside risk from overcrowded longs may be reduced. However, the data also underscores how vulnerable XRP remains to macro-driven volatility when leverage builds too aggressively.

For now, CryptoQuant’s liquidation metrics point to a market that has been forcefully de-risked, with price action likely to remain sensitive to broader macro headlines rather than purely XRP-specific catalysts.