XRP Convergence Creates Market Tension

XRP price shows the asset nearing a decisive moment as volatility compresses inside a maturing converging structure. Market participants prepare for a breakout after extended uncertainty.

XRP remains inside a narrowing formation that has produced a series of misleading moves and unstable pricing. The pattern’s late-stage development adds pressure as traders assess shrinking volatility. The structure has created hesitation among participants waiting for confirmation.

A recent post from CW (@CW8900) noted that XRP is generating confusion as it approaches the end of its convergence. Abrupt spikes and uneven wicks have triggered long-side liquidations and left spot traders uncertain. These events show the difficulty of navigating the pattern during this advanced stage.

XRP trades at $2.18 after a 2.82% daily pullback, though it still maintains a 13.83% gain over the past week. The asset has now reached the upper threshold of its consolidation, placing it inside the typical window where a breakout often forms.

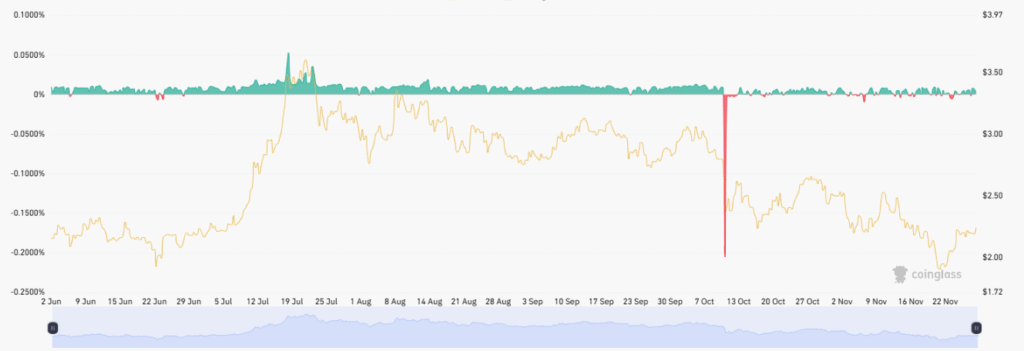

XRP Breakouts Fail as Liquidity Thins

The upper boundary of the setup has rejected every brief push above resistance. XRP has produced several short-lived moves that reverse within minutes, clearing out leverage and reducing confidence in upward attempts. These snap-backs reveal declining liquidity during expansion attempts.

The rising lower boundary continues to serve as support, yet it has produced quick wick-downs that unsettle accumulation efforts. These moves frequently trigger stop-loss placements and reduce the willingness of traders to take early positions within the structure.

Volume continues to contract, forming flat clusters that reflect uncertainty across the market. Only one recent volume spike stands out, driven more by forced unwinding than fresh XRP demand. This type of contraction often appears before volatility returns near the end of a triangle formation.

XRP Sub-Indicators Signal Early Strength

Momentum instruments depict the initial indications of the change, as XRP nears its decision point. The MACD histogram is settling around the middle again after weeks of being bearish, which indicates that the downward movement is decelerating. The stochastic oscillator is out of the oversold land, which is common before expansions.

These readings are not directional guarantees, but they show reduced selling strength. This aligns with CW’s view that sub-indicators may point to a potential rise as the structure matures and price movement tightens into the apex.

XRP now sits near 80% of its structural range, a common level where breakouts begin to form. A clean move over resistance with strong volume could end the current cycle of failed expansions. A break below rising support may accelerate downside pressure. Market participants now wait for confirmation as the week moves forward.